PLEASE DO IT STEP BY STEP CORRECTLY WITHOUT USING SHORTCUTS I WILL THUMBS UP THANK YOU.

PLEASE DO IT STEP BY STEP CORRECTLY WITHOUT USING SHORTCUTS I WILL THUMBS UP THANK YOU.

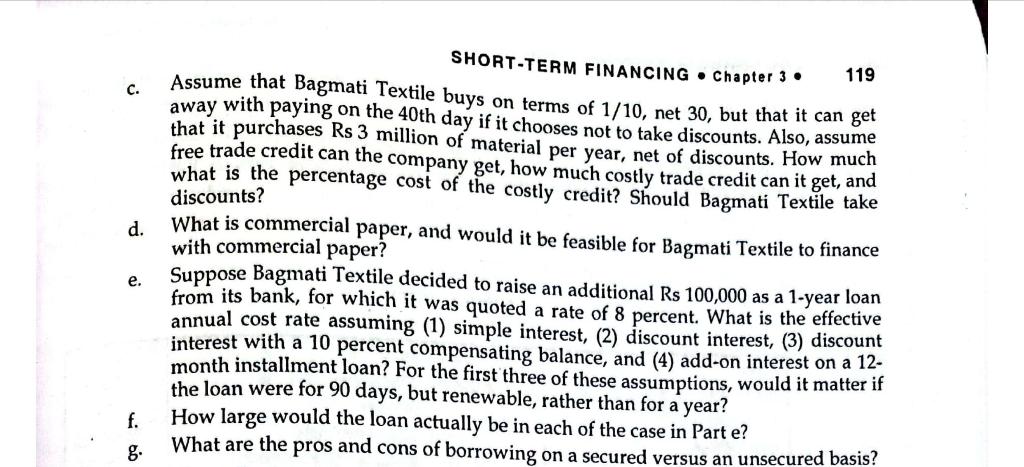

Mini Case Case 1 Bagmati Textile Company, a warm cloth manufacturer, is a small company with seasonal sales. Each year before the warm cloth season begins, Bagmati Textile purchases inventory which is financed through a combination of trade credit and short- term bank loans. At the end of the season, the company uses sales revenues to repay is short-term obligations. The company is always looking for ways to become more profitable, and senior management has asked one of its employees, Rajesh Karki, to review the company's current asset financing policies. Putting together his report Karki is trying to answer each of the following questions: What are the advantages and disadvantages of using short-term credit as a source of financing? b. Is it likely that Bagmati Textile could make significantly greater use of accruals? a. Scanned with CamScanner 119 c. discounts? d. SHORT-TERM FINANCING Chapter 3 Assume that Bagmati Textile buys on terms of 1/10, net 30, but that it can get away with paying on the 40th day if it chooses not to take discounts. Also, assume that it purchases Rs 3 million of material per year, net of discounts. How much free trade credit can the company get, how much costly trade credit can it get, and what is the percentage cost of the costly credit? Should Bagmati Textile take What is commercial paper, and would it be feasible for Bagmati Textile to finance with commercial paper? Suppose Bagmati Textile decided to raise an additional Rs 100,000 as a 1-year loan from its bank, for which it was quoted a rate of 8 percent. What is the effective annual cost rate assuming (1) simple interest, (2) discount interest, (3) discount interest with a 10 percent compensating balance, and (4) add-on interest on a 12- month installment loan? For the first three of these assumptions, would it matter if the loan were for 90 days, but renewable, rather than for a year? How large would the loan actually be in each of the case in Parte? What are the pros and cons of borrowing on a secured versus an unsecured basis? e. f. g. Mini Case Case 1 Bagmati Textile Company, a warm cloth manufacturer, is a small company with seasonal sales. Each year before the warm cloth season begins, Bagmati Textile purchases inventory which is financed through a combination of trade credit and short- term bank loans. At the end of the season, the company uses sales revenues to repay is short-term obligations. The company is always looking for ways to become more profitable, and senior management has asked one of its employees, Rajesh Karki, to review the company's current asset financing policies. Putting together his report Karki is trying to answer each of the following questions: What are the advantages and disadvantages of using short-term credit as a source of financing? b. Is it likely that Bagmati Textile could make significantly greater use of accruals? a. Scanned with CamScanner 119 c. discounts? d. SHORT-TERM FINANCING Chapter 3 Assume that Bagmati Textile buys on terms of 1/10, net 30, but that it can get away with paying on the 40th day if it chooses not to take discounts. Also, assume that it purchases Rs 3 million of material per year, net of discounts. How much free trade credit can the company get, how much costly trade credit can it get, and what is the percentage cost of the costly credit? Should Bagmati Textile take What is commercial paper, and would it be feasible for Bagmati Textile to finance with commercial paper? Suppose Bagmati Textile decided to raise an additional Rs 100,000 as a 1-year loan from its bank, for which it was quoted a rate of 8 percent. What is the effective annual cost rate assuming (1) simple interest, (2) discount interest, (3) discount interest with a 10 percent compensating balance, and (4) add-on interest on a 12- month installment loan? For the first three of these assumptions, would it matter if the loan were for 90 days, but renewable, rather than for a year? How large would the loan actually be in each of the case in Parte? What are the pros and cons of borrowing on a secured versus an unsecured basis? e. f. g

PLEASE DO IT STEP BY STEP CORRECTLY WITHOUT USING SHORTCUTS I WILL THUMBS UP THANK YOU.

PLEASE DO IT STEP BY STEP CORRECTLY WITHOUT USING SHORTCUTS I WILL THUMBS UP THANK YOU.