Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it with your best effort if u can if you can't do then leave it for some one else please do it with

please do it with your best effort if u can if you can't do then leave it for some one else please do it with your best way so that you get upvote

Accounting question!!!

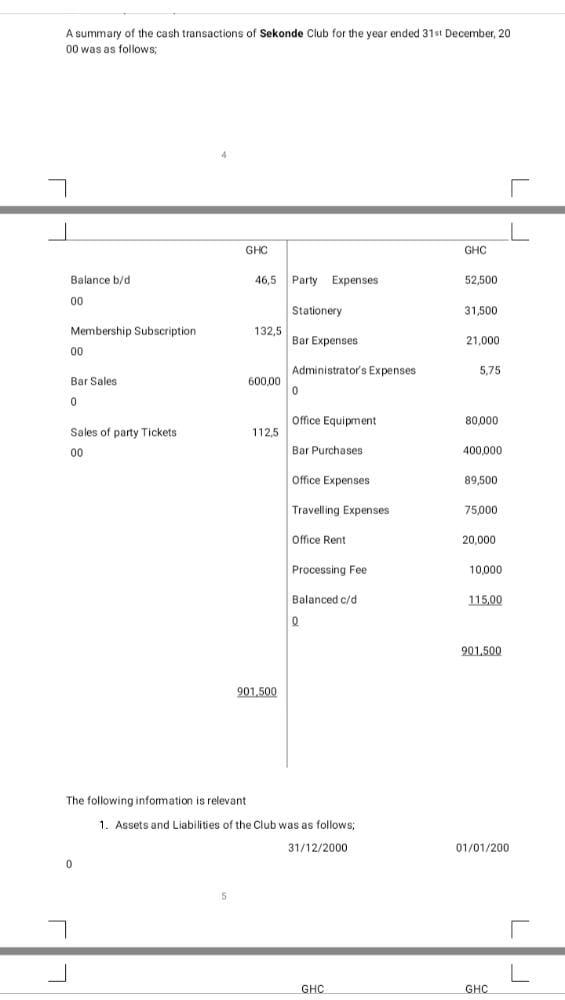

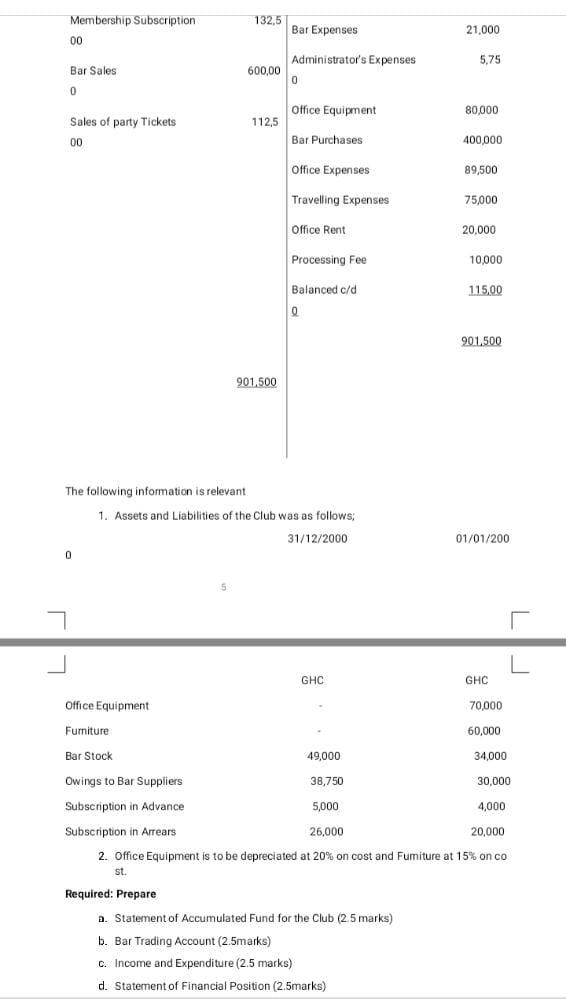

A summary of the cash transactions of Sekonde Club for the year ended 31st December, 20 00 was as follows: LU GHC GHC 46,5 Party Expenses 52,500 Balance b/d 00 Stationery 31,500 Membership Subscription 132,5 Bar Expenses 21,000 00 5,75 600,00 Bar Sales 0 Administrator's Expenses 0 0 Office Equipment 80,000 Sales of party Tickets 112,5 00 Bar Purchases 400,000 Office Expenses 89,500 Travelling Expenses 75,000 Office Rent 20,000 Processing Fee 10,000 115,00 Balanced c/d 0 901.500 901,500 The following information is relevant 1. Assets and Liabilities of the Club was as follows: 31/12/2000 0 01/01/200 LI GHC GHC 132,5 Membership Subscription 00 Bar Expenses 21,000 5,75 600,00 Bar Sales 0 Administrator's Expenses 0 Office Equipment 80,000 112,5 Sales of party Tickets 00 Bar Purchases 400,000 Office Expenses 89,500 Travelling Expenses 75,000 Office Rent 20,000 Processing Fee 10,000 Balanced c/d 115,00 0 901.500 901.500 The following information is relevant 1. Assets and Liabilities of the Club was as follows: 31/12/2000 0 01/01/200 GHC GHC Office Equipment 70,000 60,000 Furniture Bar Stock 49,000 34,000 Owings to Bar Suppliers 38,750 30,000 Subscription in Advance 5,000 4,000 Subscription in Arrears 26,000 20,000 2. Office Equipment is to be depreciated at 20% on cost and Furniture at 15% on co st. Required: Prepare a. Statement of Accumulated Fund for the Club (25 marks) b. Bar Trading Account (2.5marks) C. Income and Expenditure (2.5 marks) d. Statement of Financial Position (2.5marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started