Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do Journal Entries, T-Accounts, and Financial Statemsnts. Beamer Business Year 2019 Chris opened a Beamer business on January 1, 2 pened a Beamer business

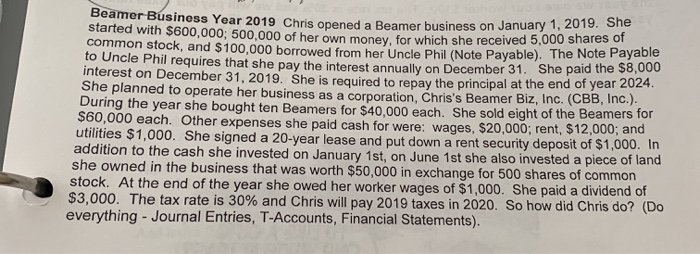

Please do Journal Entries, T-Accounts, and Financial Statemsnts.

Beamer Business Year 2019 Chris opened a Beamer business on January 1, 2 pened a Beamer business on January 1, 2019. She started with $600,000, 500,000 of her own money for which she received 5,000 shares of common stock, and $100,000 borrowed from her Uncle Phil (Note Payable). The Note Payable to Uncle Phil requires that she pay the interest annually on December 31. She paid the so, interest on December 31, 2019. She is required to repay the principal at the end of year 2024. She planned to operate her business as a corporation, Chris's Beamer Biz, Inc. (CBB, Inc.). During the year she bought ten Beamers for $40,000 each. She sold eight of the Beamers for $60,000 each. Other expenses she paid cash for were: wages, $20,000; rent, $12,000; and utilities $1,000. She signed a 20-year lease and put down a rent security deposit of $1,000. In addition to the cash she invested on January 1st, on June 1st she 1st, on June 1st she also invested a piece of land she owned in the business that was worth $50,000 in exchange for 500 shares of common stock. At the end of the year she owed her worker wages of $1,000. She paid a dividend of $3,000. The tax rate is 30% and Chris will pay 2019 taxes in 2020. So how did Chris do? (Do everything - Journal Entries, T-Accounts, Financial Statements) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started