Question

****Please do not copy and paste. I want a unique answer ****Please use the keyboard to answer ACCT 322 Output Total Fixed Cost Total Variable

****Please do not copy and paste. I want a unique answer ****Please use the keyboard to answer

ACCT 322

| Output | Total Fixed Cost | Total Variable Cost | Total Cost |

| 100 |

|

|

|

| 150 |

| 75,000 |

|

| 200 | 10,000 |

|

|

| 250 |

|

|

|

| 300 |

|

|

|

Answer:

Q.2 Discuss the differences between the Job order costing and Process costing? (2 Marks)

Answer

Q3 Abdulkrim Company manufactures a product A. The company estimates the cost function for the total costs. The cost driver is number of units. The following informations were collected:

Month Units Total Costs

January 3,560 $242,400

February 3,800 $252,000

March 4,000 $260,000

April 3,600 $244,000

May 3,200 $228,000

June 3,040 $221,600

Compute a cost function using the high-low method. (2 Mark)

Answer:

Q4 Whether a company uses process costing or job-order costing depends on its industry. A number of companies in different industries are listed below: ( 2 Marks) 1. Dairy farm 2. Custom boat builder 3. Food caterer that supplies food for wedding and other special events 4. Advertising agency 5. Coal mining company 6. Cattle feedlot that fattens cattle prior to slaughter Required: For each company, indicate whether the company is most likely to use job-order costing or process costing. Answer

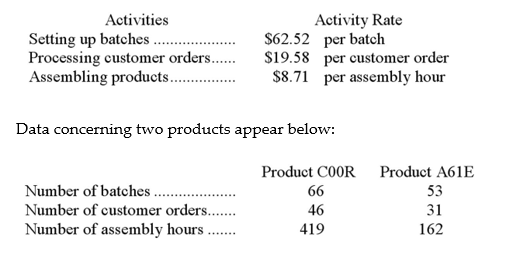

Q.5 S Corporation uses the following activity rates from its activity-based costing system to assign overhead costs to products. (2 Marks)  How much overhead cost would be assigned to each of the two products using the company's activity-based costing system? Answer

How much overhead cost would be assigned to each of the two products using the company's activity-based costing system? Answer

Activities Setting up batches........ Processing customer orders...... Assembling products............ Activity Rate $62.52 per batch $19.58 per customer order $8.71 per assembly hour Data concerning two products appear below: Number of batches...... Number of customer orders....... Number of assembly hours...... Product COOR Product A61E 66 53 46 31 419 162

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started