Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE do not copy and paste the exact same answers that are already posted. Read the comments on the others for more info but make

PLEASE do not copy and paste the exact same answers that are already posted. Read the comments on the others for more info but make sure the names for entries are correct

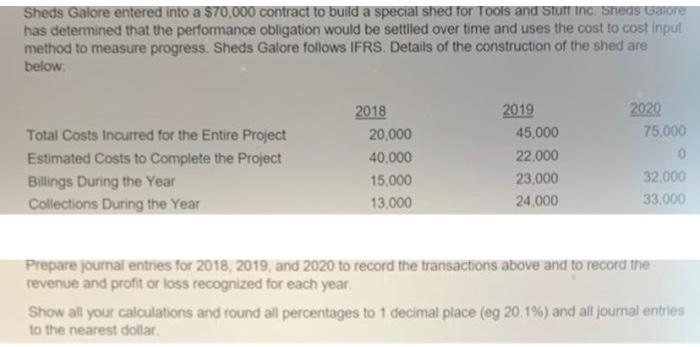

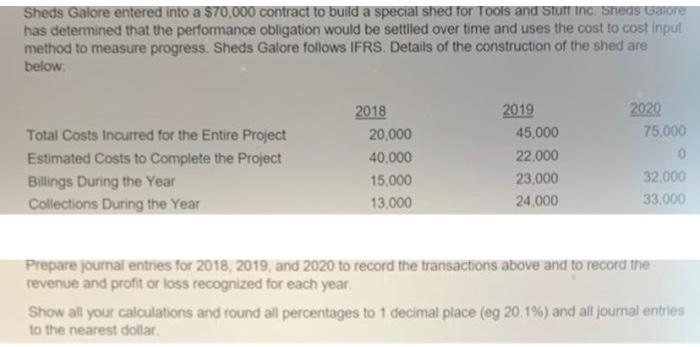

Sheds Galore entered into a $70,000 contract to build a special shed for Tools and stuffing Sheds Galore has determined that the performance obligation would be settled over time and uses the cost to cost input method to measure progress. Sheds Galore follows IFRS. Details of the construction of the shed are below 2020 75.000 Total Costs incurred for the entire Project Estimated Costs to Complete the Project Billings During the Year Collections During the Year 2018 20.000 40.000 15,000 13,000 2019 45,000 22.000 23,000 24,000 32,000 33.000 Prepare journal entries for 2018, 2019, and 2020 to record the transactions above and to record the revenue and profit or loss recognized for each year Show all your calculations and round all percentages to 1 decimal place (eg 20.1%) and all journal entries to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started