Please do not go to other cheggs for the steps or answers, they are in correct. Please show calculation.

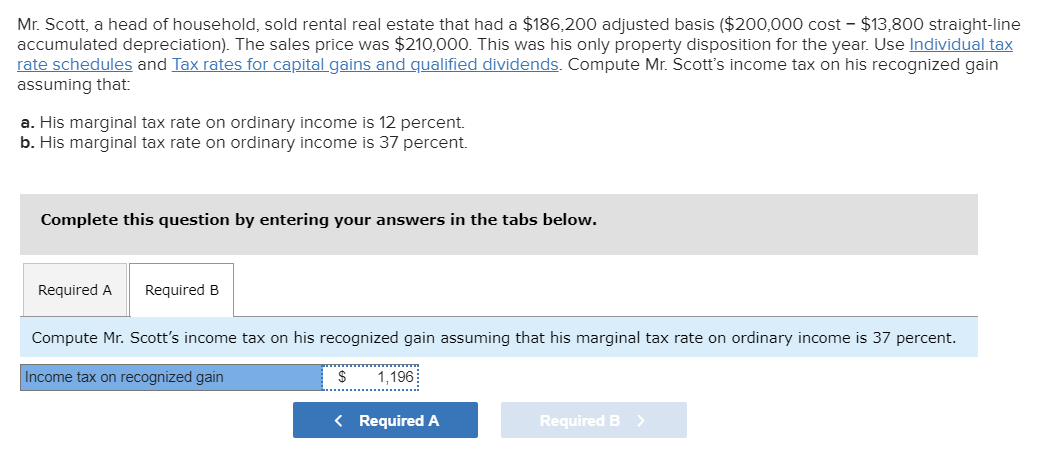

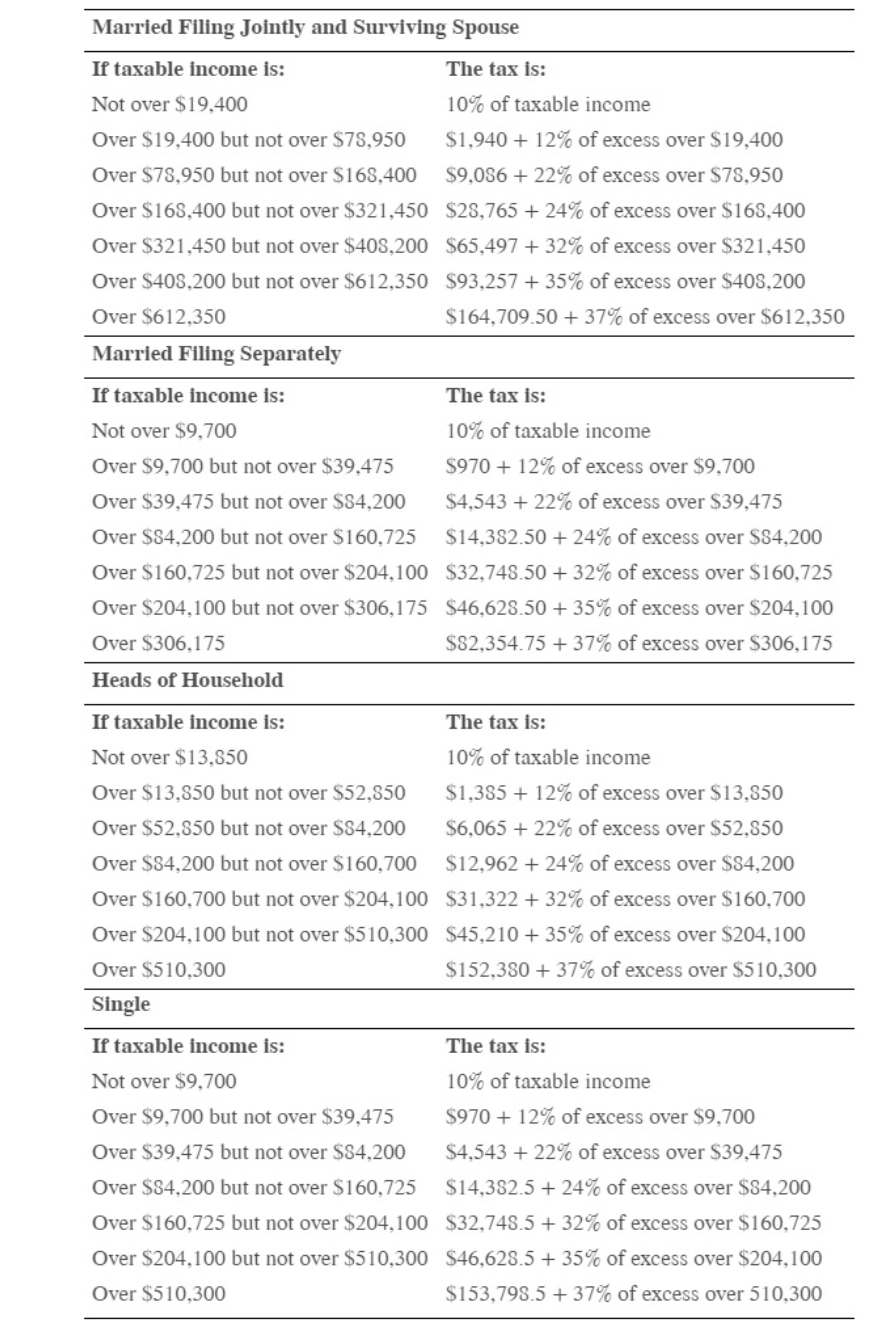

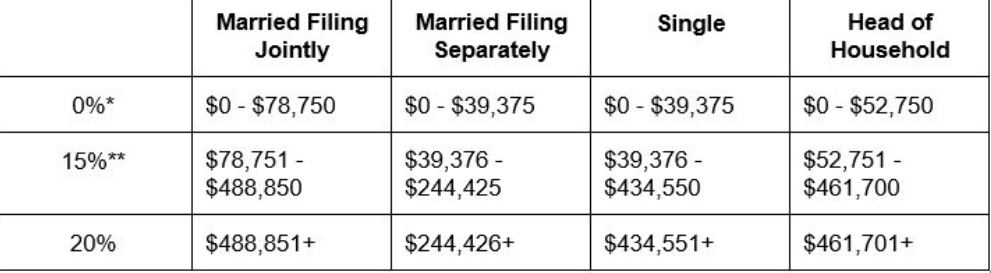

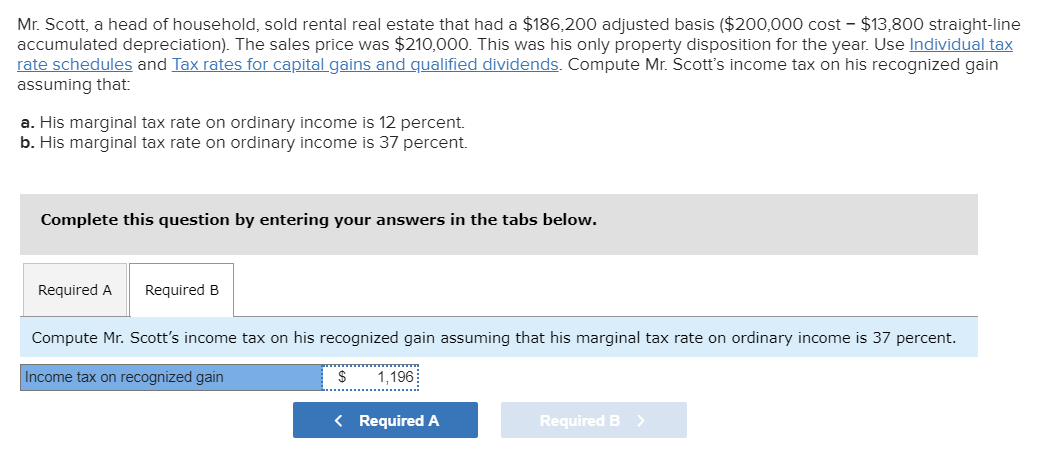

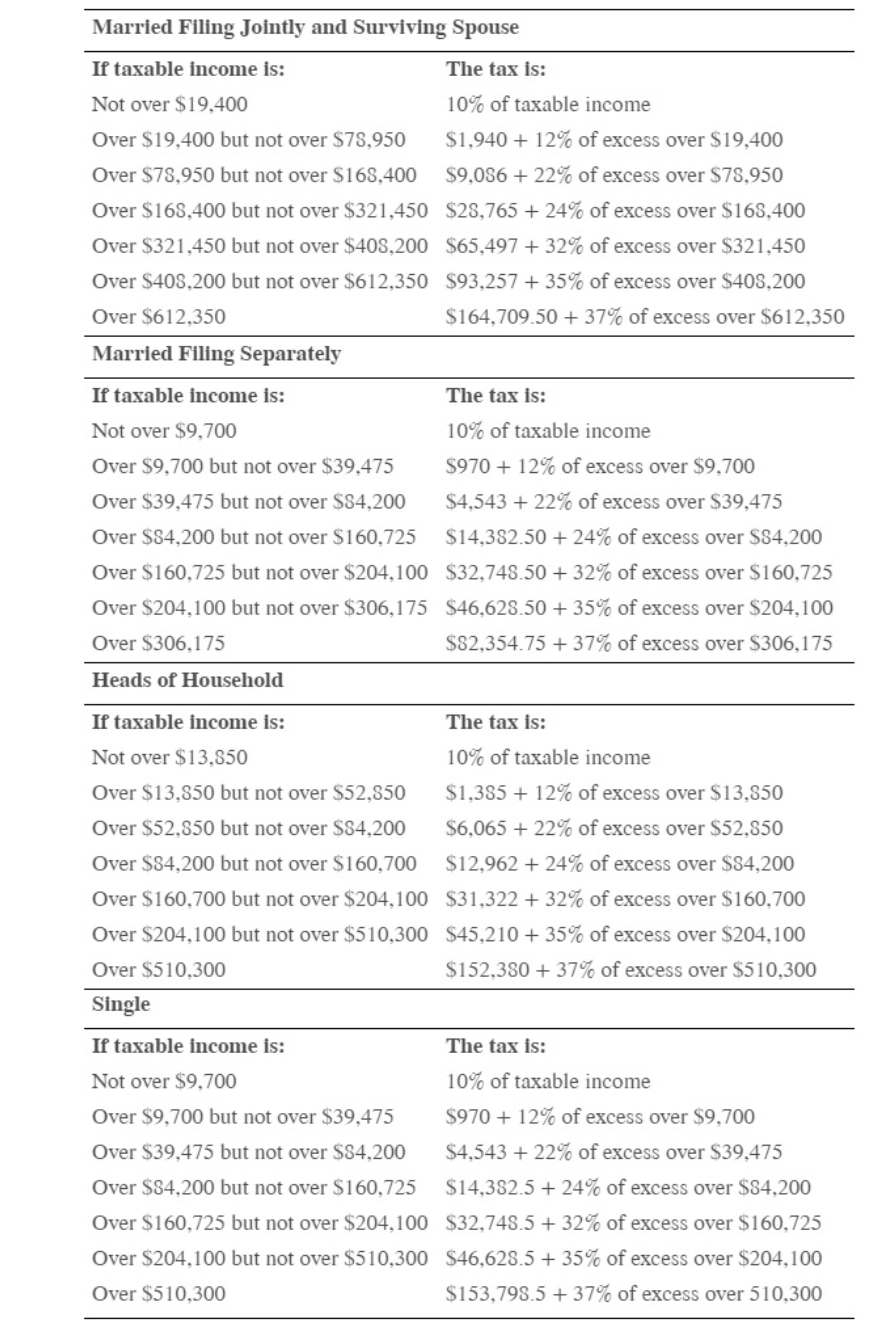

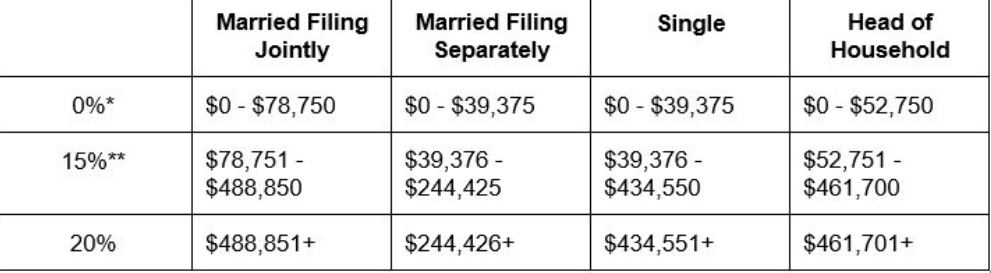

Mr. Scott, a head of household, sold rental real estate that had a $186,200 adjusted basis ($200,000 cost - $13,800 straight-line accumulated depreciation). The sales price was $210,000. This was his only property disposition for the year. Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends. Compute Mr. Scott's income tax on his recognized gain assuming that: a. His marginal tax rate on ordinary income is 12 percent. b. His marginal tax rate on ordinary income is 37 percent. Complete this question by entering your answers in the tabs below. Required A Required B Compute Mr. Scott's income tax on his recognized gain assuming that his marginal tax rate on ordinary income is 37 percent. Income tax on recognized gain $ 1,196 Married Filing Jointly and Surviving Spouse If taxable income is: The tax is: Not over $19,400 10% of taxable income Over $19,400 but not over $78,950 $1,940 + 12% of excess over $19,400 Over $78,950 but not over $168,400 $9.086 + 22% of excess over $78,950 Over $168,400 but not over $321,450 $28,765 + 24% of excess over $168,400 Over $321,450 but not over $408,200 $65,497 + 32% of excess over $321,450 Over $408,200 but not over $612,350 $93,257 + 35% of excess over $408,200 Over $612,350 $164,709.50 + 37% of excess over $612,350 Married Filing Separately If taxable income is: The tax is: Not over $9,700 10% of taxable income Over $9,700 but not over $39,475 $970 + 12% of excess over $9,700 Over $39,475 but not over $84,200 $4,543 + 22% of excess over $39,475 Over $84,200 but not over $160,725 $14,382.50 +24% of excess over $84,200 Over $160,725 but not over $204,100 $32,748.50 +32% of excess over $160,725 Over $204,100 but not over $306,175 $46,628.50 + 35% of excess over $204,100 Over $306,175 $82,354.75 + 37% of excess over $306,175 Heads of Household If taxable income is: The tax is: Not over $13,850 10% of taxable income Over $13,850 but not over $52,850 $1,385 + 12% of excess over $13,850 Over $52,850 but not over $84,200 $6.065 + 22% of excess over $52,850 Over $84,200 but not over $160,700 $12,962 + 24% of excess over $84,200 Over $160,700 but not over $204,100 $31,322 + 32% of excess over $160,700 Over $204,100 but not over $510,300 $45,210 + 35% of excess over $204,100 Over $510,300 $152,380 + 37% of excess over $510,300 Single If taxable income is: The tax is: Not over $9,700 10% of taxable income Over $9,700 but not over $39,475 $970 + 12% of excess over $9,700 Over $39,475 but not over $84,200 $4,543 + 22% of excess over $39,475 Over $84,200 but not over $160,725 $14,382.5 + 24% of excess over $84,200 Over $160,725 but not over $204,100 $32,748.5 + 32% of excess over $160,725 Over $204,100 but not over $510,300 $46,628.5 + 35% of excess over $204,100 Over $510,300 $153,798.5 + 37% of excess over 510,300 Married Filing Jointly Married Filing Separately Single Head of Household 0%* $0 - $78,750 $0 - $39,375 $0 - $39,375 $0 - $52,750 15%** $78,751 - $488,850 $39,376 - $244,425 $39,376 - $434,550 $52,751 - $461,700 20% $488,851+ $244,426+ $434,551+ $461,701+ Mr. Scott, a head of household, sold rental real estate that had a $186,200 adjusted basis ($200,000 cost - $13,800 straight-line accumulated depreciation). The sales price was $210,000. This was his only property disposition for the year. Use Individual tax rate schedules and Tax rates for capital gains and qualified dividends. Compute Mr. Scott's income tax on his recognized gain assuming that: a. His marginal tax rate on ordinary income is 12 percent. b. His marginal tax rate on ordinary income is 37 percent. Complete this question by entering your answers in the tabs below. Required A Required B Compute Mr. Scott's income tax on his recognized gain assuming that his marginal tax rate on ordinary income is 37 percent. Income tax on recognized gain $ 1,196 Married Filing Jointly and Surviving Spouse If taxable income is: The tax is: Not over $19,400 10% of taxable income Over $19,400 but not over $78,950 $1,940 + 12% of excess over $19,400 Over $78,950 but not over $168,400 $9.086 + 22% of excess over $78,950 Over $168,400 but not over $321,450 $28,765 + 24% of excess over $168,400 Over $321,450 but not over $408,200 $65,497 + 32% of excess over $321,450 Over $408,200 but not over $612,350 $93,257 + 35% of excess over $408,200 Over $612,350 $164,709.50 + 37% of excess over $612,350 Married Filing Separately If taxable income is: The tax is: Not over $9,700 10% of taxable income Over $9,700 but not over $39,475 $970 + 12% of excess over $9,700 Over $39,475 but not over $84,200 $4,543 + 22% of excess over $39,475 Over $84,200 but not over $160,725 $14,382.50 +24% of excess over $84,200 Over $160,725 but not over $204,100 $32,748.50 +32% of excess over $160,725 Over $204,100 but not over $306,175 $46,628.50 + 35% of excess over $204,100 Over $306,175 $82,354.75 + 37% of excess over $306,175 Heads of Household If taxable income is: The tax is: Not over $13,850 10% of taxable income Over $13,850 but not over $52,850 $1,385 + 12% of excess over $13,850 Over $52,850 but not over $84,200 $6.065 + 22% of excess over $52,850 Over $84,200 but not over $160,700 $12,962 + 24% of excess over $84,200 Over $160,700 but not over $204,100 $31,322 + 32% of excess over $160,700 Over $204,100 but not over $510,300 $45,210 + 35% of excess over $204,100 Over $510,300 $152,380 + 37% of excess over $510,300 Single If taxable income is: The tax is: Not over $9,700 10% of taxable income Over $9,700 but not over $39,475 $970 + 12% of excess over $9,700 Over $39,475 but not over $84,200 $4,543 + 22% of excess over $39,475 Over $84,200 but not over $160,725 $14,382.5 + 24% of excess over $84,200 Over $160,725 but not over $204,100 $32,748.5 + 32% of excess over $160,725 Over $204,100 but not over $510,300 $46,628.5 + 35% of excess over $204,100 Over $510,300 $153,798.5 + 37% of excess over 510,300 Married Filing Jointly Married Filing Separately Single Head of Household 0%* $0 - $78,750 $0 - $39,375 $0 - $39,375 $0 - $52,750 15%** $78,751 - $488,850 $39,376 - $244,425 $39,376 - $434,550 $52,751 - $461,700 20% $488,851+ $244,426+ $434,551+ $461,701+