Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE DO NOT USE ANY DATA THAT HAS ALREADY BEEN SUBMITTED FOR THIS QUESTION PREVIOUSLY. ONLY NEW & ORIGINAL WORK. THANK YOU! Using the information

PLEASE DO NOT USE ANY DATA THAT HAS ALREADY BEEN SUBMITTED FOR THIS QUESTION PREVIOUSLY. ONLY NEW & ORIGINAL WORK. THANK YOU!

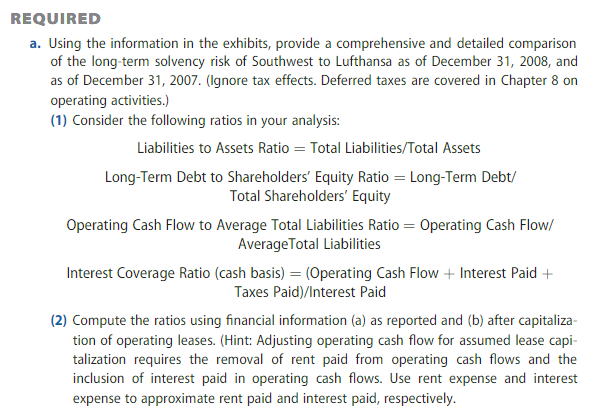

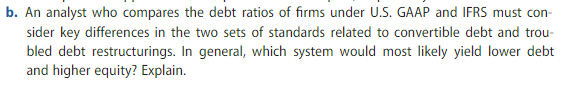

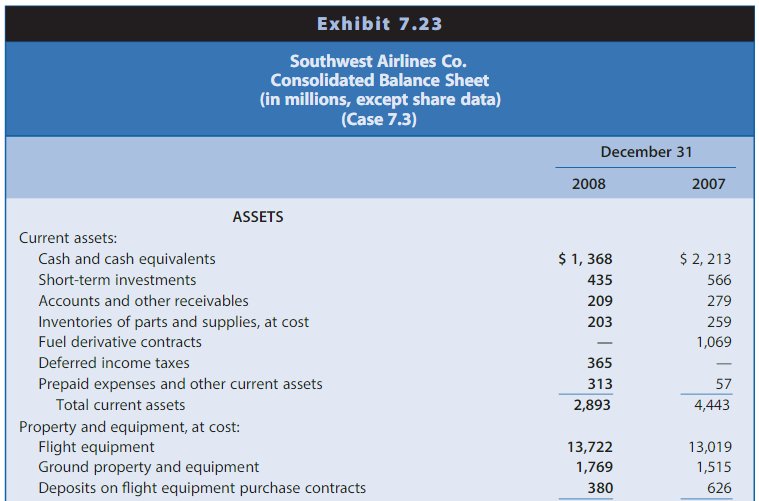

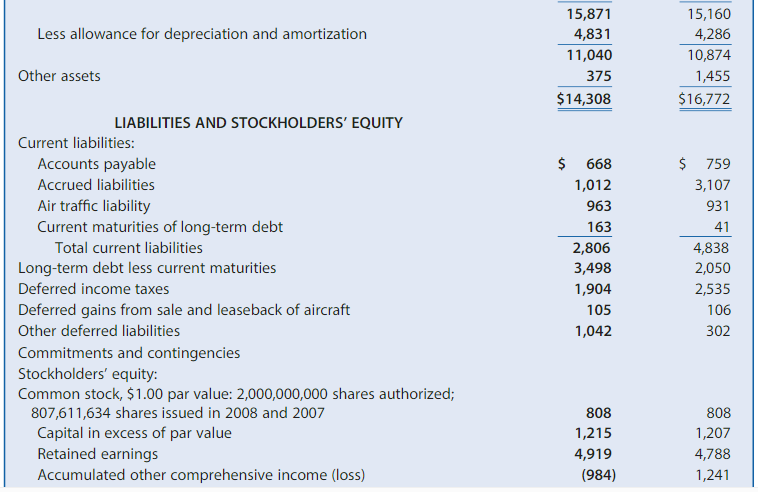

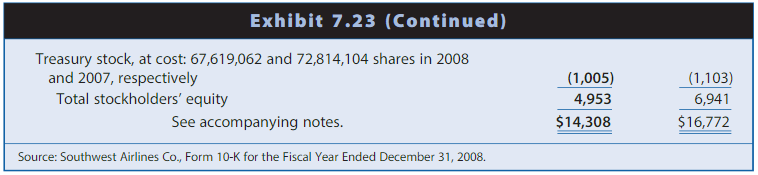

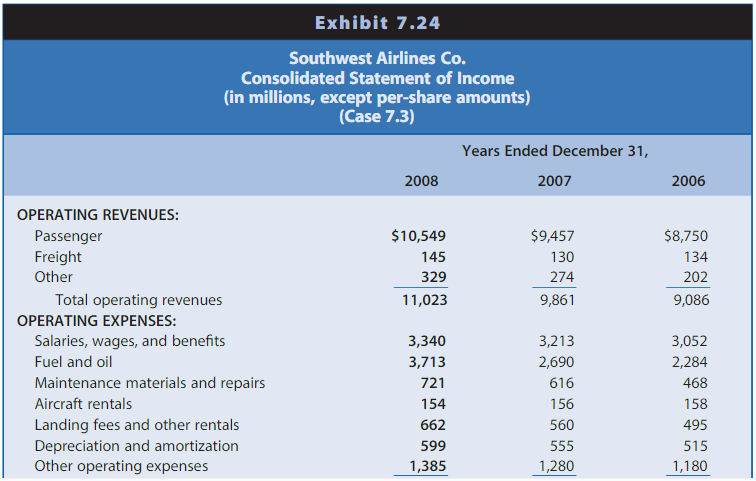

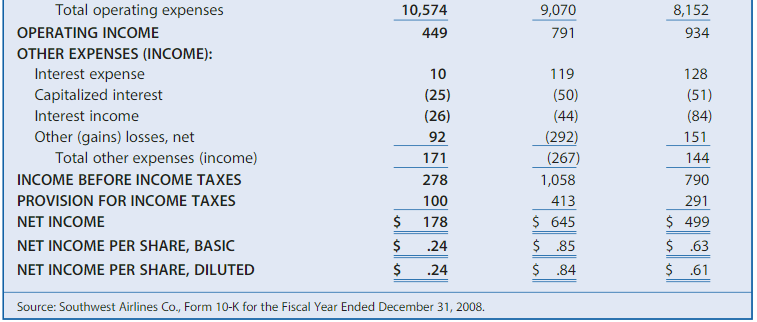

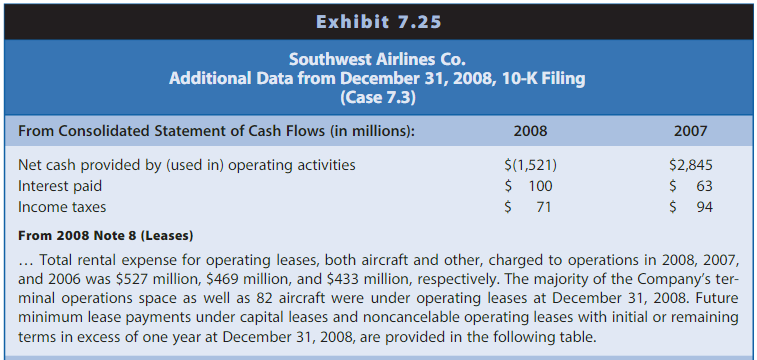

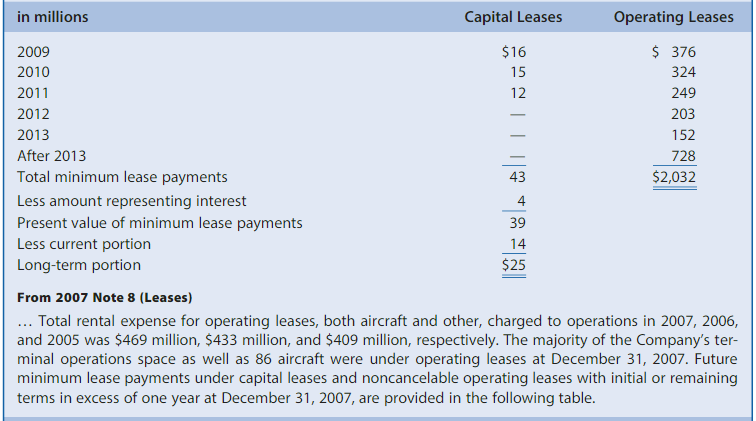

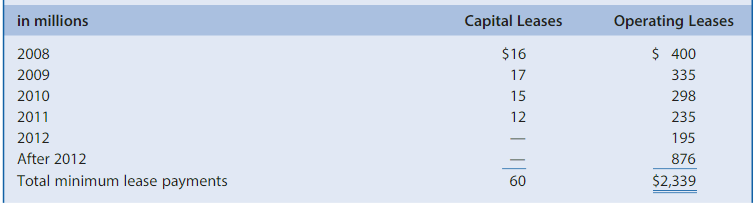

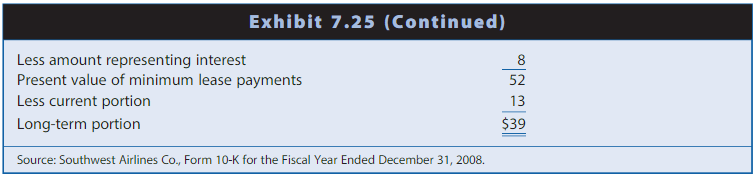

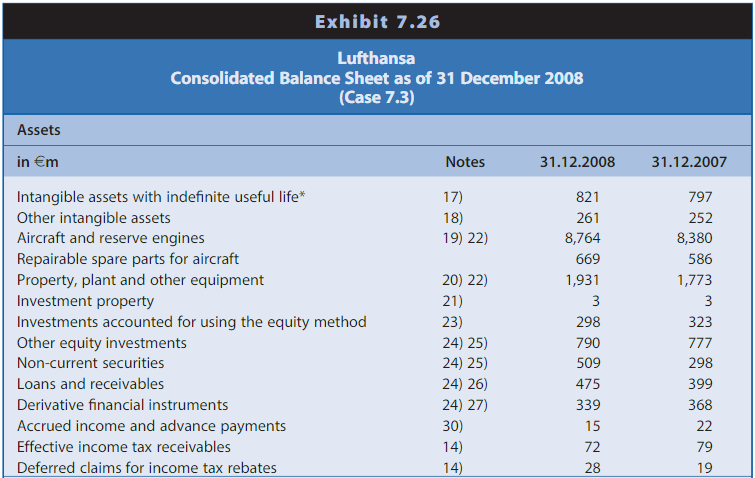

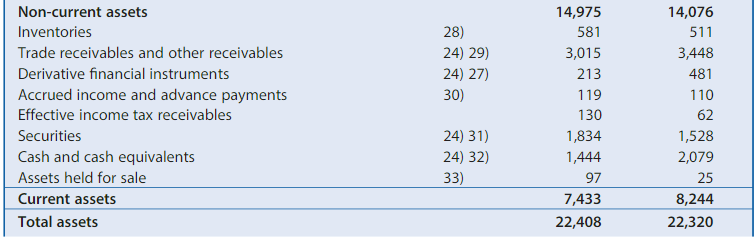

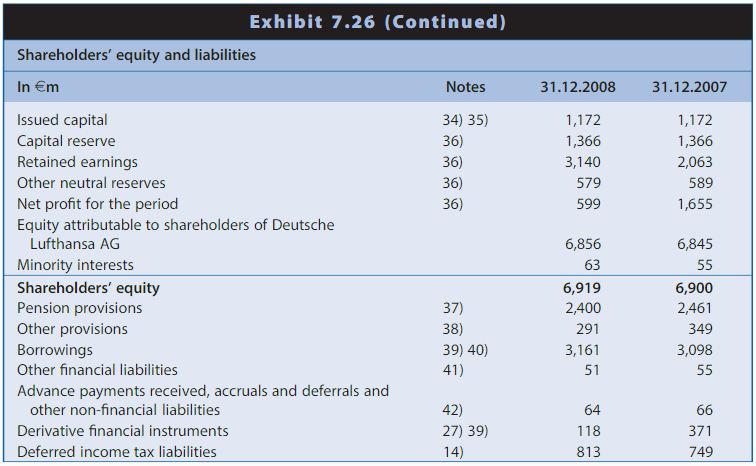

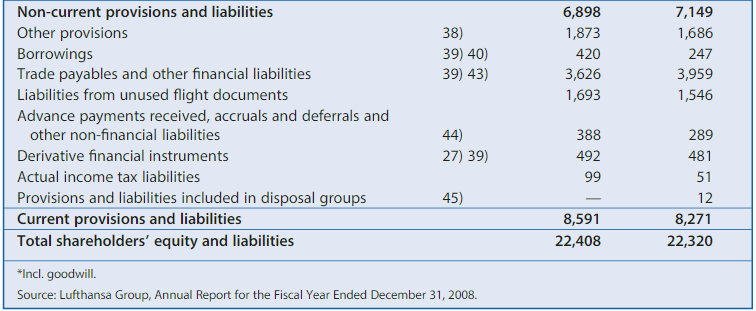

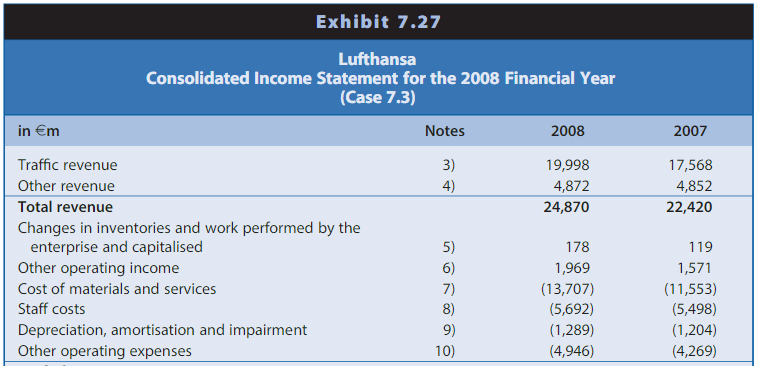

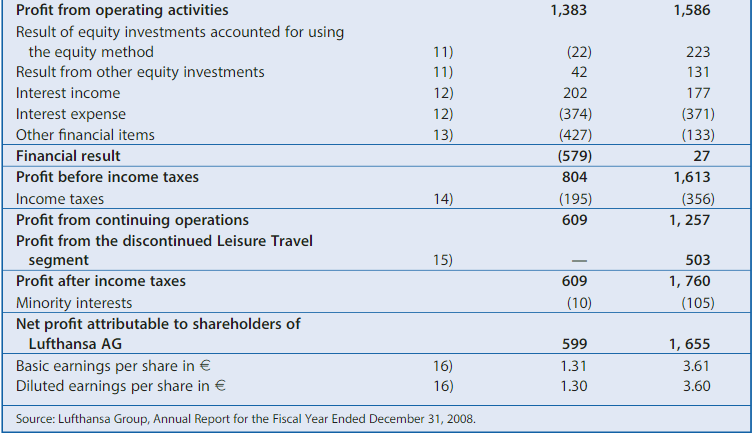

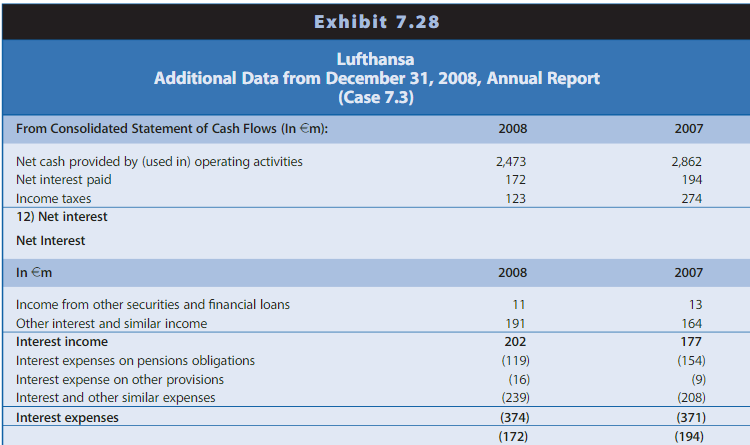

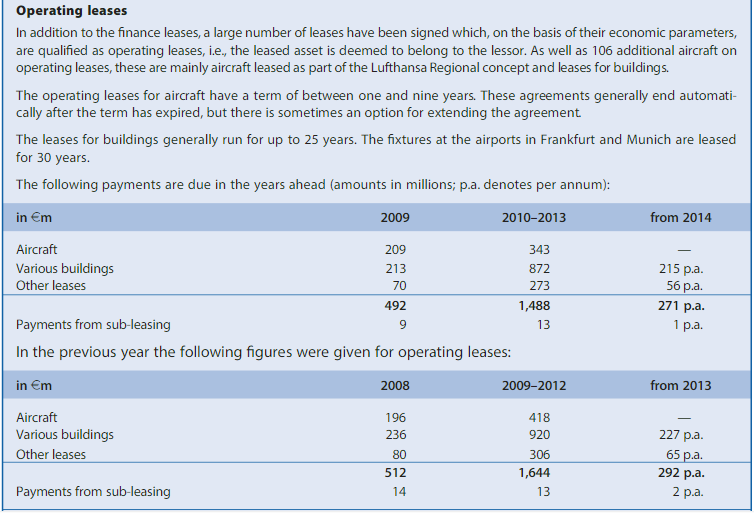

Using the information in the exhibits, provide a comprehensive and detailed comparison of the long-term solvency risk of Southwest to Lufthansa as of December 31, 2008, and as of December 31, 2007. (Ignore tax effects. Deferred taxes are covered in Chapter 8 on operating activities.) (1) Consider the following ratios in your analysis: Liabilities to Assets Ratio = Total Liabilities/Total Assets Long-Term Debt to Shareholders' Equity Ratio = Long-Term Debt/ Total Shareholders' Equity Operating Cash Flow to Average Total Liabilities Ratio = Operating Cash Flow/ AverageTotal Liabilities Interest Coverage Ratio (cash basis) = (Operating Cash Flow + Interest Paid + Taxes Paid)/Interest Paid (2) Compute the ratios using financial information (a) as reported and (b) after capitalization of operating leases. (Hint: Adjusting operating cash flow for assumed lease capitalization requires the removal of rent paid from operating cash flows and the inclusion of interest paid in operating cash flows. Use rent expense and interest expense to approximate rent paid and interest paid, respectively. b. An analyst who compares the debt ratios of firms under U.S. GAAP and IFRS must consider key differences in the two sets of standards related to convertible debt and troubled debt restructurings. In general, which system would most likely yield lower debt and higher equity? Explain. Exhibit 7.23 (Continued) Treasury stock, at cost: 67,619,062 and 72,814,104 shares in 2008 and 2007, respectively Total stockholders' equity See accompanying notes. 4,953(1,005) $16,7726,941(1,103) Source: Southwest Airlines Co., Form 10-K for the Fiscal Year Ended December 31, 2008. Total operating expenses OPERATING INCOME OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES NET INCOME NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED Source: Southwest Airlines Co., Form 10-K for the Fiscal Year Ended December 31, 2008. ... Total rental expense for operating leases, both aircraft and other, charged to operations in 2008, 2007, and 2006 was $527 million, $469 million, and $433 million, respectively. The majority of the Company's terminal operations space as well as 82 aircraft were under operating leases at December 31 , 2008. Future minimum lease payments under capital leases and noncancelable operating leases with initial or remaining terms in excess of one year at December 31, 2008, are provided in the following table. From 2007 Note 8 (Leases) ... Total rental expense for operating leases, both aircraft and other, charged to operations in 2007, 2006, and 2005 was $469 million, $433 million, and $409 million, respectively. The majority of the Company's terminal operations space as well as 86 aircraft were under operating leases at December 31, 2007. Future minimum lease payments under capital leases and noncancelable operating leases with initial or remaining terms in excess of one year at December 31,2007 , are provided in the following table. Exhibit 7.25 (Continued) Less amount representing interest 528 Present value of minimum lease payments $3913 Less current portion Long-term portion Source: Southwest Airlines Co., Form 10-K for the Fiscal Year Ended December 31, 2008. \begin{tabular}{|lrrr|} Non-current assets & & 14,975 & 14,076 \\ Inventories & 28) & 581 & 511 \\ Trade receivables and other receivables & 24)29) & 3,015 & 3,448 \\ Derivative financial instruments & 24)27) & 213 & 481 \\ Accrued income and advance payments & 30) & 119 & 110 \\ Effective income tax receivables & & 130 & 62 \\ Securities & 24)31) & 1,834 & 1,528 \\ Cash and cash equivalents & 24)32) & 1,444 & 2,079 \\ Assets held for sale & 33) & 97 & 25 \\ \hline Current assets & & 7,433 & 8,244 \\ \hline Total assets & 22,408 & 22,320 \end{tabular} *Incl. goodwill. Source: Lufthansa Group, Annual Report for the Fiscal Year Ended December 31, 2008. Profit from operating activities Source: Lufthansa Group, Annual Report for the Fiscal Year Ended December 31, 2008. Operating leases In addition to the finance leases, a large number of leases have been signed which, on the basis of their economic parameters, are qualified as operating leases, i.e., the leased asset is deemed to belong to the lessor. As well as 106 additional aircraft on operating leases, these are mainly aircraft leased as part of the Lufthansa Regional concept and leases for buildings. The operating leases for aircraft have a term of between one and nine years. These agreements generally end automatically after the term has expired, but there is sometimes an option for extending the agreement. The leases for buildings generally run for up to 25 years. The fixtures at the airports in Frankfurt and Munich are leased for 30 years. The following payments are due in the years ahead (amounts in millions; p.a. denotes per annum): Using the information in the exhibits, provide a comprehensive and detailed comparison of the long-term solvency risk of Southwest to Lufthansa as of December 31, 2008, and as of December 31, 2007. (Ignore tax effects. Deferred taxes are covered in Chapter 8 on operating activities.) (1) Consider the following ratios in your analysis: Liabilities to Assets Ratio = Total Liabilities/Total Assets Long-Term Debt to Shareholders' Equity Ratio = Long-Term Debt/ Total Shareholders' Equity Operating Cash Flow to Average Total Liabilities Ratio = Operating Cash Flow/ AverageTotal Liabilities Interest Coverage Ratio (cash basis) = (Operating Cash Flow + Interest Paid + Taxes Paid)/Interest Paid (2) Compute the ratios using financial information (a) as reported and (b) after capitalization of operating leases. (Hint: Adjusting operating cash flow for assumed lease capitalization requires the removal of rent paid from operating cash flows and the inclusion of interest paid in operating cash flows. Use rent expense and interest expense to approximate rent paid and interest paid, respectively. b. An analyst who compares the debt ratios of firms under U.S. GAAP and IFRS must consider key differences in the two sets of standards related to convertible debt and troubled debt restructurings. In general, which system would most likely yield lower debt and higher equity? Explain. Exhibit 7.23 (Continued) Treasury stock, at cost: 67,619,062 and 72,814,104 shares in 2008 and 2007, respectively Total stockholders' equity See accompanying notes. 4,953(1,005) $16,7726,941(1,103) Source: Southwest Airlines Co., Form 10-K for the Fiscal Year Ended December 31, 2008. Total operating expenses OPERATING INCOME OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES NET INCOME NET INCOME PER SHARE, BASIC NET INCOME PER SHARE, DILUTED Source: Southwest Airlines Co., Form 10-K for the Fiscal Year Ended December 31, 2008. ... Total rental expense for operating leases, both aircraft and other, charged to operations in 2008, 2007, and 2006 was $527 million, $469 million, and $433 million, respectively. The majority of the Company's terminal operations space as well as 82 aircraft were under operating leases at December 31 , 2008. Future minimum lease payments under capital leases and noncancelable operating leases with initial or remaining terms in excess of one year at December 31, 2008, are provided in the following table. From 2007 Note 8 (Leases) ... Total rental expense for operating leases, both aircraft and other, charged to operations in 2007, 2006, and 2005 was $469 million, $433 million, and $409 million, respectively. The majority of the Company's terminal operations space as well as 86 aircraft were under operating leases at December 31, 2007. Future minimum lease payments under capital leases and noncancelable operating leases with initial or remaining terms in excess of one year at December 31,2007 , are provided in the following table. Exhibit 7.25 (Continued) Less amount representing interest 528 Present value of minimum lease payments $3913 Less current portion Long-term portion Source: Southwest Airlines Co., Form 10-K for the Fiscal Year Ended December 31, 2008. \begin{tabular}{|lrrr|} Non-current assets & & 14,975 & 14,076 \\ Inventories & 28) & 581 & 511 \\ Trade receivables and other receivables & 24)29) & 3,015 & 3,448 \\ Derivative financial instruments & 24)27) & 213 & 481 \\ Accrued income and advance payments & 30) & 119 & 110 \\ Effective income tax receivables & & 130 & 62 \\ Securities & 24)31) & 1,834 & 1,528 \\ Cash and cash equivalents & 24)32) & 1,444 & 2,079 \\ Assets held for sale & 33) & 97 & 25 \\ \hline Current assets & & 7,433 & 8,244 \\ \hline Total assets & 22,408 & 22,320 \end{tabular} *Incl. goodwill. Source: Lufthansa Group, Annual Report for the Fiscal Year Ended December 31, 2008. Profit from operating activities Source: Lufthansa Group, Annual Report for the Fiscal Year Ended December 31, 2008. Operating leases In addition to the finance leases, a large number of leases have been signed which, on the basis of their economic parameters, are qualified as operating leases, i.e., the leased asset is deemed to belong to the lessor. As well as 106 additional aircraft on operating leases, these are mainly aircraft leased as part of the Lufthansa Regional concept and leases for buildings. The operating leases for aircraft have a term of between one and nine years. These agreements generally end automatically after the term has expired, but there is sometimes an option for extending the agreement. The leases for buildings generally run for up to 25 years. The fixtures at the airports in Frankfurt and Munich are leased for 30 years. The following payments are due in the years ahead (amounts in millions; p.a. denotes per annum)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started