Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do not use excel to calculate, need to use formulas by hand! thanks 1. Briefly discuss the following questions: a. (7) What is the

Please do not use excel to calculate, need to use formulas by hand! thanks

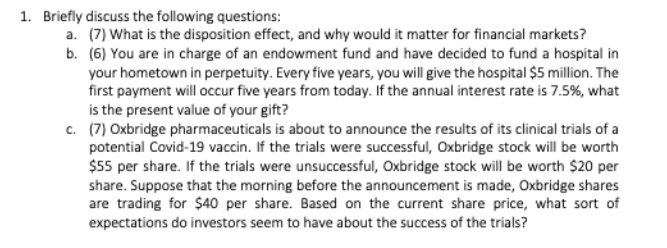

1. Briefly discuss the following questions: a. (7) What is the disposition effect, and why would it matter for financial markets? b. (6) You are in charge of an endowment fund and have decided to fund a hospital in your hometown in perpetuity. Every five years, you will give the hospital $5 million. The first payment will occur five years from today. If the annual interest rate is 7.5%, what is the present value of your gift? C. (7) Oxbridge pharmaceuticals is about to announce the results of its clinical trials of a potential Covid-19 vaccin. If the trials were successful, Oxbridge stock will be worth $55 per share. If the trials were unsuccessful, Oxbridge stock will be worth $20 per share. Suppose that the morning before the announcement is made, Oxbridge shares are trading for $40 per share. Based on the current share price, what sort of expectations do investors seem to have about the success of the trials? 1. Briefly discuss the following questions: a. (7) What is the disposition effect, and why would it matter for financial markets? b. (6) You are in charge of an endowment fund and have decided to fund a hospital in your hometown in perpetuity. Every five years, you will give the hospital $5 million. The first payment will occur five years from today. If the annual interest rate is 7.5%, what is the present value of your gift? C. (7) Oxbridge pharmaceuticals is about to announce the results of its clinical trials of a potential Covid-19 vaccin. If the trials were successful, Oxbridge stock will be worth $55 per share. If the trials were unsuccessful, Oxbridge stock will be worth $20 per share. Suppose that the morning before the announcement is made, Oxbridge shares are trading for $40 per share. Based on the current share price, what sort of expectations do investors seem to have about the success of the trialsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started