Answered step by step

Verified Expert Solution

Question

1 Approved Answer

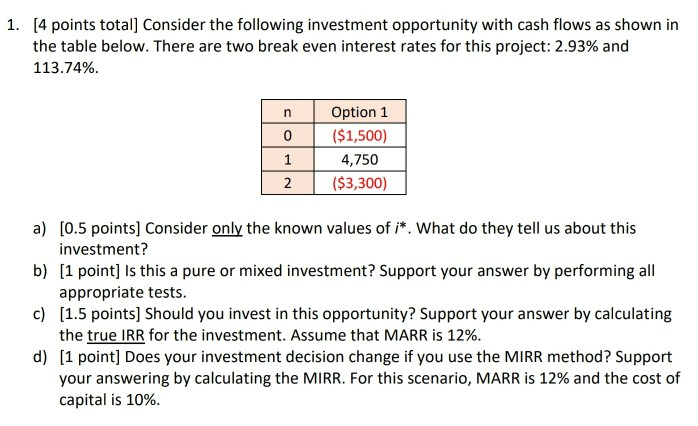

Please do not use excell, or any software. Only use equations/formulas. Thank you. 1. [4 points total] Consider the following investment opportunity with cash flows

Please do not use excell, or any software. Only use equations/formulas. Thank you.

1. [4 points total] Consider the following investment opportunity with cash flows as shown in the table below. There are two break even interest rates for this project: 2.93% and 113.74% n Option 1 ($1,500) 4,750 ($3,300) 1 2 a) [0.5 points] Consider only the known values of i*. What do they tell us about this investment? b) [1 point] Is this a pure or mixed investment? Support your answer by performing all appropriate tests. c) (1.5 points) Should you invest in this opportunity? Support your answer by calculating the true IRR for the investment. Assume that MARR is 12%. d) (1 point] Does your investment decision change if you use the MIRR method? Support your answering by calculating the MIRR. For this scenario, MARR is 12% and the cost of capital is 10% 1. [4 points total] Consider the following investment opportunity with cash flows as shown in the table below. There are two break even interest rates for this project: 2.93% and 113.74% n Option 1 ($1,500) 4,750 ($3,300) 1 2 a) [0.5 points] Consider only the known values of i*. What do they tell us about this investment? b) [1 point] Is this a pure or mixed investment? Support your answer by performing all appropriate tests. c) (1.5 points) Should you invest in this opportunity? Support your answer by calculating the true IRR for the investment. Assume that MARR is 12%. d) (1 point] Does your investment decision change if you use the MIRR method? Support your answering by calculating the MIRR. For this scenario, MARR is 12% and the cost of capital is 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started