Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do number 22 thanks CHAPTER 6 Interest Rates and Bond Valuation 52 21. Bond Yields Bart Software has 5.7 percent coupon bonds on the

please do number 22

thanks

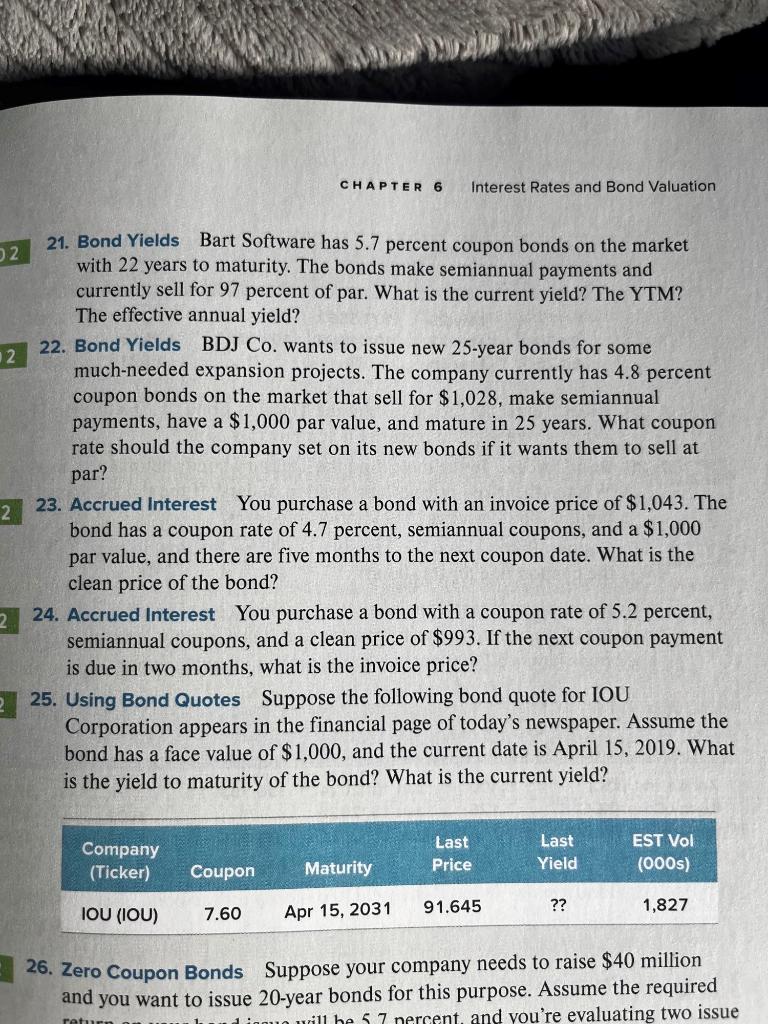

CHAPTER 6 Interest Rates and Bond Valuation 52 21. Bond Yields Bart Software has 5.7 percent coupon bonds on the market with 22 years to maturity. The bonds make semiannual payments and currently sell for 97 percent of par. What is the current yield? The YTM? The effective annual yield? 22. Bond Yields BDJ Co. wants to issue new 25-year bonds for some 2 much-needed expansion projects. The company currently has 4.8 percent coupon bonds on the market that sell for $1,028, make semiannual payments, have a $1,000 par value, and mature in 25 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? 2 23. Accrued Interest You purchase a bond with an invoice price of $1,043. The bond has a coupon rate of 4.7 percent, semiannual coupons, and a $1,000 par value, and there are five months to the next coupon date. What is the clean price of the bond? 2 24. Accrued Interest You purchase a bond with a coupon rate of 5.2 percent, semiannual coupons, and a clean price of $993. If the next coupon payment is due in two months, what is the invoice price? 25. Using Bond Quotes Suppose the following bond quote for IOU Corporation appears in the financial page of today's newspaper. Assume the bond has a face value of $1,000, and the current date is April 15, 2019. What is the yield to maturity of the bond? What is the current yield? Company (Ticker) Last Price Last Yield EST Vol (000s) Coupon Maturity IOU (IOU) ?? 7.60 91.645 Apr 15, 2031 1,827 26. Zero Coupon Bonds Suppose your company needs to raise $40 million and you want to issue 20-year bonds for this purpose. Assume the required Limoun will be 57 nercent, and you're evaluating two issue returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started