please do number 4, 5, 6

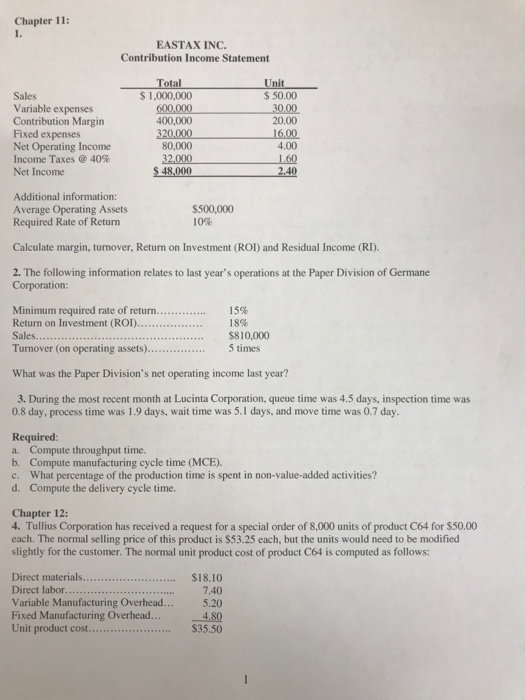

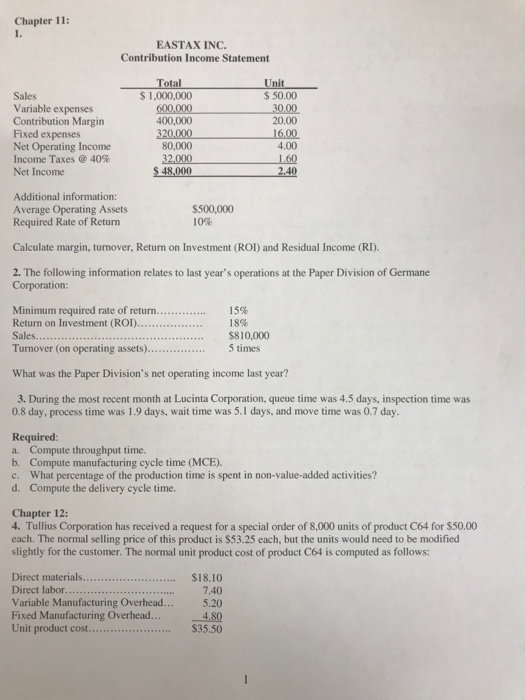

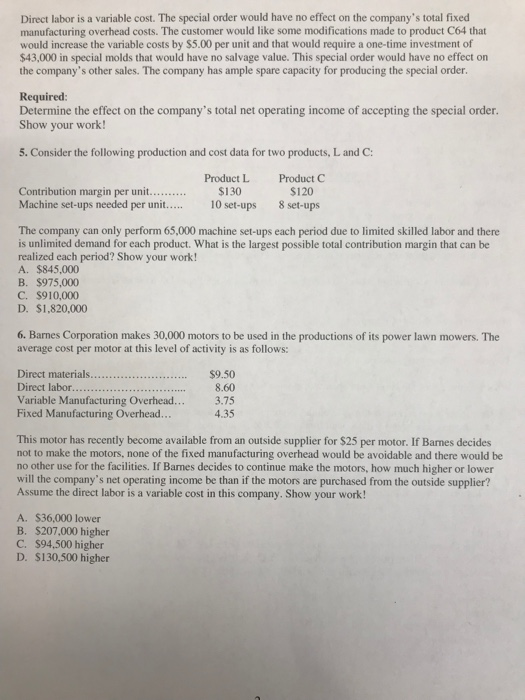

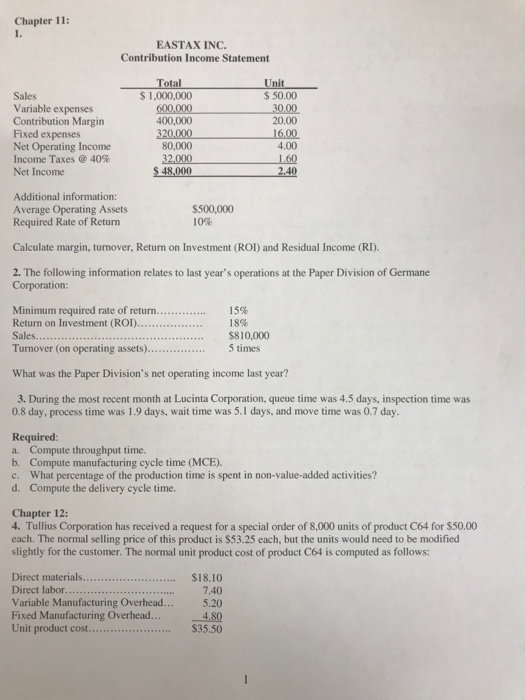

Chapter 11 EASTAX INC. Contribution Income Statement Sales Variable expenses Contribution Margin Fixed expenses Net Operating Income Income Taxes @ 40% Net Income $ 1,000,000 S 50.00 600,000 400,000 20.00 4.00 60 2.40 80,000 Additional information: Average Operating Assets Required Rate of Return $500,000 10% Calculate margin, turnover, Return on Investment (ROI) and Residual Income (RI 2. The following information relates to last year's operations at the Paper Division of Germane Corporation: Minimum required rate of return Return on Investment (ROI)... Sales. Turnover (on operating assets). 15% 18% $810,000 5 times What was the Paper Division's net operating income last year? 3. During the most recent month at Lucinta Corporation, queue time was 4.5 days, inspection time was 0.8 day, process time was 1.9 days, wait time was 5.1 days, and move time was 0.7 day. Required: a. Compute throughput time. b. Compute manufacturing cycle time (MCE). c. What percentage of the production time is spent in non-value-added activities? d. Compute the delivery cycle time Chapter 12 4. Tullius Corporation has received a request for a special order of 8,000 units of product C64 for $50.00 each. The normal selling price of this product is $53.25 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product C64 is computed as follows: Direct labor. Variable Manufacturing Overhead... Fixed Manufacturing Overhead... Unit product cost 7.40 5.20 $35.50 Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product C64 that would increase the variable costs by $5.00 per unit and that would require a one-time investment of $43,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. Required: Determine the effect on the company's total net operating income of accepting the special order Show your work! 5. Consider the following production and cost data for two products, L and C: Product L $130 Product C $120 Machine set-ups needed per unit..10 set-ups 8 set-ups The company can only perform 65,000 machine set-ups each period due to limited skilled labor and there is unlimited demand for each product. What is the largest possible total contribution margin that can be realized each period? Show your work! A. $845,000 B. $975,000 C. $910,000 D. $1,820,000 6. Barnes Corporation makes 30,000 motors to be used in the productions of its power lawn mowers. The average cost per motor at this level of activity is as follows: Direct material... $9.50 Direct labor. Variable Manufacturing Overhead... Fixed Manufacturing Overhead... 8.60 3.75 4.35 This motor has recently become available from an outside supplier for $25 per motor. If Bames decides not to make the motors, none of the fixed manufacturing overhead would be avoidable and there would be no other use for the facilities. If Bames decides to continue make the motors, how much higher or lower will the company's net operating income be than if the motors are purchased from the outside supplier? Assume the direct labor is a variable cost in this company. Show your work! A. $36,000 lower B. $207.000 higher C. $94,500 higher D. $130,500 higher