Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do only Part B ASAP... I'll give you up thumb definitely QUESTION ONE a a) A stock is currently traded at 70 and is

please do only Part B ASAP... I'll give you up thumb definitely

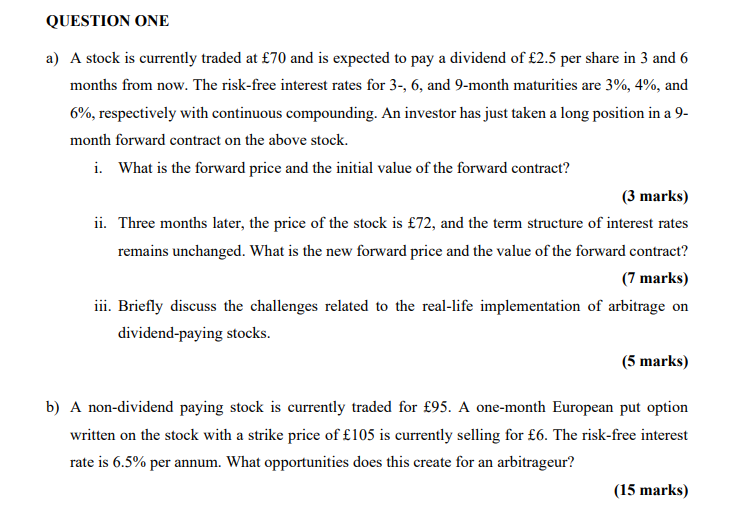

QUESTION ONE a a) A stock is currently traded at 70 and is expected to pay a dividend of 2.5 per share in 3 and 6 months from now. The risk-free interest rates for 3-, 6, and 9-month maturities are 3%, 4%, and 6%, respectively with continuous compounding. An investor has just taken a long position in a 9- month forward contract on the above stock. i. What is the forward price and the initial value of the forward contract? (3 marks) ii. Three months later, the price of the stock is 72, and the term structure of interest rates remains unchanged. What is the new forward price and the value of the forward contract? (7 marks) iii. Briefly discuss the challenges related to the real-life implementation of arbitrage on dividend paying stocks. (5 marks) b) A non-dividend paying stock is currently traded for 95. A one-month European put option written on the stock with a strike price of 105 is currently selling for 6. The risk-free interest rate is 6.5% per annum. What opportunities does this create for an arbitrageur? (15 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started