Please do only the calculations part

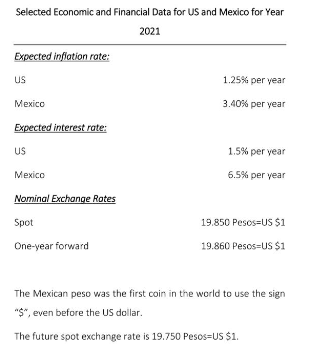

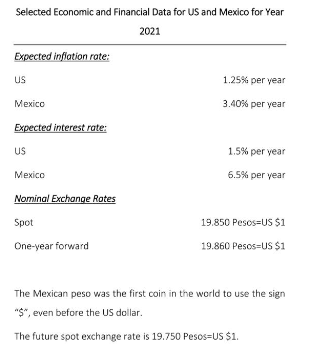

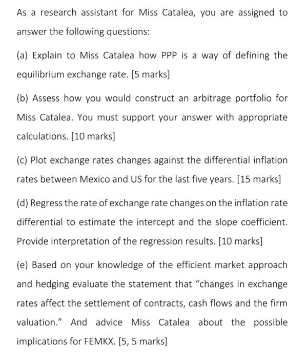

Fidelity Emerging Market Fund (FEMKX) specializes in investing in emerging stock markets of the world. Miss Catalea, an experienced hand in international investments and finance is currently interested in the Mexican stock market and is planned to invest US $ 500,000 Mexico is the first country in Latin America to sign an Economic Partnership, Political Coordination and Cooperation Agreement (Global Agreement) with the European Union (EU). This has . formally helped to boost stock prices in Mexico. But at the same time, Miss Catalea is quite concerned with the volatility and unpredictability of the exchange rates of the Mexican currency. Miss Catalea would like to understand what actually drives the Mexican exchange rates. Since the inflation rate is much higher in Mexico than in United States (US), Miss Catalea thinks that purchasing power parity (PPP) has profound implications in international financial management Miss Catalea conducted her own research and has provided the following selected economic and financial data for your attention. Selected Economic and Financial Data for US and Mexico for Year 2021 Expected inflation rate: us 1.25% per year Mexico 3.40% per year Expected interest rate: US 1.5% per year Mexico 6.5% per year Nominal Exchange Rotes Spot 19.850 Pesos=US $1 One-year forward 19.860 Pesos=US $1 The Mexican peso was the first coin in the world to use the sign "$", even before the US dollar. The future spot exchange rate is 19.750 Pesos=US $1. As a research assistant for Miss Catalea, you are assigned to answer the following questions: (a) Explain to Miss Catalea how PPP is a way of defining the equilibrium exchange rate. [5 marks] (b) Assess how you would construct an arbitrage portfolio for Miss Catalea. You must support your answer with appropriate calculations. [10 marks] (c) Plot exchange rates changes against the differential inflation rates between Mexico and US for the last five years. [15 marks] (d) Regress the rate of exchange rate changes on the inflation rate differential to estimate the intercept and the slope coefficient. Provide interpretation of the regression results. [10 marks] (e) Based on your knowledge of the efficient market approach and hedging evaluate the statement that "changes in exchange rates affect the settlement of contracts, cash flows and the firm valuation. And advice Miss Catalea about the possible implications for FEMKX. [5,5 marks) Fidelity Emerging Market Fund (FEMKX) specializes in investing in emerging stock markets of the world. Miss Catalea, an experienced hand in international investments and finance is currently interested in the Mexican stock market and is planned to invest US $ 500,000 Mexico is the first country in Latin America to sign an Economic Partnership, Political Coordination and Cooperation Agreement (Global Agreement) with the European Union (EU). This has . formally helped to boost stock prices in Mexico. But at the same time, Miss Catalea is quite concerned with the volatility and unpredictability of the exchange rates of the Mexican currency. Miss Catalea would like to understand what actually drives the Mexican exchange rates. Since the inflation rate is much higher in Mexico than in United States (US), Miss Catalea thinks that purchasing power parity (PPP) has profound implications in international financial management Miss Catalea conducted her own research and has provided the following selected economic and financial data for your attention. Selected Economic and Financial Data for US and Mexico for Year 2021 Expected inflation rate: us 1.25% per year Mexico 3.40% per year Expected interest rate: US 1.5% per year Mexico 6.5% per year Nominal Exchange Rotes Spot 19.850 Pesos=US $1 One-year forward 19.860 Pesos=US $1 The Mexican peso was the first coin in the world to use the sign "$", even before the US dollar. The future spot exchange rate is 19.750 Pesos=US $1. As a research assistant for Miss Catalea, you are assigned to answer the following questions: (a) Explain to Miss Catalea how PPP is a way of defining the equilibrium exchange rate. [5 marks] (b) Assess how you would construct an arbitrage portfolio for Miss Catalea. You must support your answer with appropriate calculations. [10 marks] (c) Plot exchange rates changes against the differential inflation rates between Mexico and US for the last five years. [15 marks] (d) Regress the rate of exchange rate changes on the inflation rate differential to estimate the intercept and the slope coefficient. Provide interpretation of the regression results. [10 marks] (e) Based on your knowledge of the efficient market approach and hedging evaluate the statement that "changes in exchange rates affect the settlement of contracts, cash flows and the firm valuation. And advice Miss Catalea about the possible implications for FEMKX. [5,5 marks)