Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do part 2 only in 15 minutes please urgently... I'll give you up thumb definitely Problem 10 You have until 9:00 PM to complete

please do part 2 only in 15 minutes please urgently... I'll give you up thumb definitely

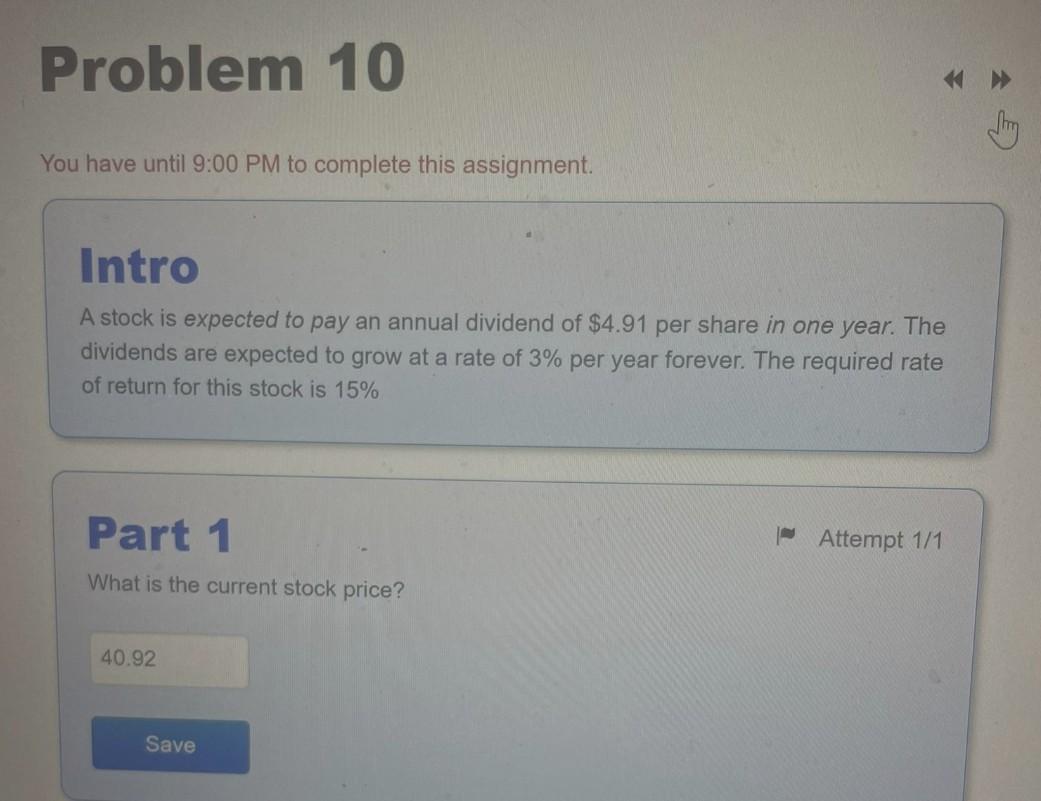

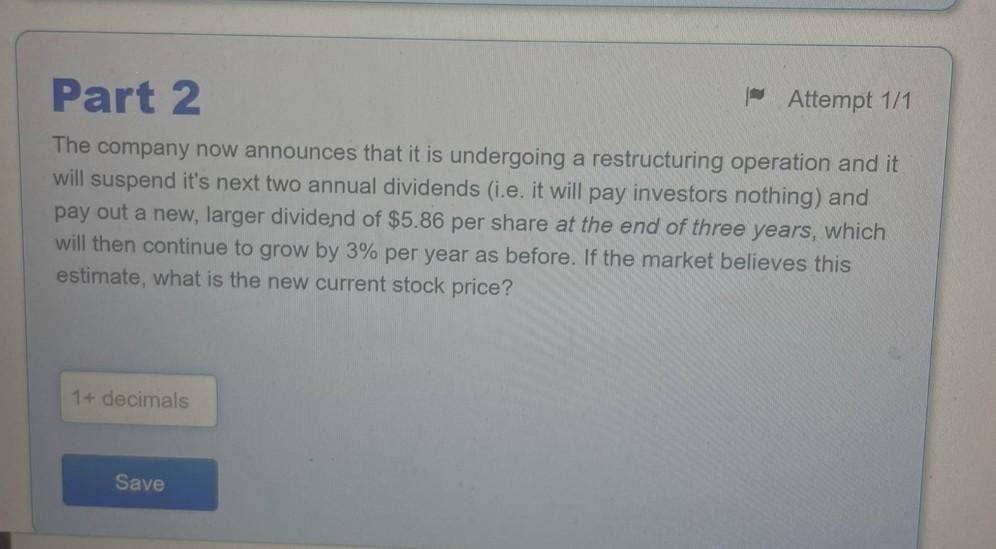

Problem 10 You have until 9:00 PM to complete this assignment. Intro A stock is expected to pay an annual dividend of $4.91 per share in one year. The dividends are expected to grow at a rate of 3% per year forever. The required rate of return for this stock is 15% Part 1 What is the current stock price? 40.92 Save Attempt 1/1 Part 2 Attempt 1/1 The company now announces that it is undergoing a restructuring operation and it will suspend it's next two annual dividends (i.e. it will pay investors nothing) and pay out a new, larger dividend of $5.86 per share at the end of three years, which will then continue to grow by 3% per year as before. If the market believes this estimate, what is the new current stock price? 1+ decimals SaveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started