Please do Part A, Cash Flow Using Indirect Method

Please do Part A, Cash Flow Using Indirect Method

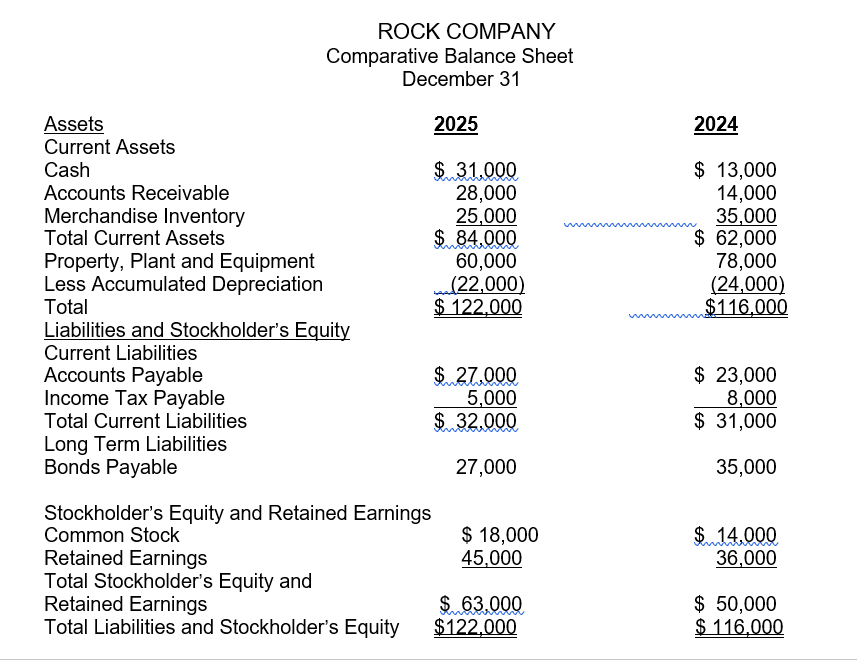

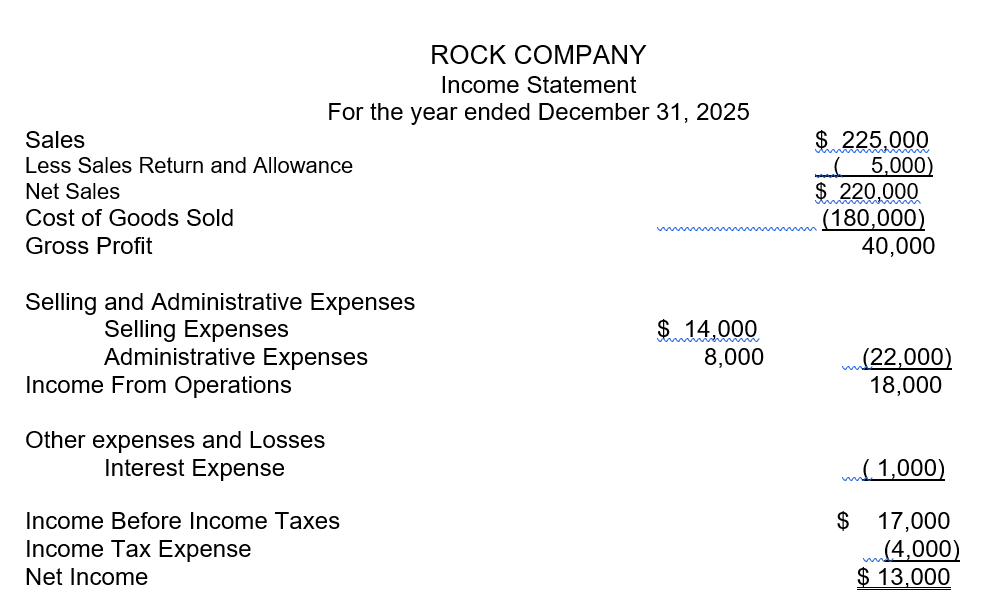

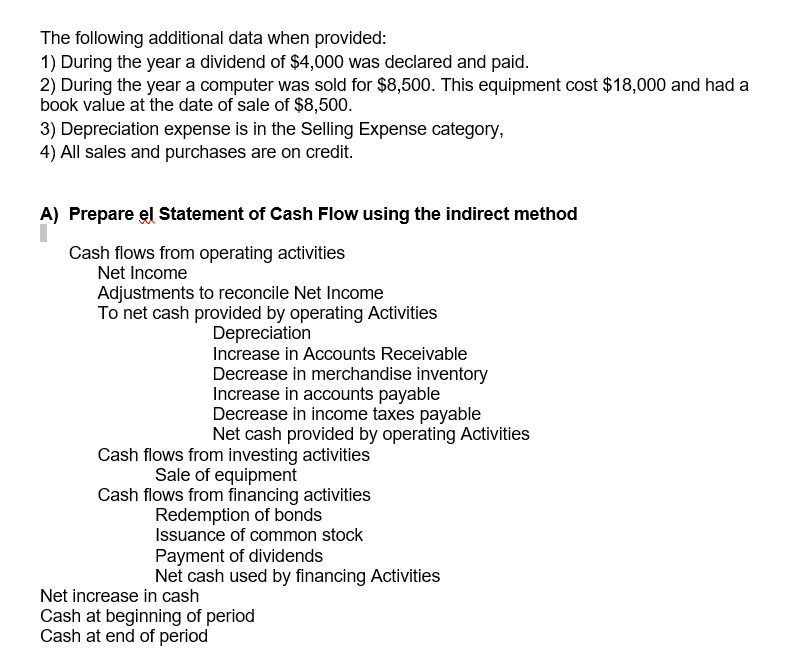

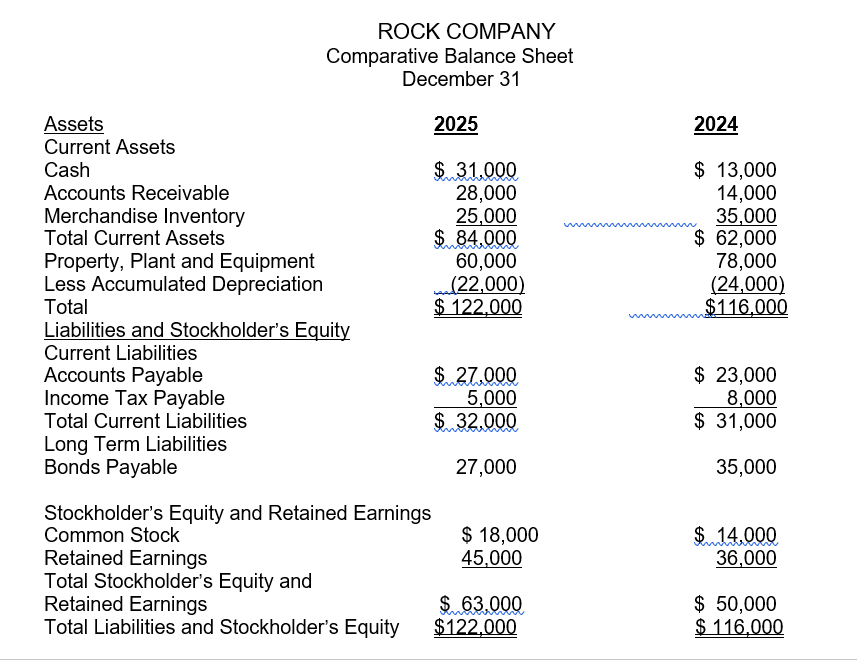

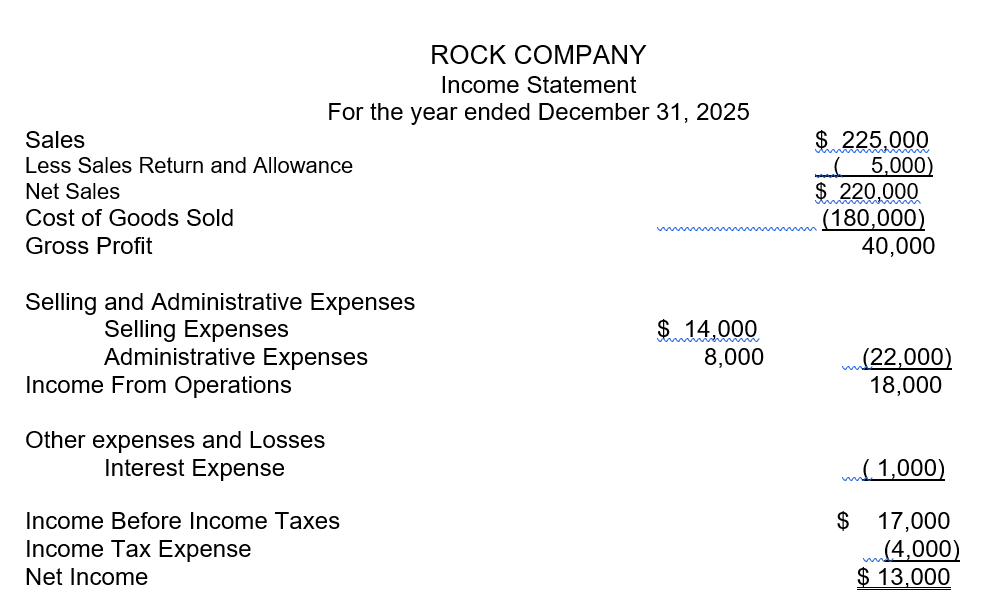

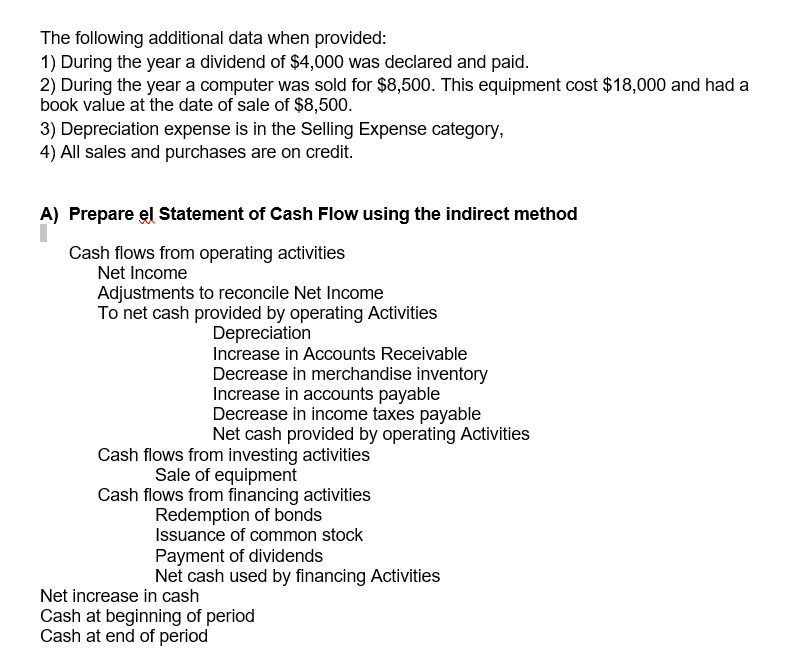

ROCK COMPANY Comparative Balance Sheet December 31 2025 2024 Assets Current Assets Cash Accounts Receivable Merchandise Inventory Total Current Assets Property, Plant and Equipment Less Accumulated Depreciation Total Liabilities and Stockholder's Equity Current Liabilities Accounts Payable Income Tax Payable Total Current Liabilities Long Term Liabilities Bonds Payable $ 31,000 28,000 25,000 $ 84,000 60,000 (22,000) $ 122.000 $ 13,000 14,000 35,000 $ 62,000 78,000 (24,000) $116.000 $ 27,000 5,000 $ 32.000 $ 23,000 8,000 $ 31,000 27,000 35,000 $ 14,000 36,000 Stockholder's Equity and Retained Earnings Common Stock $ 18,000 Retained Earnings 45,000 Total Stockholder's Equity and Retained Earnings $63.000 Total Liabilities and Stockholder's Equity $122.000 $ 50,000 $ 116.000 ROCK COMPANY Income Statement For the year ended December 31, 2025 Sales Less Sales Return and Allowance Net Sales Cost of Goods Sold Gross Profit $ 225,000 ( 5,000) $ 220,000 (180,000) 40,000 Selling and Administrative Expenses Selling Expenses Administrative Expenses Income From Operations $14,000 8,000 (22,000) 18,000 Other expenses and Losses Interest Expense (1,000) $ Income Before Income Taxes Income Tax Expense Net Income 17,000 (4,000) $ 13,000 The following additional data when provided: 1) During the year a dividend of $4,000 was declared and paid. 2) During the year a computer was sold for $8,500. This equipment cost $18,000 and had a book value at the date of sale of $8,500. 3) Depreciation expense is in the Selling Expense category, 4) All sales and purchases are on credit. A) Prepare el Statement of Cash Flow using the indirect method Cash flows from operating activities Net Income Adjustments to reconcile Net Income To net cash provided by operating Activities Depreciation Increase in Accounts Receivable Decrease in merchandise inventory Increase in accounts payable Decrease in income taxes payable Net cash provided by operating Activities Cash flows from investing activities Sale of equipment Cash flows from financing activities Redemption of bonds Issuance of common stock Payment of dividends Net cash used by financing Activities Net increase in cash Cash at beginning of period Cash at end of period

Please do Part A, Cash Flow Using Indirect Method

Please do Part A, Cash Flow Using Indirect Method