Please do quickly

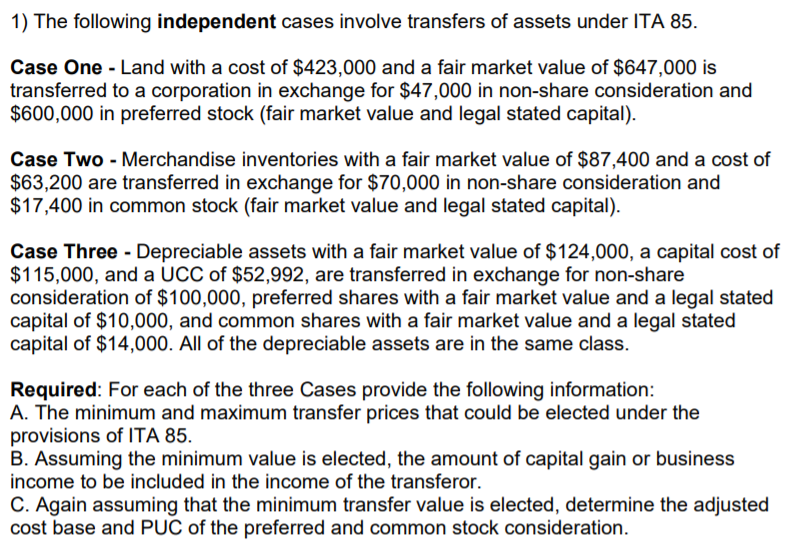

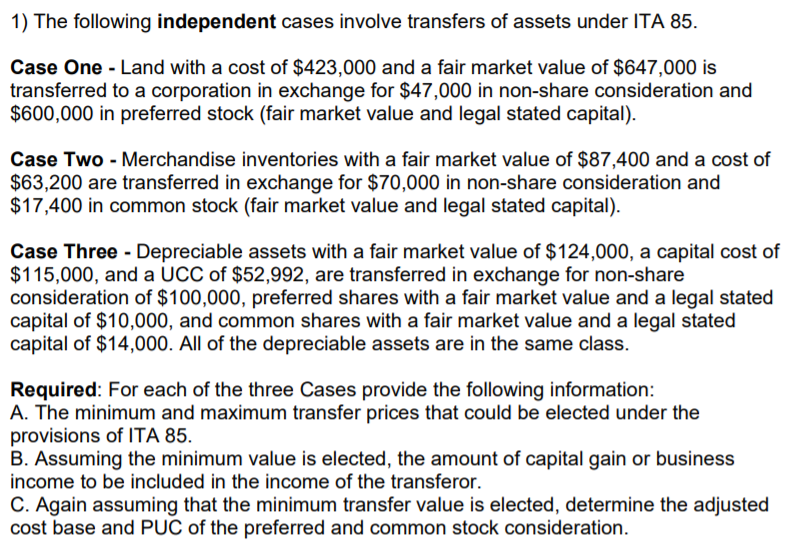

1) The following independent cases involve transfers of assets under ITA 85. Case One - Land with a cost of $423,000 and a fair market value of $647,000 is transferred to a corporation in exchange for $47,000 in non-share consideration and $600,000 in preferred stock (fair market value and legal stated capital). Case Two - Merchandise inventories with a fair market value of $87,400 and a cost of $63,200 are transferred in exchange for $70,000 in non-share consideration and $17,400 in common stock (fair market value and legal stated capital). Case Three - Depreciable assets with a fair market value of $124,000, a capital cost of $115,000, and a UCC of $52,992, are transferred in exchange for non-share consideration of $100,000, preferred shares with a fair market value and a legal stated capital of $10,000, and common shares with a fair market value and a legal stated capital of $14,000. All of the depreciable assets are in the same class. Required: For each of the three Cases provide the following information: A. The minimum and maximum transfer prices that could be elected under the provisions of ITA 85. B. Assuming the minimum value is elected, the amount of capital gain or business income to be included in the income of the transferor. C. Again assuming that the minimum transfer value is elected, determine the adjusted cost base and PUC of the preferred and common stock consideration. 1) The following independent cases involve transfers of assets under ITA 85. Case One - Land with a cost of $423,000 and a fair market value of $647,000 is transferred to a corporation in exchange for $47,000 in non-share consideration and $600,000 in preferred stock (fair market value and legal stated capital). Case Two - Merchandise inventories with a fair market value of $87,400 and a cost of $63,200 are transferred in exchange for $70,000 in non-share consideration and $17,400 in common stock (fair market value and legal stated capital). Case Three - Depreciable assets with a fair market value of $124,000, a capital cost of $115,000, and a UCC of $52,992, are transferred in exchange for non-share consideration of $100,000, preferred shares with a fair market value and a legal stated capital of $10,000, and common shares with a fair market value and a legal stated capital of $14,000. All of the depreciable assets are in the same class. Required: For each of the three Cases provide the following information: A. The minimum and maximum transfer prices that could be elected under the provisions of ITA 85. B. Assuming the minimum value is elected, the amount of capital gain or business income to be included in the income of the transferor. C. Again assuming that the minimum transfer value is elected, determine the adjusted cost base and PUC of the preferred and common stock consideration