please do recommendations to managment

please do recommendations to managment

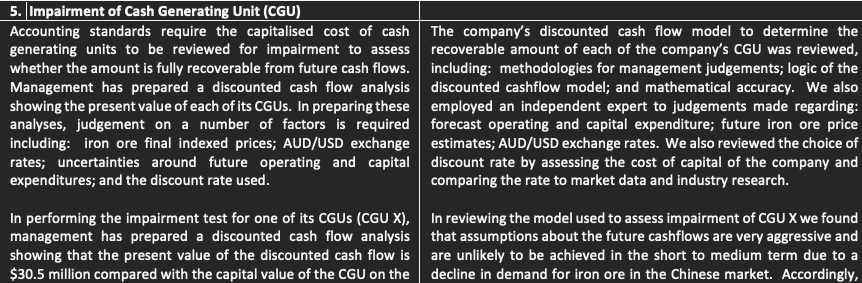

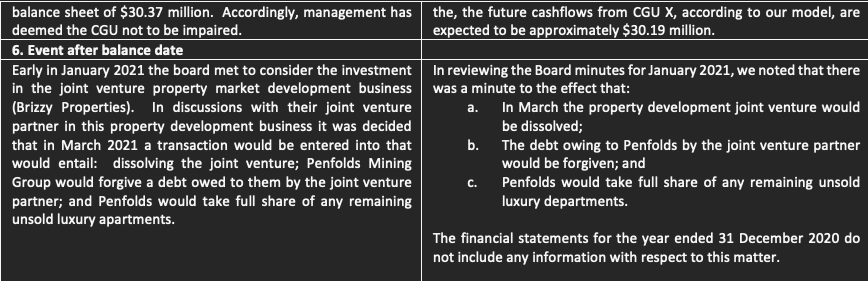

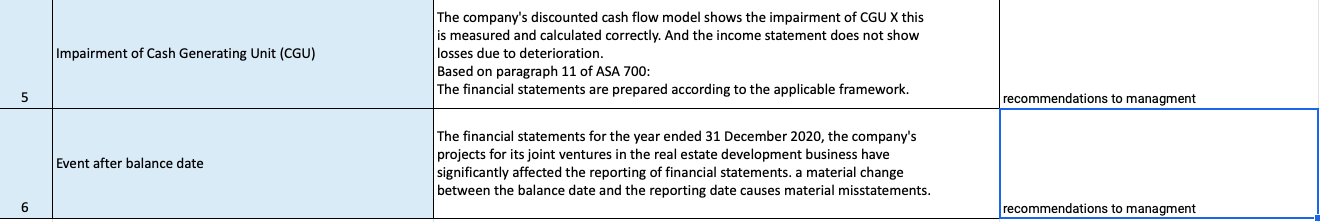

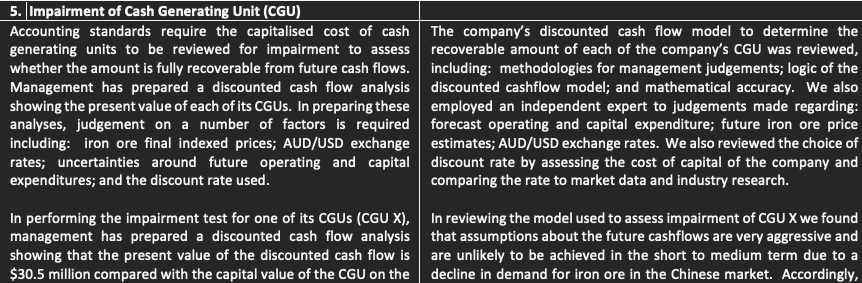

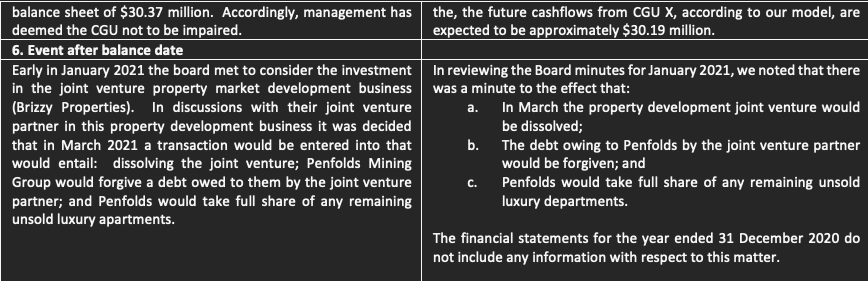

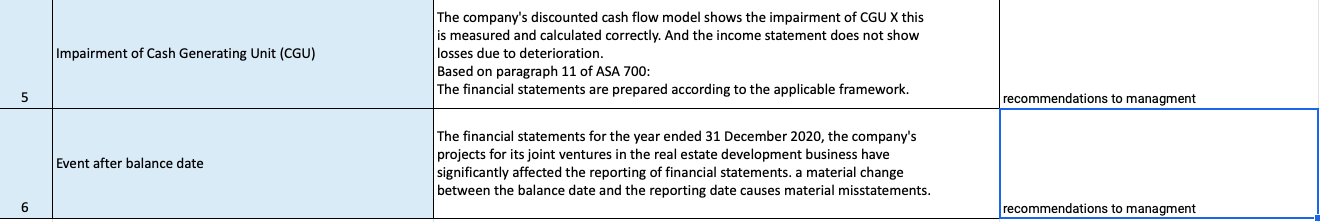

5. Impairment of Cash Generating Unit (CGU) Accounting standards require the capitalised cost of cash The company's discounted cash flow model to determine the generating units to be reviewed for impairment to assess recoverable amount of each of the company's CGU was reviewed, whether the amount is fully recoverable from future cash flows. including: methodologies for management judgements; logic of the Management has prepared a discounted cash flow analysis discounted cashflow model; and mathematical accuracy. We also showing the present value of each of its CGUS. In preparing these employed an independent expert to judgements made regarding: analyses, judgement on a number of factors is required forecast operating and capital expenditure; future iron ore price including: iron ore final indexed prices; AUD/USD exchange estimates; AUD/USD exchange rates. We also reviewed the choice of rates; uncertainties around future operating and capital discount rate by assessing the cost of capital of the company and expenditures; and the discount rate used. comparing the rate to market data and industry research. In performing the impairment test for one of its CGUS (CGU X), In reviewing the model used to assess impairment of CGU X we found management has prepared a discounted cash flow analysis that assumptions about the future cashflows are very aggressive and showing that the present value of the discounted cash flow is are unlikely to be achieved in the short to medium term due to a $30.5 million compared with the capital value of the CGU on the decline in demand for iron ore in the Chinese market. Accordingly, balance sheet of $30.37 million. Accordingly, management has the, the future cashflows from CGU X, according to our model, are deemed the CGU not to be impaired. expected to be approximately $30.19 million. 6. Event after balance date Early in January 2021 the board met to consider the investment In reviewing the Board minutes for January 2021, we noted that there in the joint venture property market development business was a minute to the effect that: (Brizzy Properties). In discussions with their joint venture a. In March the property development joint venture would partner in this property development business it was decided be dissolved; that in March 2021 a transaction would be entered into that b. The debt owing to Penfolds by the joint venture partner would entail: dissolving the joint venture; Penfolds Mining would be forgiven; and Group would forgive a debt owed to them by the joint venture Penfolds would take full share of any remaining unsold partner; and Penfolds would take full share of any remaining luxury departments. unsold luxury apartments. The financial statements for the year ended 31 December 2020 do not include any information with respect to this matter. C. Impairment of Cash Generating Unit (CGU) The company's discounted cash flow model shows the impairment of CGU X this is measured and calculated correctly. And the income statement does not show losses due to deterioration. Based on paragraph 11 of ASA 700: The financial statements are prepared according to the applicable framework. recommendations to managment Event after balance date The financial statements for the year ended 31 December 2020, the company's projects for its joint ventures in the real estate development business have significantly affected the reporting of financial statements. a material change between the balance date and the reporting date causes material misstatements. 6 recommendations to managment 5. Impairment of Cash Generating Unit (CGU) Accounting standards require the capitalised cost of cash The company's discounted cash flow model to determine the generating units to be reviewed for impairment to assess recoverable amount of each of the company's CGU was reviewed, whether the amount is fully recoverable from future cash flows. including: methodologies for management judgements; logic of the Management has prepared a discounted cash flow analysis discounted cashflow model; and mathematical accuracy. We also showing the present value of each of its CGUS. In preparing these employed an independent expert to judgements made regarding: analyses, judgement on a number of factors is required forecast operating and capital expenditure; future iron ore price including: iron ore final indexed prices; AUD/USD exchange estimates; AUD/USD exchange rates. We also reviewed the choice of rates; uncertainties around future operating and capital discount rate by assessing the cost of capital of the company and expenditures; and the discount rate used. comparing the rate to market data and industry research. In performing the impairment test for one of its CGUS (CGU X), In reviewing the model used to assess impairment of CGU X we found management has prepared a discounted cash flow analysis that assumptions about the future cashflows are very aggressive and showing that the present value of the discounted cash flow is are unlikely to be achieved in the short to medium term due to a $30.5 million compared with the capital value of the CGU on the decline in demand for iron ore in the Chinese market. Accordingly, balance sheet of $30.37 million. Accordingly, management has the, the future cashflows from CGU X, according to our model, are deemed the CGU not to be impaired. expected to be approximately $30.19 million. 6. Event after balance date Early in January 2021 the board met to consider the investment In reviewing the Board minutes for January 2021, we noted that there in the joint venture property market development business was a minute to the effect that: (Brizzy Properties). In discussions with their joint venture a. In March the property development joint venture would partner in this property development business it was decided be dissolved; that in March 2021 a transaction would be entered into that b. The debt owing to Penfolds by the joint venture partner would entail: dissolving the joint venture; Penfolds Mining would be forgiven; and Group would forgive a debt owed to them by the joint venture Penfolds would take full share of any remaining unsold partner; and Penfolds would take full share of any remaining luxury departments. unsold luxury apartments. The financial statements for the year ended 31 December 2020 do not include any information with respect to this matter. C. Impairment of Cash Generating Unit (CGU) The company's discounted cash flow model shows the impairment of CGU X this is measured and calculated correctly. And the income statement does not show losses due to deterioration. Based on paragraph 11 of ASA 700: The financial statements are prepared according to the applicable framework. recommendations to managment Event after balance date The financial statements for the year ended 31 December 2020, the company's projects for its joint ventures in the real estate development business have significantly affected the reporting of financial statements. a material change between the balance date and the reporting date causes material misstatements. 6 recommendations to managment

please do recommendations to managment

please do recommendations to managment