Please do requirements 1 through 3

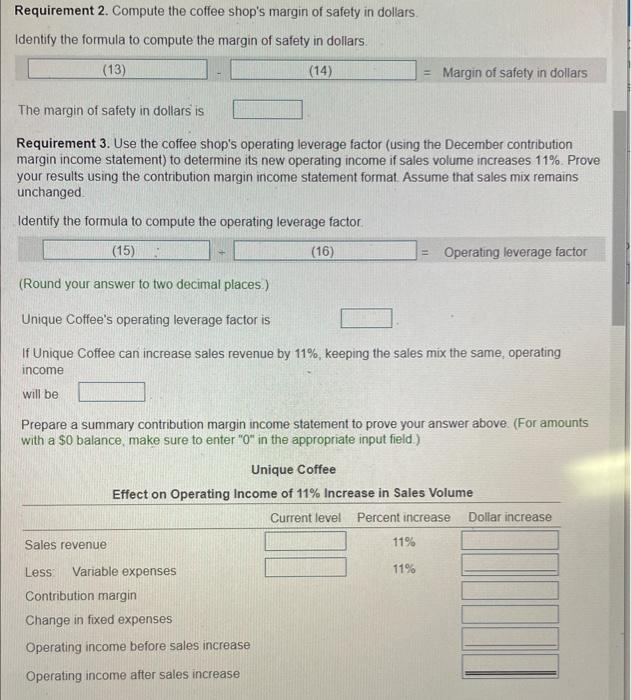

Data table below

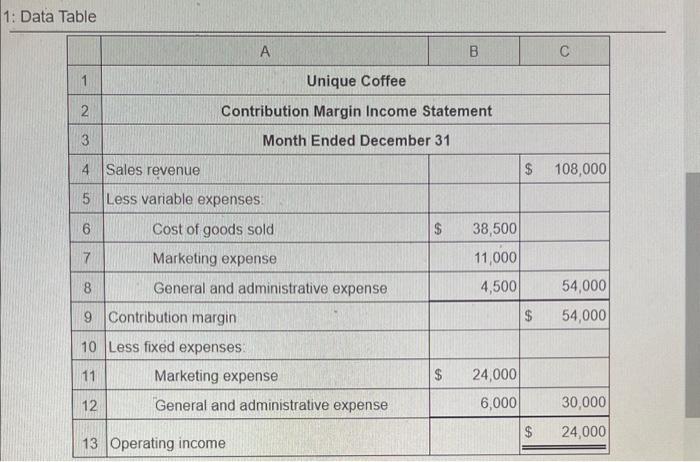

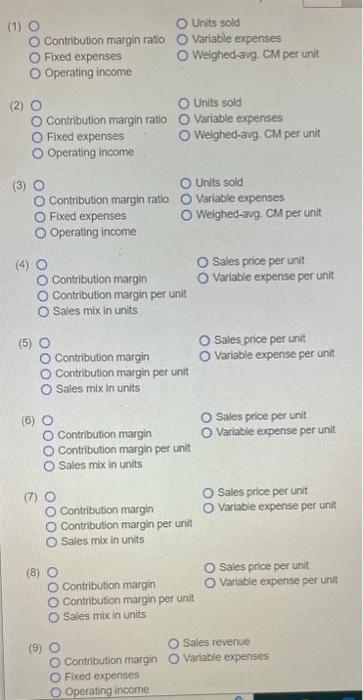

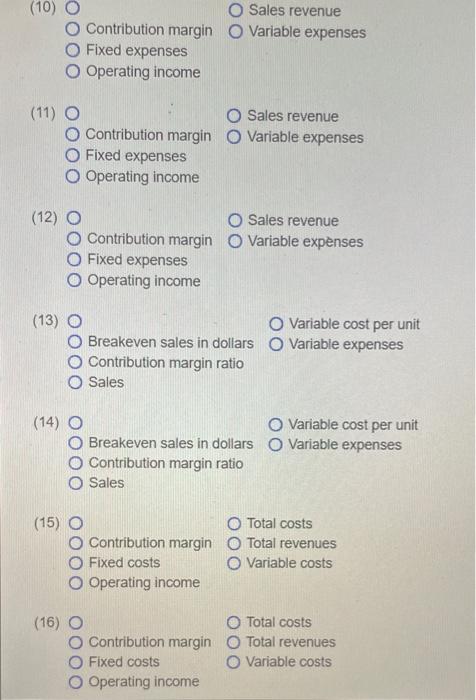

Awnser choices below

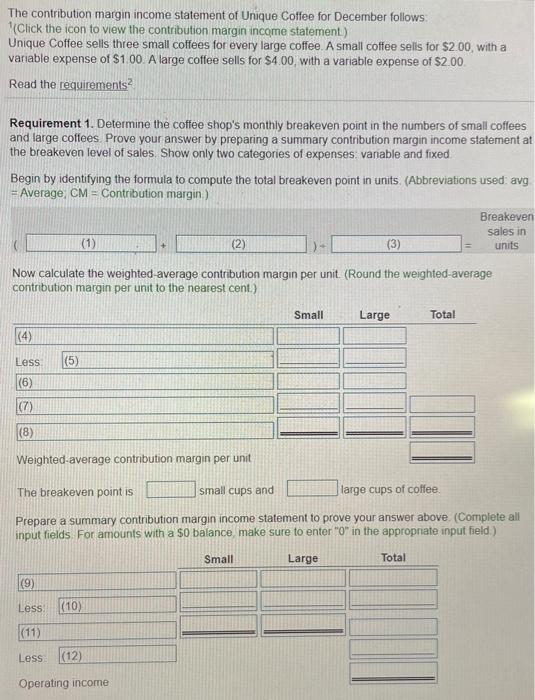

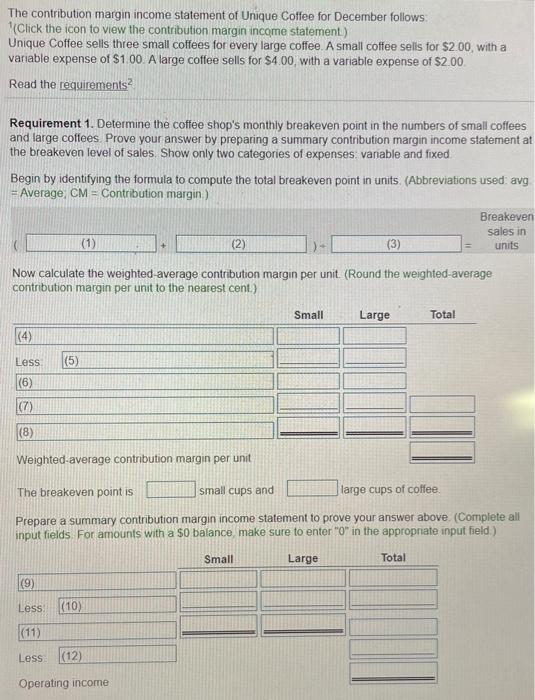

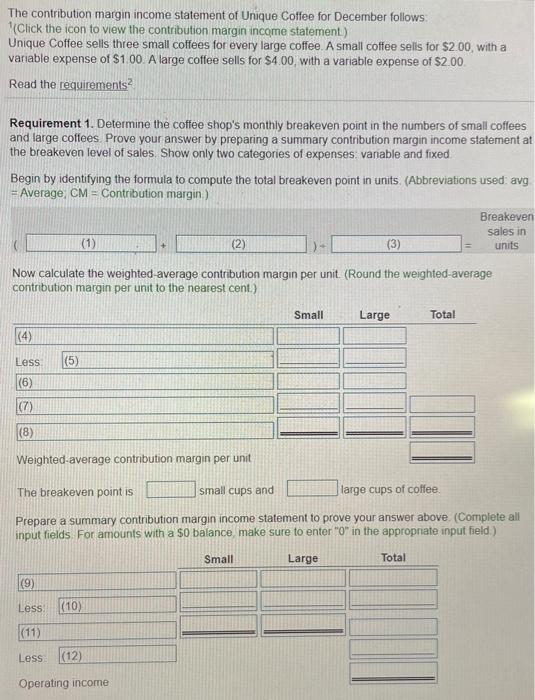

The contribution margin income statement of Unique Coffee for December follows: '(Click the icon to view the contribution margin income statement) Unique Coffee sells three small coffees for every large coffee. A small coffee sells for $2.00, with a variable expense of $1.00. A large coffee sells for $4.00, with a variable expense of $2.00 Read the requirements 2 Requirement 1. Determine the coffee shop's monthly breakeven point in the numbers of small coffees and large coffees. Prove your answer by preparing a summary contribution margin income statement at the breakeven level of sales. Show only two categories of expenses: variable and fixed Begin by identifying the formula to compute the total breakeven point in units. (Abbreviations used. avg =Average, CM= Contribution margin.) Now calculate the weighted-average contribution margin per unit. (Round the weighted-average contribution margin per unit to the nearest cent.) Weighted-average contribution margin per unit The breakeven point is small cups and large cups of coffee. Prepare a summary contribution margin income statement to prove your answer above. (Complete all input fields For amounts with a 50 balance, make sure to enter "0" in the appropriate input field.) Requirement 2. Compute the coffee shop's margin of safety in dollars: Identify the formula to compute the margin of safety in dollars. = Margin of safety in dollars The margin of safety in dollars is Requirement 3. Use the coffee shop's operating leverage factor (using the December contribution margin income statement) to determine its new operating income if sales volume increases 11%. Prove your results using the contribution margin income statement format. Assume that sales mix remains unchanged Identify the formula to compute the operating leverage factor (Round your answer to two decimal places.) Unique Coffee's operating leverage factor is If Unique Coffee can increase sales revenue by 11%, keeping the sales mix the same, operating income will be Prepare a summary contribution margin income statement to prove your answer above. (For amounts with a $0 balance, make sure to enter " 0" in the appropriate input field.) 1: Data Table (1) \begin{tabular}{l|l} Contribution margin ratio & Variable expenses \\ Fixed expenses & Weighed-avg. CM per unit \end{tabular} Operating income \begin{tabular}{l|l} \hline & Units sold \\ \hline Contribution margin ratio & Variable expenses \\ \hline Fixed expenses & Weighed-avg. CM per unit \\ Operating income & \end{tabular} (2) Operating income \begin{tabular}{|l|l} \hline & Units sold \\ \hline Contribution margin ratio & Variable expenses \\ \hline Fixed expenses & Weighed-avg. CM per unit \\ \hline Operating income & \end{tabular} (3) (4) Sales price per unit Contribution margin Variable expense per unit Contribution margin per unit Sales mmx in units (5) (6) Sales price per unit Contribution margin Variable expense per unit Contribution margin per unit Sales mix in units (7) (9) Fixed expenses Operating income Sales revenue Contribution margin Variable expenses Fixed expenses Operating income (11) \begin{tabular}{ll} \hline & Sales revenue \\ \hline Contribution margin & Variable expenses \\ \hline \end{tabular} Fixed expenses Operating income (12) Sales revenue Contribution margin Variable expenses Fixed expenses Operating income (13) Variable cost per unit Breakeven sales in dollars Variable expenses Contribution margin ratio Sales (14) Variable cost per unit Breakeven sales in dollars Variable expenses Contribution margin ratio Sales (15) Total costs Contribution margin Total revenues Fixed costs Variable costs Operating income (16) Total costs Contribution margin Total revenues Fixed costs Variable costs