Answered step by step

Verified Expert Solution

Question

1 Approved Answer

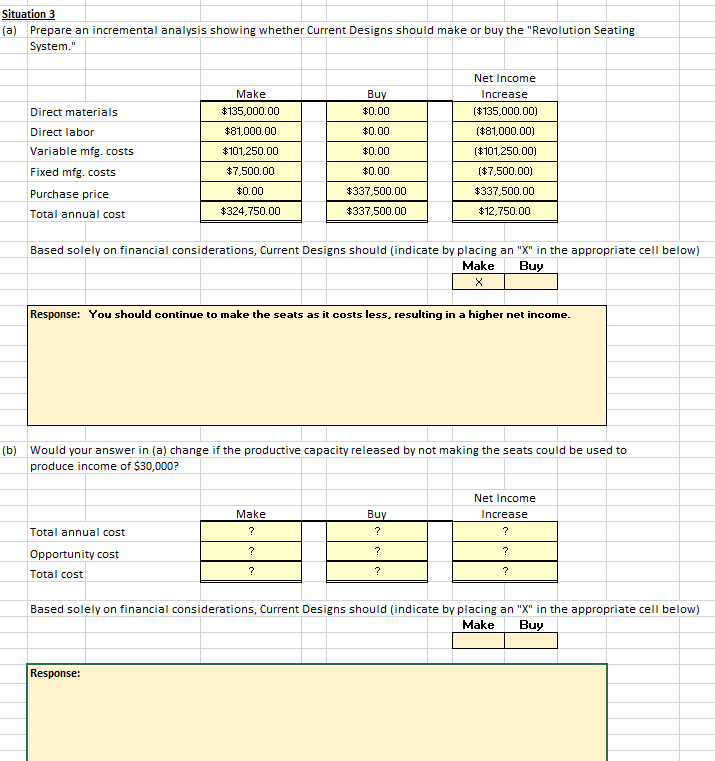

PLEASE DO SITUATION 3 PART B Situation 3 One of Current Designs' competitive advantages is found in the ingenuity of its owners and CEO, Mike

PLEASE DO SITUATION 3 PART B

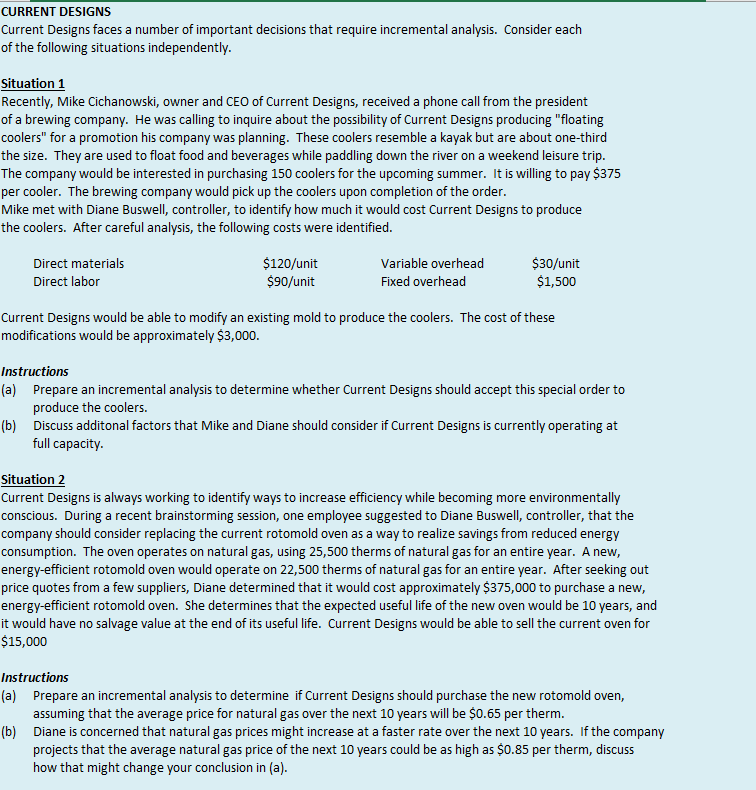

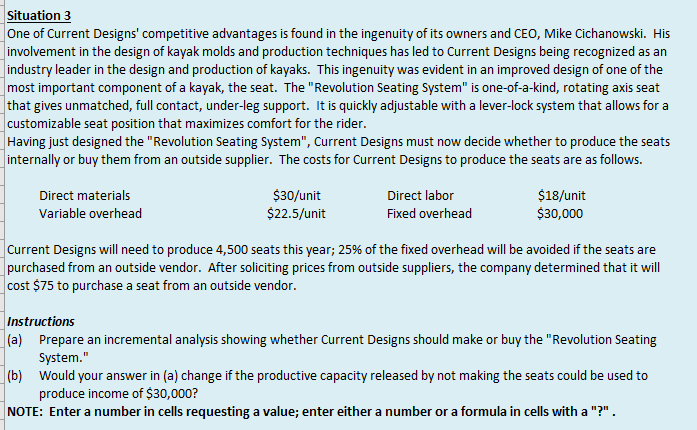

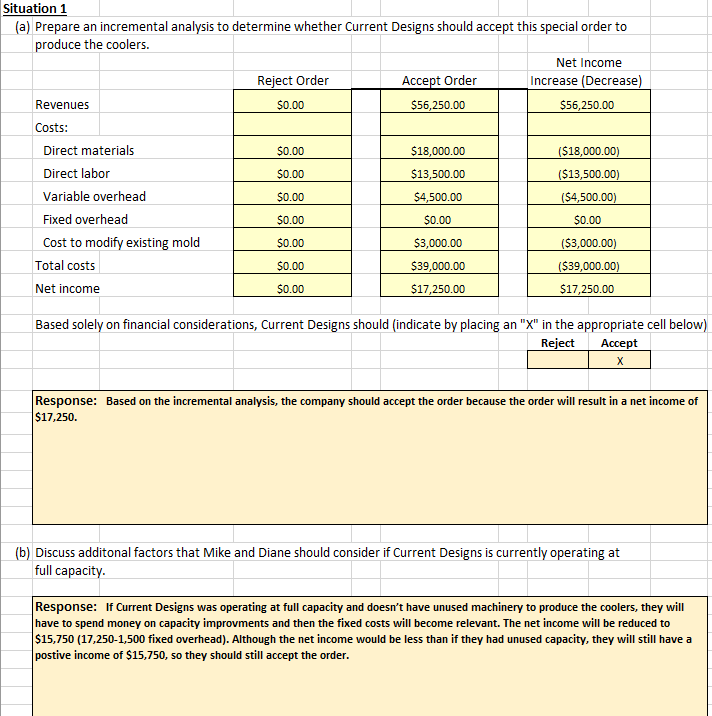

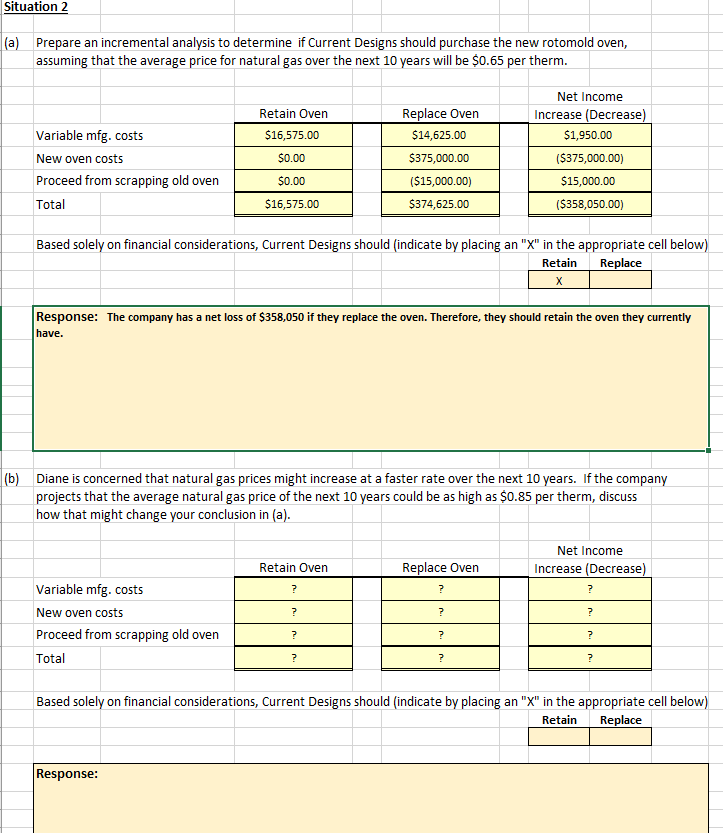

Situation 3 One of Current Designs' competitive advantages is found in the ingenuity of its owners and CEO, Mike Cichanowski. His involvement in the design of kayak molds and production techniques has led to Current Designs being recognized as arn industry leader in the design and production of kayaks. This ingenuity was evident in an improved design of one of the most important component of a kayak, the seat. The "Revolution Seating System" is one-of-a-kind, rotating axis seat that gives unmatched, full contact, under-leg support. It is quickly adjustable with a lever-lock system that allows fora customizable seat position that maximizes comfort for the rider Having just designed the "Revolution Seating System", Current Designs must now decide whether to produce the seats internally or buy them from an outside supplier. The costs for Current Designs to produce the seats are as follows. Direct materials Variable overhead $30/unit $22.5/unit Direct labor Fixed overhead $18/unit $30,000 Current Designs will need to produce 4,500 seats this year, 25% of the fixed overhead will be avoided if the seats are purchased from an outside vendor. After soliciting prices from outside suppliers, the company determined that it will cost $75 to purchase a seat from an outside vendor Instructions (a) Prepare an incremental analysis showing whether Current Designs should make or buy the Revolution Seating System." Would your answer in (a) change if the productive capacity released by not making the seats could be used to produce income of $30,000? (b) NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a"? Situation 2 (a) Prepare an incremental analysis to determine if Current Designs should purchase the new rotomold oven, assuming that the average price for natural gas over the next 10 years will be $0.65 per therm Variable mfg. costs New oven costs Proceed from scrapping old oven Total etain Oven $16,575.00 $0.00 $0.00 $16,575.00 Replace Oven 514,625.00 5375,000.00 (S15,000.00) 5374,625.00 Net Income Increase (Decrease $1,950.00 ($375,000.00) 15,000.00 (S358,050.00) Based solely on financial considerations, Current Designs should (indicate by placing an "X in the appropriate cell below) RetainReplace Response: have. The company has a net loss of $358,050 if they replace the oven. Therefore, they should retain the oven they currently (b) Diane is concerned that natural gas prices might increase at a faster rate over the next 10 years. If the company projects that the average natural gas price of the next 10 years could be as high as $0.85 per therm, discuss how that might change your conclusion in (a) Net Income Increase (Decrease Retain Oven Replace Oven Variable mfg. costs New oven costs Proceed from scrapping old oven Total Based solely on financial considerations, Current Designs should (indicate by placing an "X in the appropriate cell below) RetainReplace ResponseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started