Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do the above question in excel You and a group of investors are considering buying an office property with the following Pro Forma: Potential

Please do the above question in excel

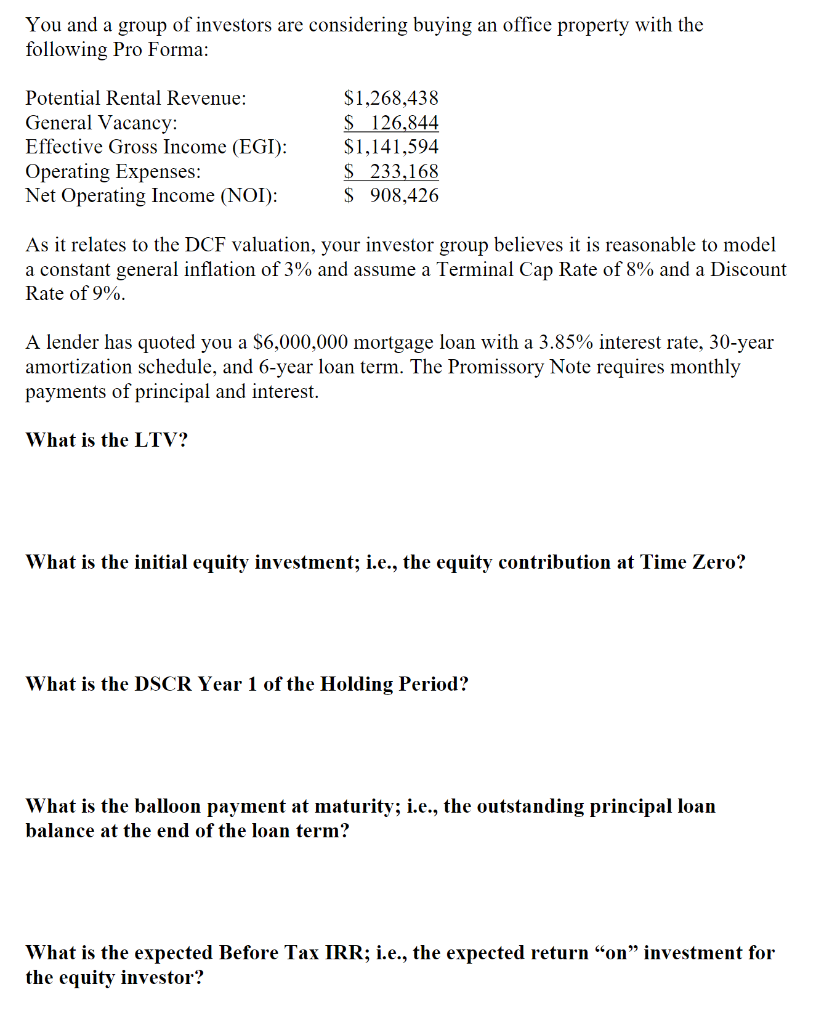

You and a group of investors are considering buying an office property with the following Pro Forma: Potential Rental Revenue: General Vacancy: Effective Gross Income (EGI): Operating Expenses: Net Operating Income (NOI): $1,268,438 $ 126,844 $1,141,594 $ 233,168 $ 908,426 As it relates to the DCF valuation, your investor group believes it is reasonable to model a constant general inflation of 3% and assume a Terminal Cap Rate of 8% and a Discount Rate of 9%. A lender has quoted you a $6,000,000 mortgage loan with a 3.85% interest rate, 30-year amortization schedule, and 6-year loan term. The Promissory Note requires monthly payments of principal and interest. What is the LTV? What is the initial equity investment; i.e., the equity contribution at Time Zero? What is the DSCR Year 1 of the Holding Period? What is the balloon payment at maturity; i.e., the outstanding principal loan balance at the end of the loan term? What is the expected Before Tax IRR; i.e., the expected return "on" investment for the equity investor? You and a group of investors are considering buying an office property with the following Pro Forma: Potential Rental Revenue: General Vacancy: Effective Gross Income (EGI): Operating Expenses: Net Operating Income (NOI): $1,268,438 $ 126,844 $1,141,594 $ 233,168 $ 908,426 As it relates to the DCF valuation, your investor group believes it is reasonable to model a constant general inflation of 3% and assume a Terminal Cap Rate of 8% and a Discount Rate of 9%. A lender has quoted you a $6,000,000 mortgage loan with a 3.85% interest rate, 30-year amortization schedule, and 6-year loan term. The Promissory Note requires monthly payments of principal and interest. What is the LTV? What is the initial equity investment; i.e., the equity contribution at Time Zero? What is the DSCR Year 1 of the Holding Period? What is the balloon payment at maturity; i.e., the outstanding principal loan balance at the end of the loan term? What is the expected Before Tax IRR; i.e., the expected return "on" investment for the equity investorStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started