Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do the above question on excel please Seven years ago a client financed a $495,000 home purchase with a thirty-year, 3.70% fixed rate, 80%

Please do the above question on excel please

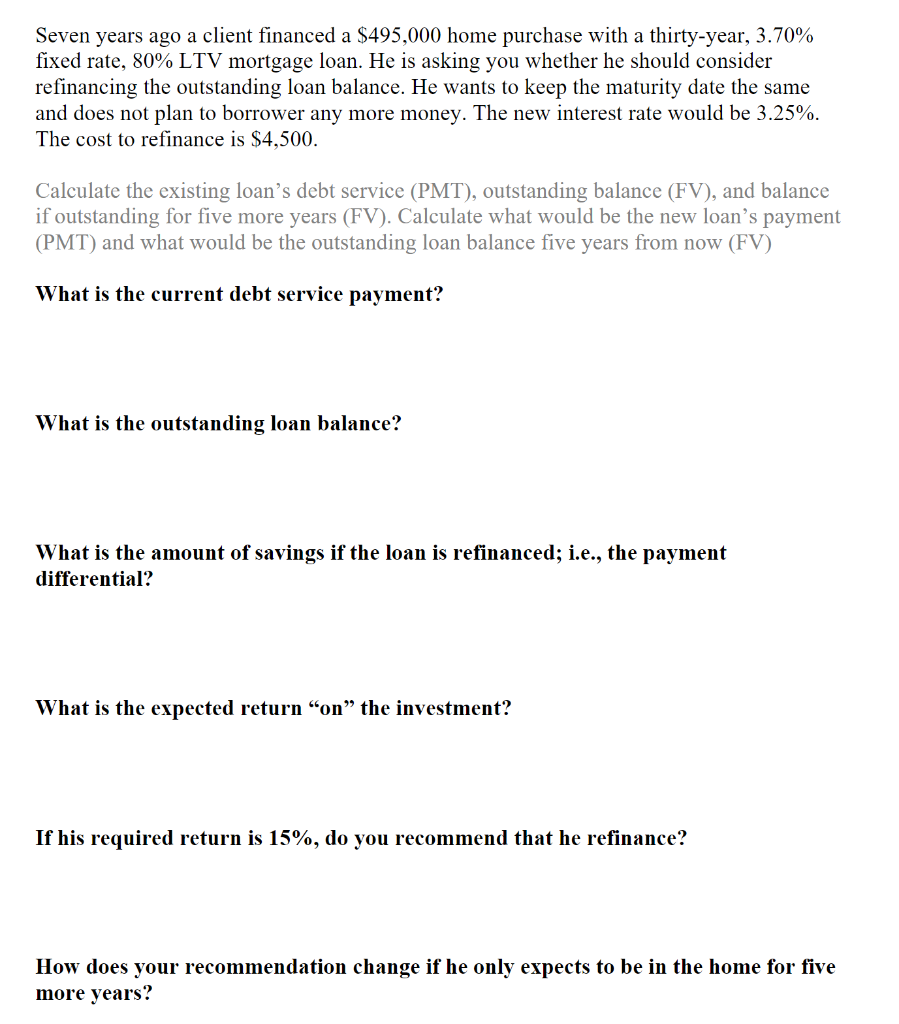

Seven years ago a client financed a $495,000 home purchase with a thirty-year, 3.70% fixed rate, 80% LTV mortgage loan. He is asking you whether he should consider refinancing the outstanding loan balance. He wants to keep the maturity date the same and does not plan to borrower any more money. The new interest rate would be 3.25%. The cost to refinance is $4,500. Calculate the existing loan's debt service (PMT), outstanding balance (FV), and balance if outstanding for five more years (FV). Calculate what would be the new loan's payment (PMT) and what would be the outstanding loan balance five years from now (FV) What is the current debt service payment? What is the outstanding loan balance? What is the amount of savings if the loan is refinanced; i.e., the payment differential? What is the expected return "on" the investment? If his required return is 15%, do you recommend that he refinance? How does your recommendation change if he only expects to be in the home for five more yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started