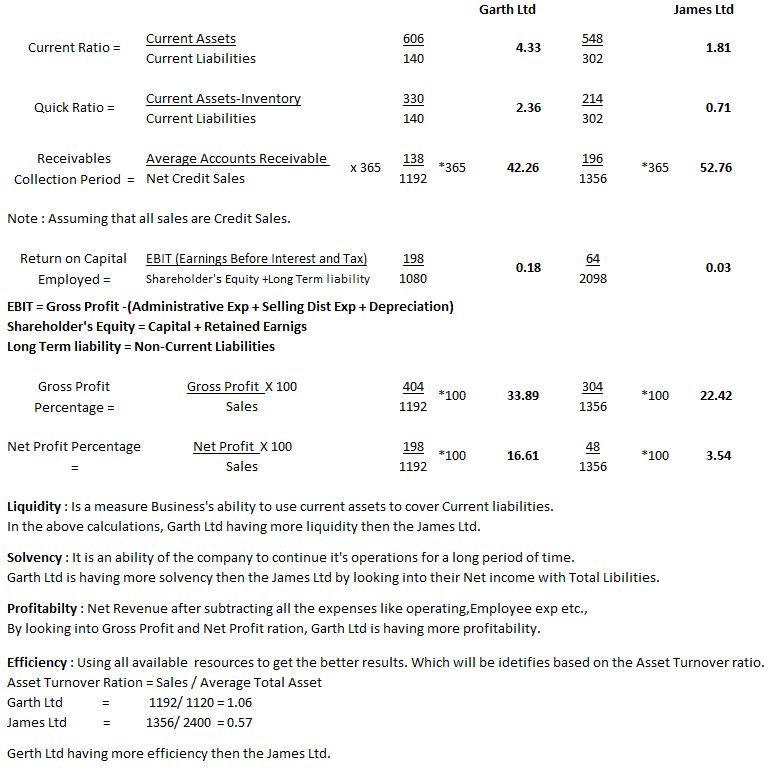

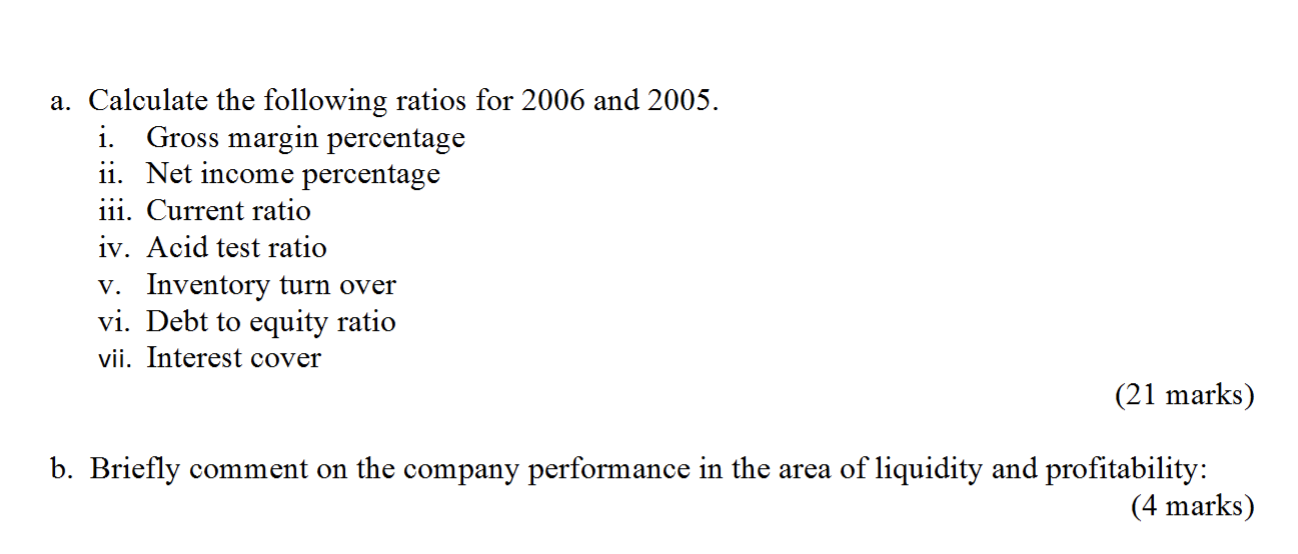

PLEASE DO THE ABOVE QUESTION SIMILAR TO THIS :

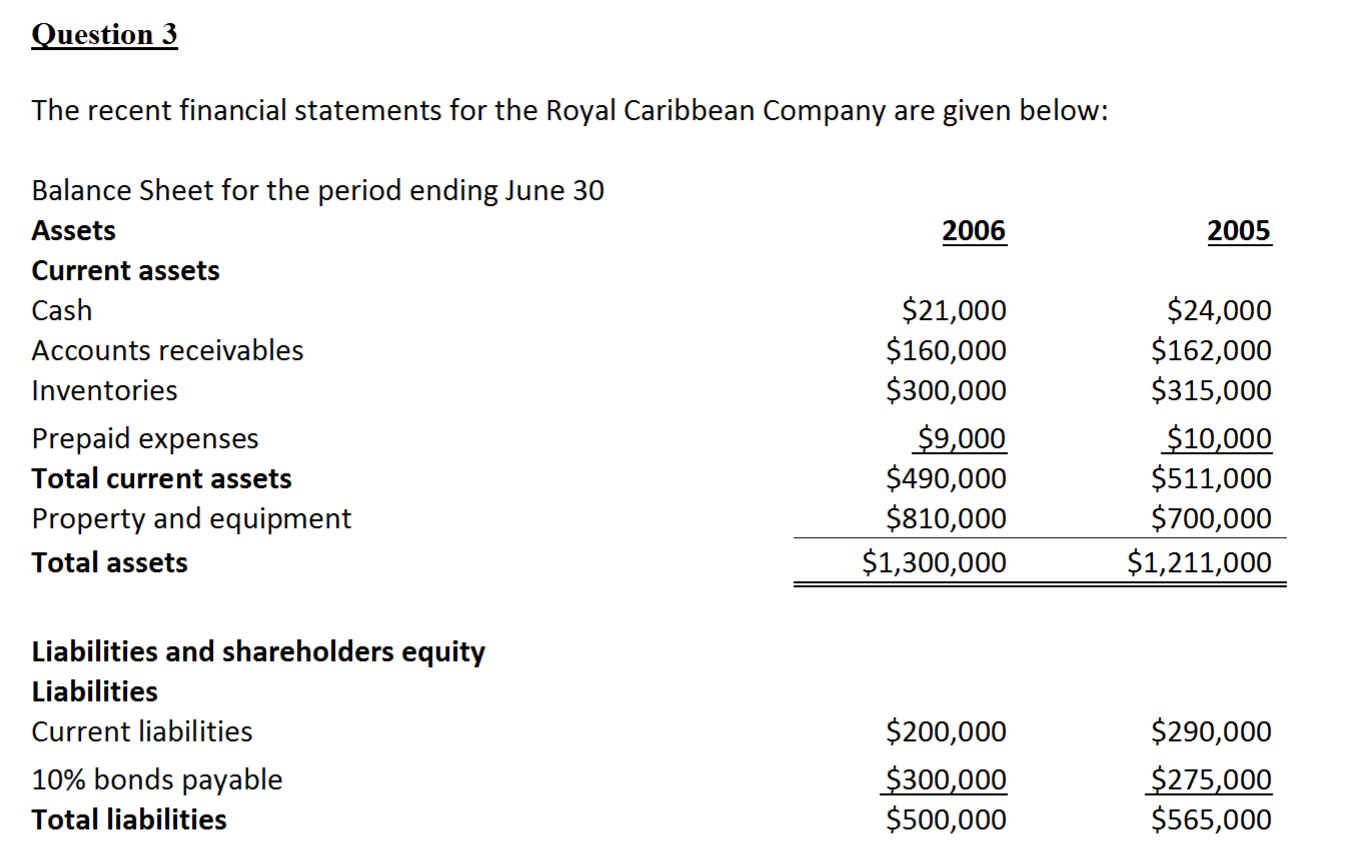

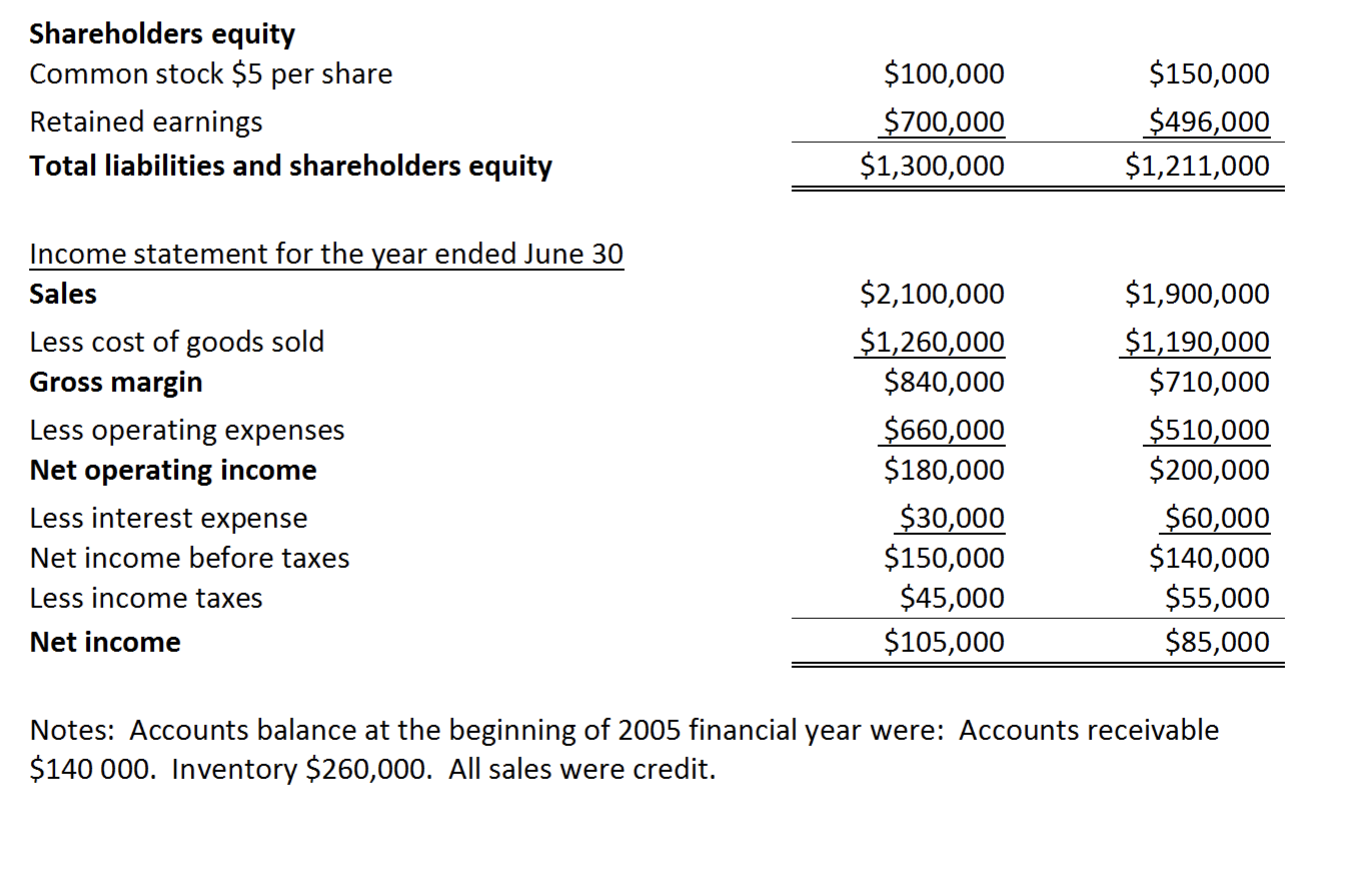

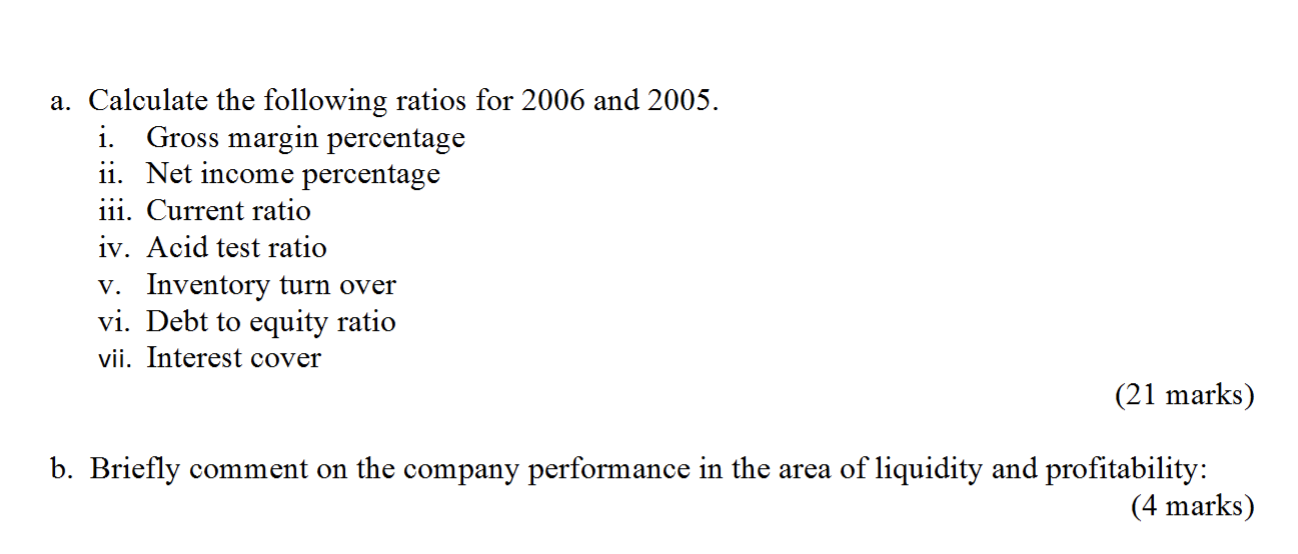

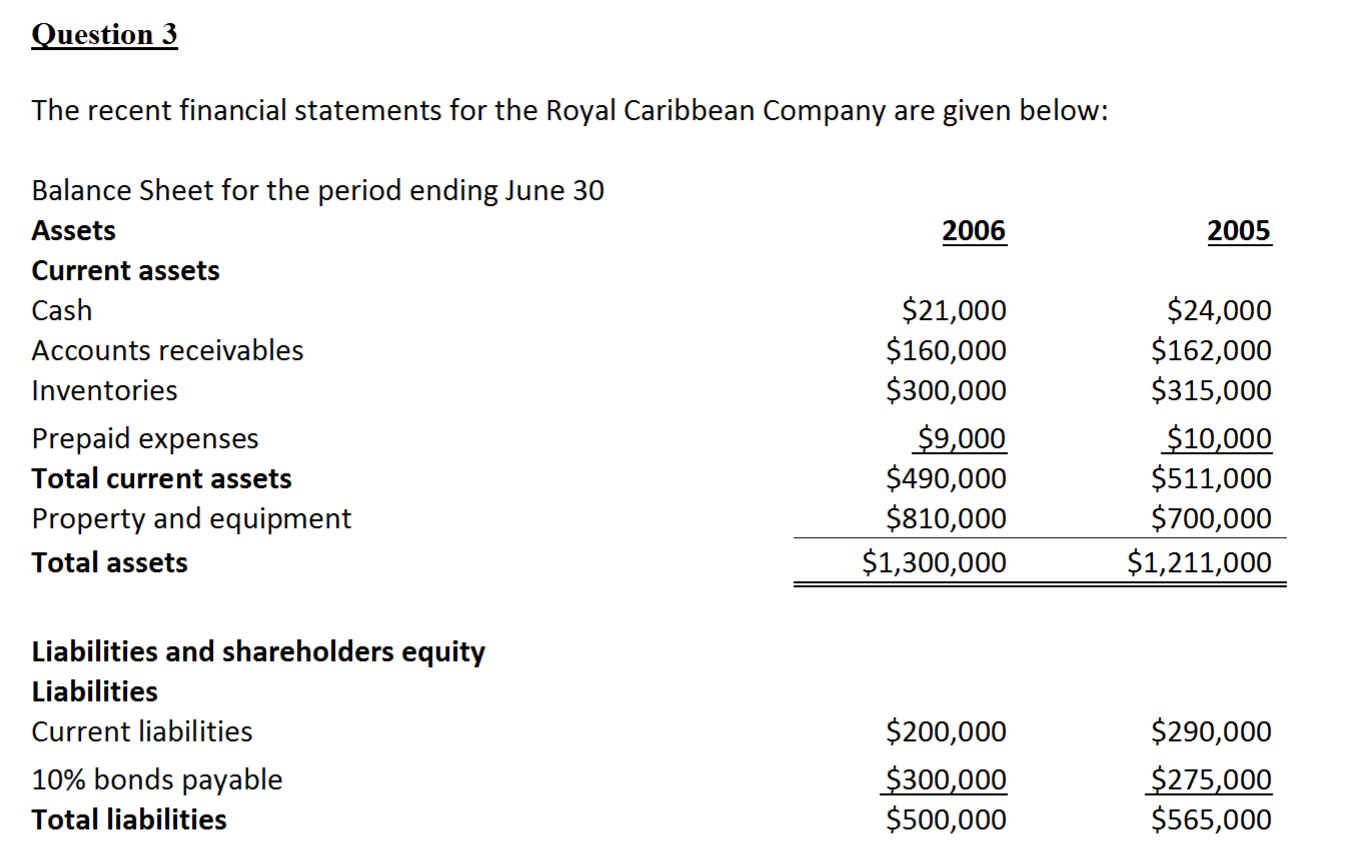

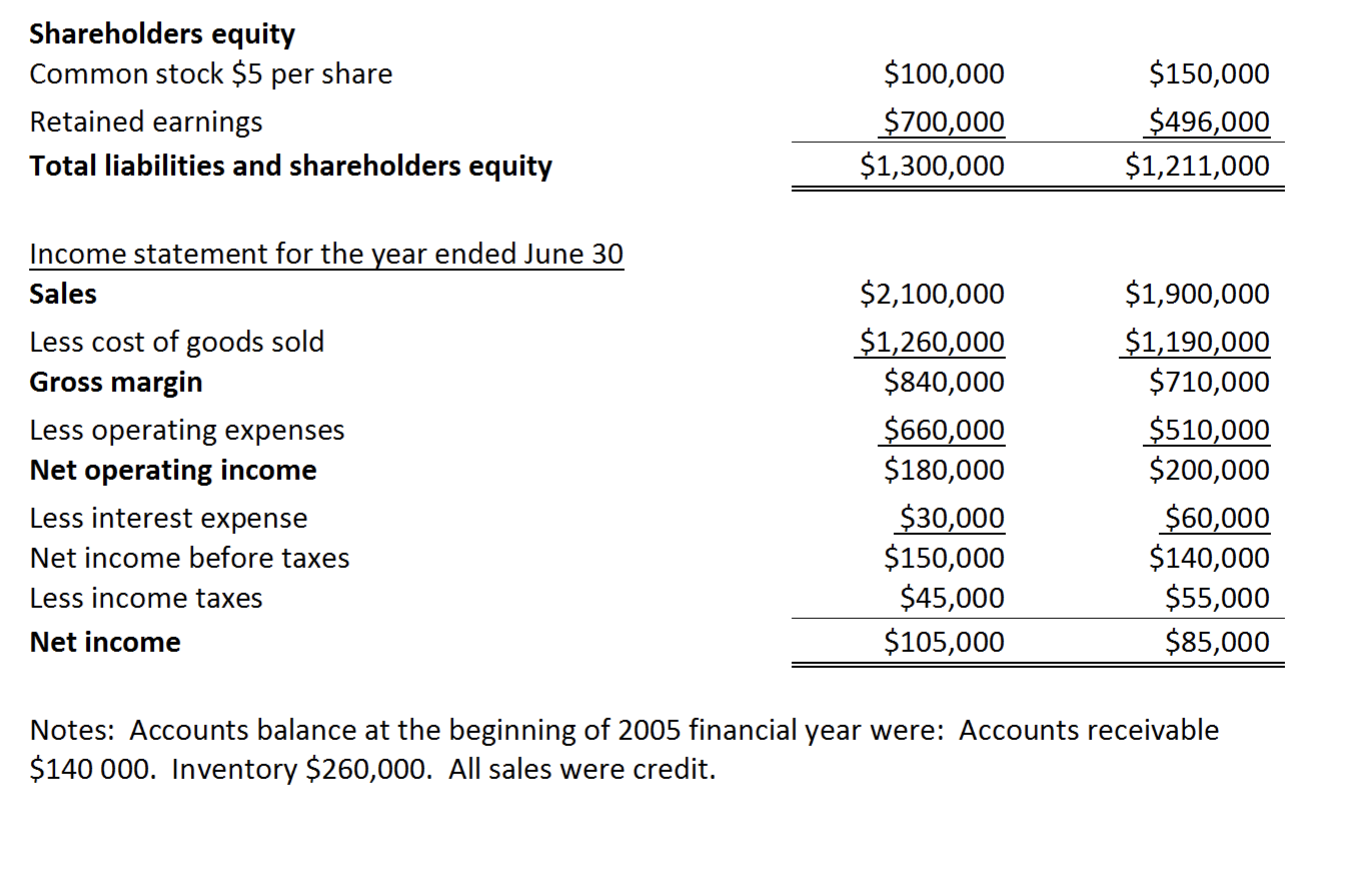

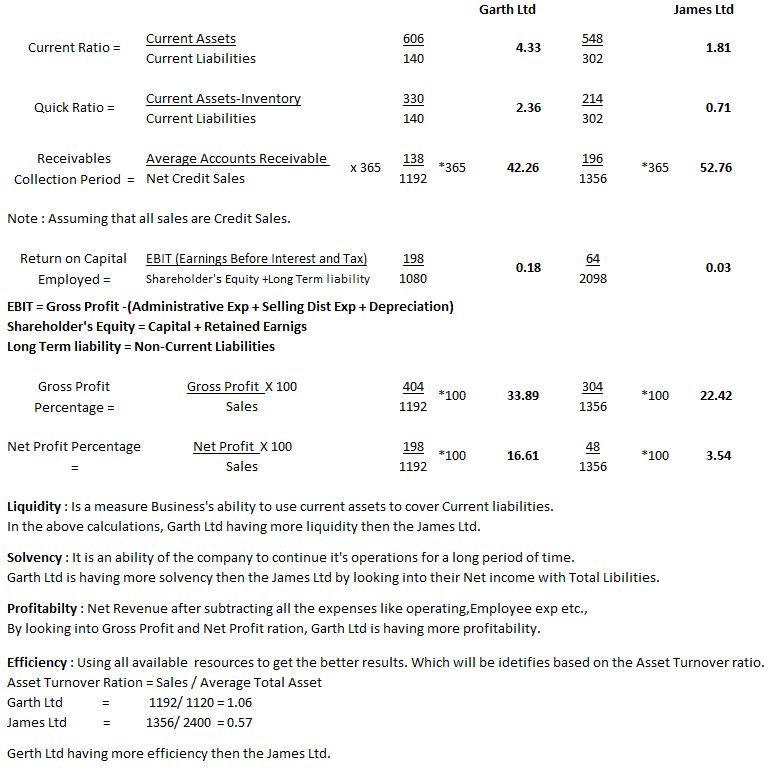

Question 3 The recent financial statements for the Royal Caribbean Company are given below: 2006 2005 Balance Sheet for the period ending June 30 Assets Current assets Cash Accounts receivables Inventories Prepaid expenses Total current assets Property and equipment Total assets $21,000 $160,000 $300,000 $9,000 $490,000 $810,000 $1,300,000 $24,000 $162,000 $315,000 $10,000 $511,000 $700,000 $1,211,000 Liabilities and shareholders equity Liabilities Current liabilities 10% bonds payable Total liabilities $200,000 $300,000 $500,000 $290,000 $275,000 $565,000 Shareholders equity Common stock $5 per share Retained earnings Total liabilities and shareholders equity $100,000 $700,000 $1,300,000 $150,000 $496,000 $1,211,000 Income statement for the year ended June 30 Sales Less cost of goods sold Gross margin Less operating expenses Net operating income Less interest expense Net income before taxes Less income taxes Net income $2,100,000 $1,260,000 $840,000 $660,000 $180,000 $30,000 $150,000 $45,000 $105,000 $1,900,000 $1,190,000 $710,000 $510,000 $200,000 $60,000 $140,000 $55,000 $85,000 Notes: Accounts balance at the beginning of 2005 financial year were: Accounts receivable $140 000. Inventory $260,000. All sales were credit. a. Calculate the following ratios for 2006 and 2005. i. Gross margin percentage ii. Net income percentage iii. Current ratio iv. Acid test ratio V. Inventory turn over vi. Debt to equity ratio vii. Interest cover (21 marks) b. Briefly comment on the company performance in the area of liquidity and profitability: (4 marks) Garth Ltd James Ltd Current Ratio = Current Assets Current Liabilities 4.33 1.81 Quick Ratio = Current Assets-Inventory Current Liabilities 2.36 0.71 Receivables Average Accounts Receivable Collection Period = Net Credit Sales 365 138 *365 196 *365 52.76 1192365 1356 Note: Assuming that all sales are Credit Sales. 0.18 64 2098 0.03 Return on Capital EBIT (Earnings Before Interest and Tax) 198 Employed = Shareholder's Equity +Long Term liability 1080 EBIT = Gross Profit - (Administrative Exp + Selling Dist Exp+Depreciation) Shareholder's Equity = Capital + Retained Earnigs Long Term liability = Non-Current Liabilities Gross Profit Percentage = Gross Profit X 100 Sales 404 *100 1192 33.89 cm 304 1356 *100 22.42 Net Profit Percentage Net Profit X 100 Sales 198 *100 16.61 48 *100 3.54 1192 1356 Liquidity : Is a measure Business's ability to use current assets to cover Current liabilities. In the above calculations, Garth Ltd having more liquidity then the James Ltd. Solvency : It is an ability of the company to continue it's operations for a long period of time. Garth Ltd is having more solvency then the James Ltd by looking into their Net income with Total Libilities. Profitabilty: Net Revenue after subtracting all the expenses like operating, Employee exp etc., By looking into Gross Profit and Net Profit ration, Garth Ltd is having more profitability. Efficiency: Using all available resources to get the better results. Which will be idetifies based on the Asset Turnover ratio. Asset Turnover Ration = Sales / Average Total Asset Garth Ltd = 1192/ 1120 = 1.06 James Ltd = 1356/ 2400 = 0.57 Gerth Ltd having more efficiency then the James Ltd