Please do the journal entries

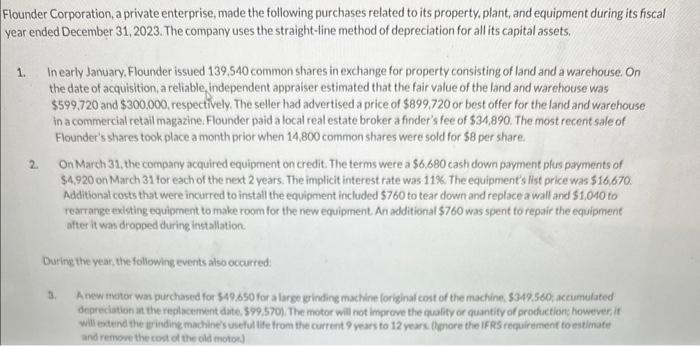

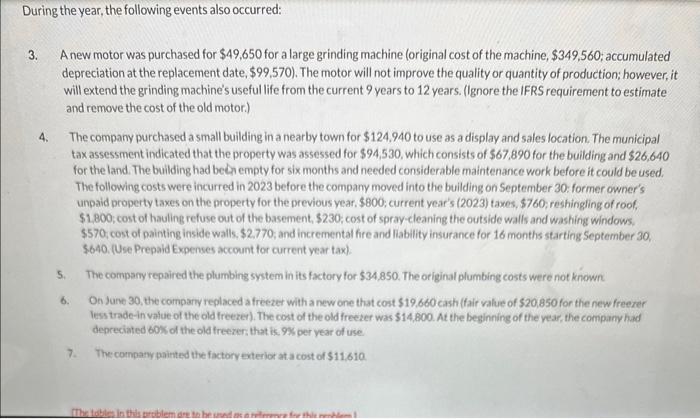

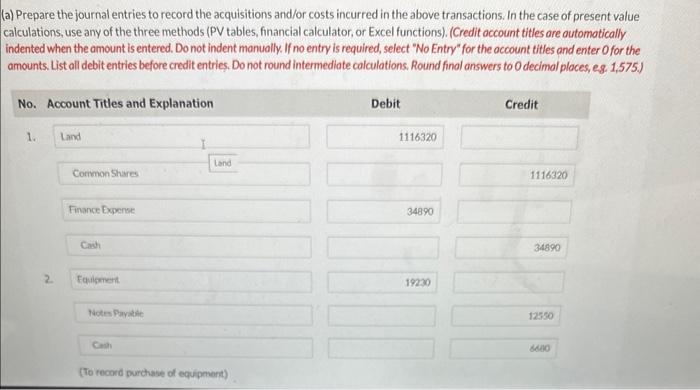

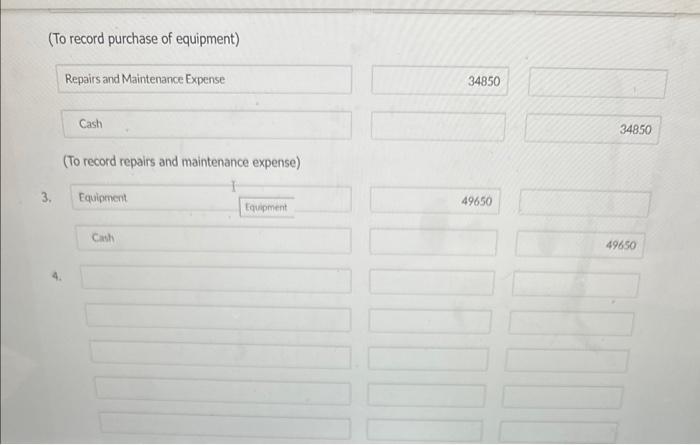

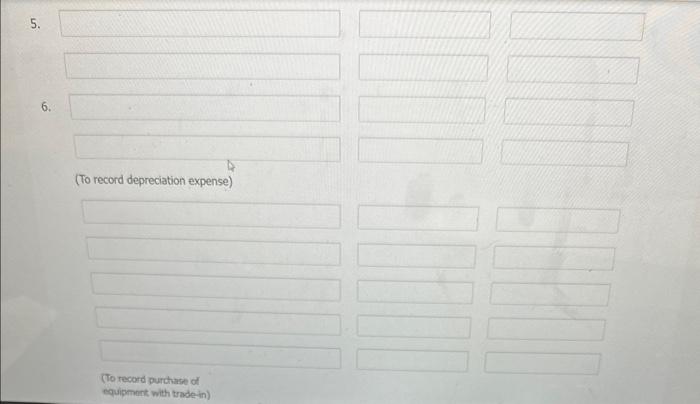

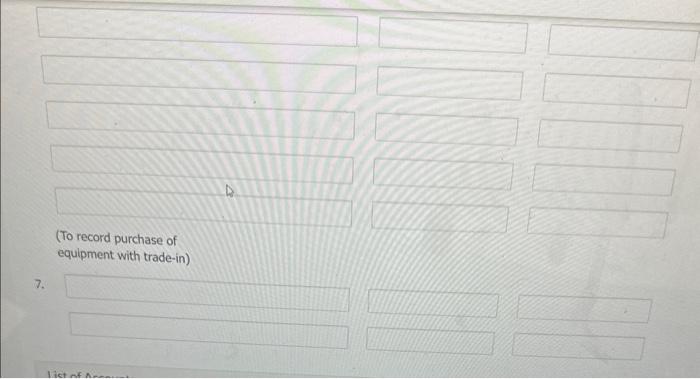

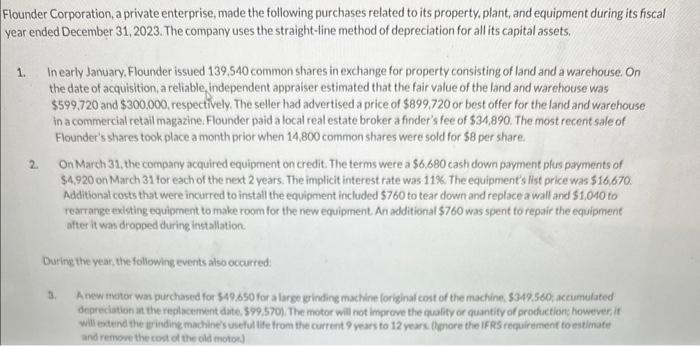

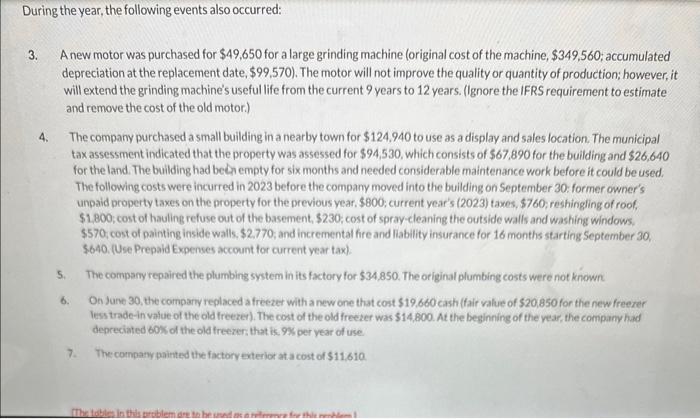

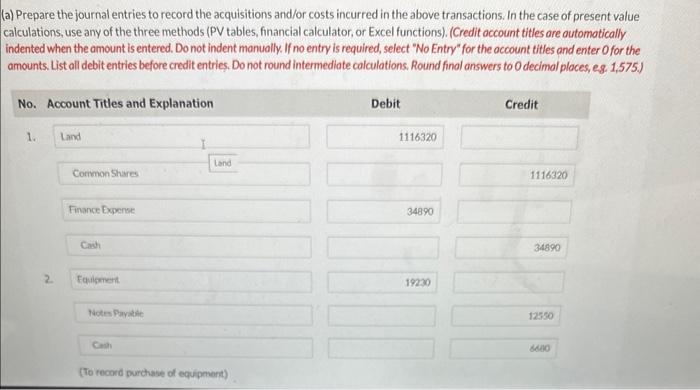

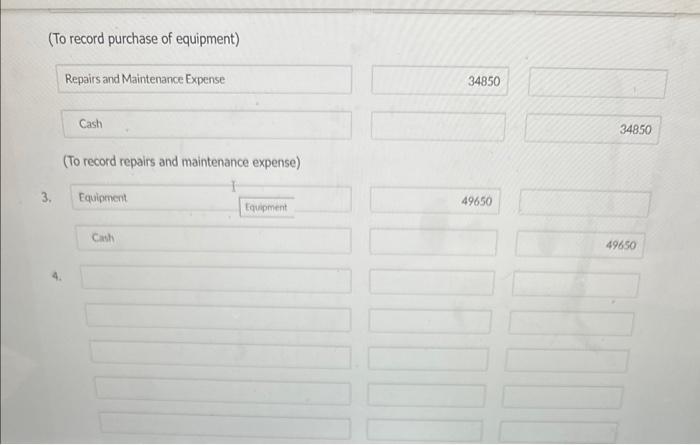

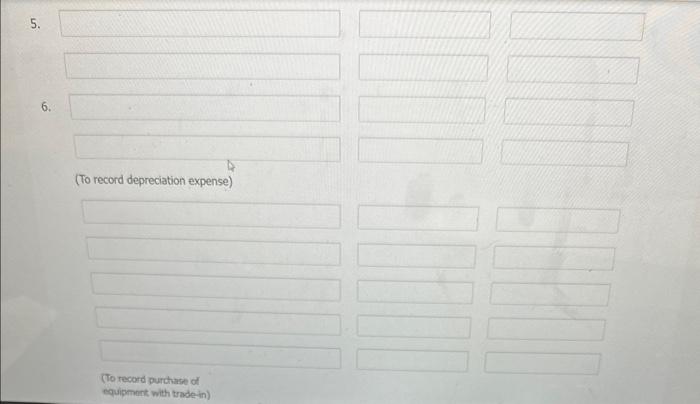

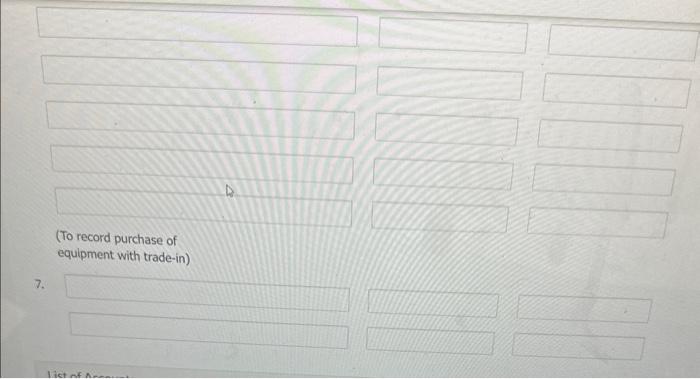

ounder Corporation, a private enterprise, made the following purchases related to its property, plant, and equipment during its fiscal ear ended December 31,2023. The company uses the straight-line method of depreciation for all its capital assets. 1. In early January. Flounder issued 139.540 common shares in exchange for property consisting of land and a warehouse. On the date of acquisition, a reliable, independent appraiser estimated that the fair value of the land and warehouse was $599.720 and $300.000, respectively. The seller had advertised a price of $899.720 or best offer for the land and warehouse in a commercial retail magazine. Flounder paid a local real estate broker a finder's fee of $34,890. The most recent sale of Flounder's shares took place a month prior when 14,800 common shares were sold for $8 per share. 2. On March 31 , the company acquired equipment on credit. The terms were a $6,680 cash down payment plus payments of $4,920 on March 31 for each of the next 2 years. The implicit interest rate was 11% The equipment's list price was $16,670. Additional costs that were incurred to install the equipment included $760 to tear down and replace a wall and $1,040 to rearrange existing equipment to make room for the new equipment. An additional $760 was spent fo repair the equipment after it was dropped during installation. During the year, the following events also occurred: 3. A new motor was purchased for 549.650 for a large ginding machine foriginal cont of the machine, 5349.560 , accumulated depreciation in the replacement date, 599.570) The motor will not improve the quafify or quantify of production, however, if will extend the trindine machine's usefuatife from the current 9 years to 12 years thgore the If RS requirement to estimate and remowe the cont of the old motor? 3. A new motor was purchased for $49,650 for a large grinding machine (original cost of the machine, $349,560; accumulated depreciation at the replacement date, $99,570 ). The motor will not improve the quality or quantity of production; however, it will extend the grinding machine's useful life from the current 9 years to 12 years. (Ignore the IFRS requirement to estimate and remove the cost of the old motor.) 4. The company purchased a small building in a nearby town for $124.940 to use as a display and sales location. The municipal tax assessment indicated that the property was assessed for $94,530, which consists of $67,890 for the building and $26,640 for the land. The building had bedr empty for six months and needed considerable maintenance work before it could be used. The following costs were incurred in 2023 before the company moved into the building on September 30 : former owner's unpaid property taxes on the property for the previous year, $800; current year's (2023) taxes, $760; reshingling of roof, \$1.800; cost of hauling refuse out of the basement, $230; cost of spray-cleaning the outside walls and washing windows. $570, cost of painting inside walls, $2.770, and incremental fire and liability insurance for 16 months starting September 30 , 5640. (Use Prepaid Expenses account for current year tax). 5. The company repaired the plumbing system in its factory for $34,850. The original plumbing costs were not known 6. On June 30, the compary replaced a freezer with a new one that cost $19,660 cash (fair value of 520,850 for the new freerer less trade-in value of the old freeze). The cost of the old freezer was $14,800. At the beginning of the vear, the company had depreciated 60N of the old freezer: that is. 98 per year of use. 7. The company painted the factory exterior at a cost of $11,610 a) Prepare the journal entries to record the acquisitions and/or costs incurred in the above transactions. In the case of present value calculations, use any of the three methods (PV tables, financial calculator, or Excel functions), (Credit occount titles ore outomotically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. List all debit entries before credit entries. Do not round intermediate colculations. Round final answers to 0 decimal places, eg. 1,575.) (To record purchase of equipment) Repairs and Maintenance Expense 34850 Cash (To record repairs and maintenance expense) 3. 49650 4. 5. 6. (To record depreciation expense) (To record purchtase of equipmant with trade in) (To record purchase of equipment with trade-in) 7