Please do the journal entries! Thank you for your time!

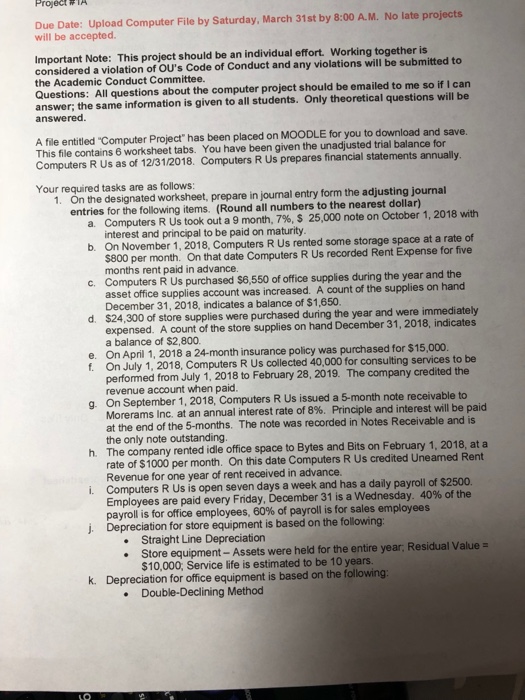

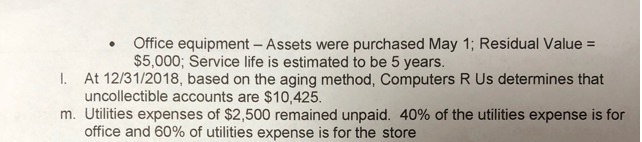

Due Date: Upload Computer File by Saturday, March 31st by 8:00 A.M. No late projects will be accepted. Important Note: This project should be an individual effort Working together is considered a violation of OU's Code of Conduct and any violations will be submitted to the Academic Conduct Committee. Questions: All questions about the computer project should be emailed to me so if I carn answer; the same information is given to all students. Only theoretical questions will be answered A file entitled "Computer Project has been placed on MOODLE for you to download and save This file contains 6 worksheet tabs. You have been given the unadjusted trial balance for Computers R Us as of 12/31/2018. Computers R Us prepares financial statements annually Your required tasks are as follows: 1. On the designated worksheet, prepare in journal entry form the adjusting entries for the following items. (Round all numbers to the nearest dollar) Computers R Us took out a 9 month, 7%, $ 25,000 note on October 1, 2018 with interest and principal to be paid on maturity. a. b. On November 1, 2018, Computers R Us rented some storage space at a rate of c. Computers R Us purchased $6,550 of office supplies during the year and the d. $24,30 $800 per month. On that date Computers R Us recorded Rent Expense for five months rent paid in advance. asset office supplies account was increased. A count of the supplies on hand December 31, 2018, indicates a balance of $1,650. 0 of store supplies were purchased during the year and were immediately expensed. A count of the store supplies on hand December 31, 2018, indicates a balance of $2,800 On April 1, 2018 a 24-month insurance policy was purchased for $15 On July 1, 2018, Computers R Us collected 40,000 for consulting services to be performed from July 1, 2018 to February 28, 2019. The company credited the revenue account when paid On September 1, 2018, Computers R Us issued a 5-month note receivable to Morerams Inc at an annual interest rate of 8%. Principle and interest will be paid at the end of the 5-months. The note was recorded in Notes Receivable and is the only note outstanding. The company rented idle office space to Bytes and Bits on February 1, 2018, at a rate of $1000 per month. On this date Computers R Us credited Uneamed Rent Revenue for one year of rent received in advance. Computers R Us is open seven days a week and has a daily payroll of $2500. Employees are paid every Fnday, December 31 is a Wednesday, 40% of the payroll is for office employees, 60% of payroll is for sales employees e. f. ,000 g. h. j. Depreciation for store equipment is based on the following Straight Line Depreciation Store equipment- Assets were held for the entire year, Residual Value $10,000, Service life is estimated to be 10 years. . k. Depreciation for office equipment is based on the following: Double-Declining Method