Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do the questions in the second photo and third photo as well if possible. PB7-2 Analyzing Make-or-Buy Decision LO 7-2, 7-4 Greenview Corp. (see

Please do the questions in the second photo and third photo as well if possible.

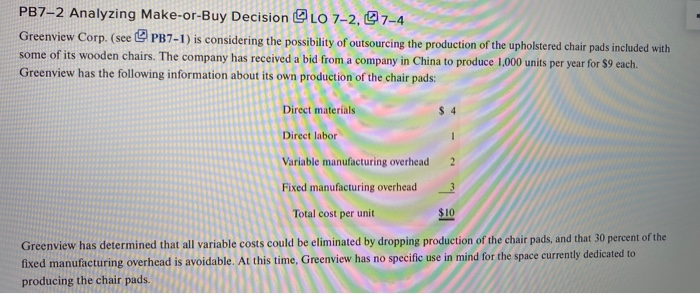

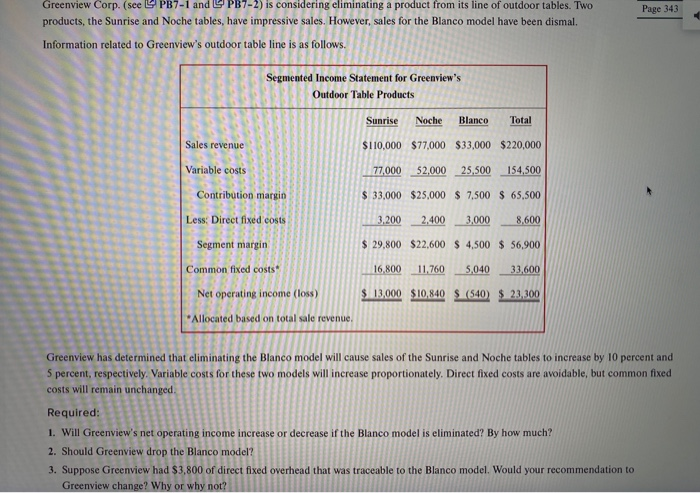

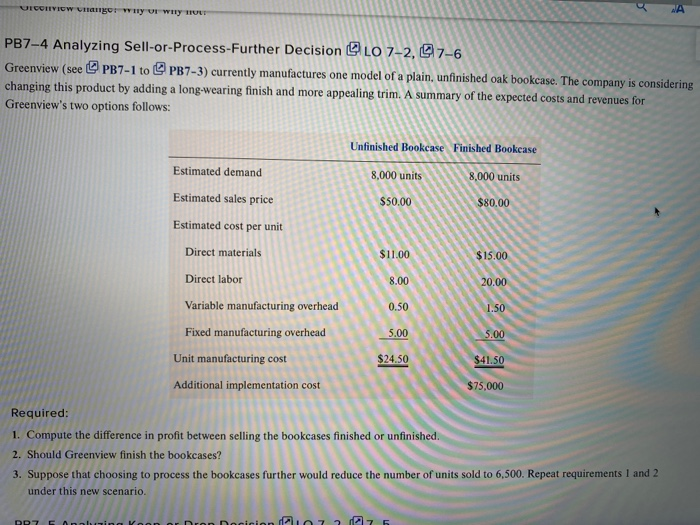

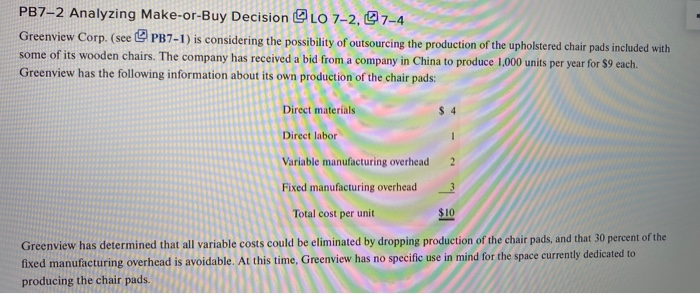

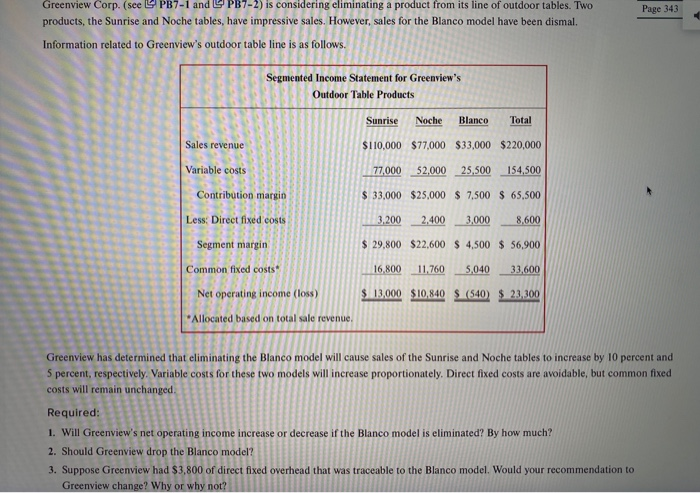

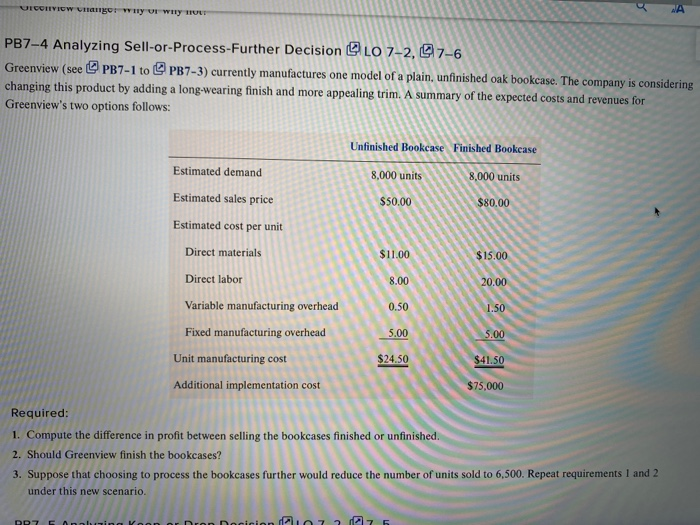

PB7-2 Analyzing Make-or-Buy Decision LO 7-2, 7-4 Greenview Corp. (see PB7-1) is considering the possibility of outsourcing the production of the upholstered chair pads included with some of its wooden chairs. The company has received a bid from a company in China to produce 1,000 units per year for $9 each. Greenview has the following information about its own production of the chair pads: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per unit Greenview has determined that all variable costs could be eliminated by dropping production of the chair pads, and that 30 percent of the fixed manufacturing overhead is avoidable. At this time, Greenview has no specific use in mind for the space currently dedicated to producing the chair pads. Page 343 Greenview Corp. (see L PB7-1 and LPB7-2) is considering eliminating a product from its line of outdoor tables. Two products, the Sunrise and Noche tables, have impressive sales. However, sales for the Blanco model have been dismal. Information related to Greenview's outdoor table line is as follows. Segmented Income Statement for Greenview's Outdoor Table Products Sunrise Noche Blanco Total Sales revenue $110,000 $77,000 $33,000 $220,000 Variable costs 77,000 52,000 25,500 154,500 Contribution margin $ 33,000 $25,000 $ 7,500 $ 65,500 Less: Direct fixed costs 3.200 2.400 3.000 8.600 Segment margin $ 29,800 $22.600 $ 4,500 $ 56.900 Common fixed costs 16,800 11.760 5,040 33,600 $ 13,000 $10,840 S (540) $ 23,300 Net operating income (loss) *Allocated based on total sale revenue. Greenview has determined that eliminating the Blanco model will cause sales of the Sunrise and Noche tables to increase by 10 percent and 5 percent, respectively. Variable costs for these two models will increase proportionately. Direct fixed costs are avoidable, but common fixed costs will remain unchanged. Required: 1. Will Greenview's net operating income increase or decrease if the Blanco model is eliminated? By how much? 2. Should Greenview drop the Blanco model? 3. Suppose Greenview had $3,800 of direct fixed overhead that was traceable to the Blanco model. Would your recommendation to Greenview change? Why or why not? CHIVICW Ulangor why I wy TUL PB7-4 Analyzing Sell-or-Process-Further Decision LO 7-2, 7-6 Greenview (see PB7-1 to PB7-3) currently manufactures one model of a plain, unfinished oak bookcase. The company is considering changing this product by adding a long-wearing finish and more appealing trim. A summary of the expected costs and revenues for Greenview's two options follows: Unfinished Bookcase Finished Bookcase 8,000 units 8,000 units Estimated demand Estimated sales price $50.00 $80,00 Estimated cost per unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit manufacturing cost $41.50 Additional implementation cost Required: 1. Compute the difference in profit between selling the bookcases finished or unfinished 2. Should Greenview finish the bookcases? 3. Suppose that choosing to process the bookcases further would reduce the number of units sold to 6,500. Repeat requirements 1 and 2 under this new scenario. RR7 Enabing Koon or Dron Dominion rinn 72 75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started