Please, do the same format to make it easier for me to understand your answers. I don't want to drive myself crazy by trying to figure out what you did while it should be easy

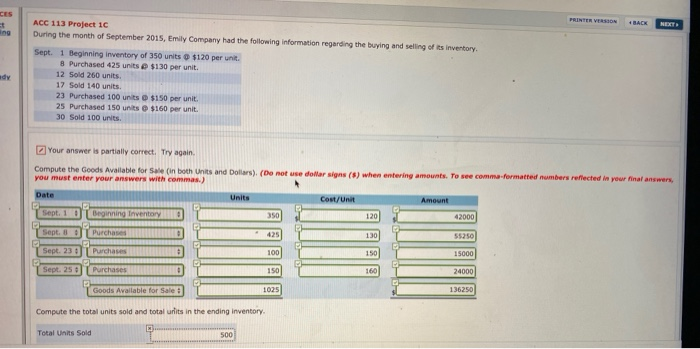

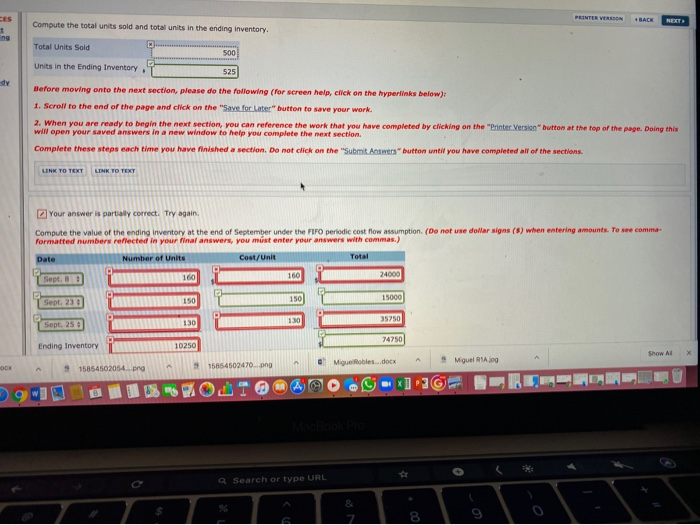

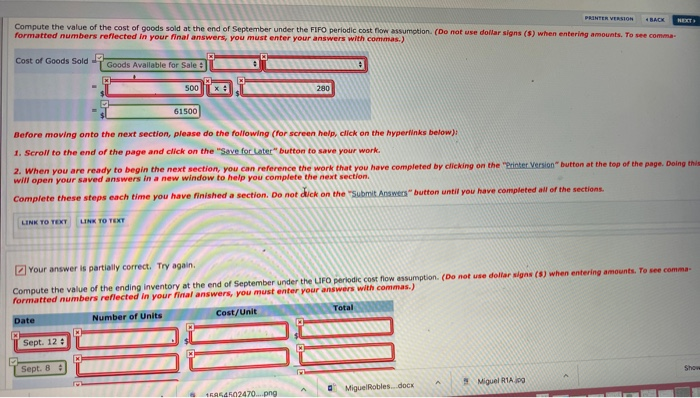

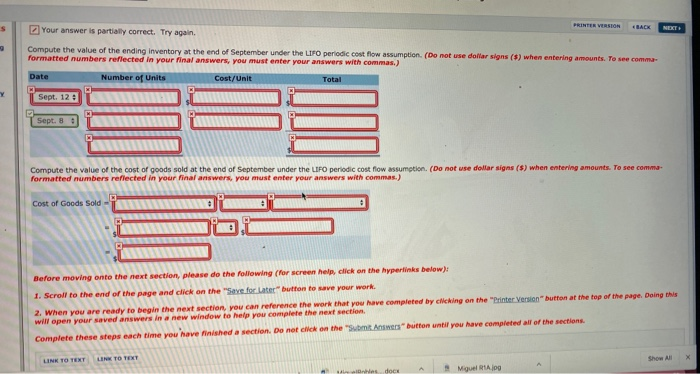

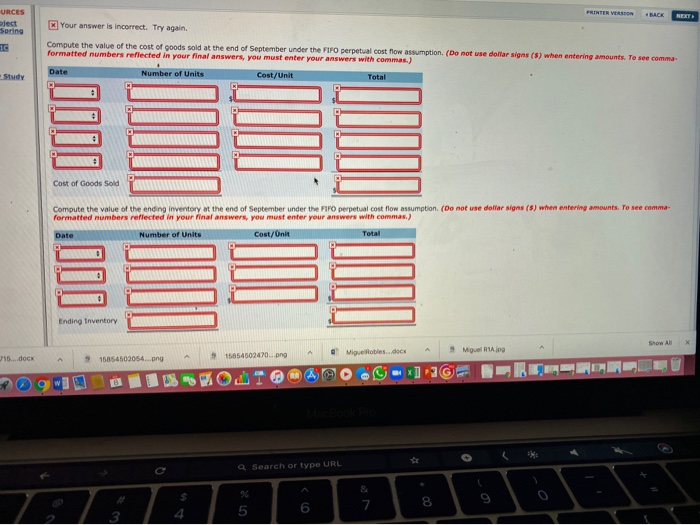

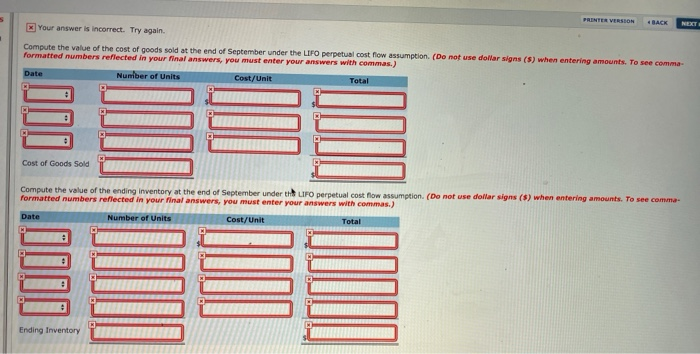

ACC 113 Project 1C During the month of September 2015, Emily Company had the following information regarding the buying and selling of its inventory. Sept. 1 Beginning inventory of 350 units $120 per unit 8 Purchased 425 units $130 per unit. 12 Sold 260 units 17 Sold 140 units. 23 Purchased 100 units $150 per unit. 25 Purchased 150 units $160 per unit. 30 Sold 100 units Your answer is partially correct. Try again Compute the Goods Available for Sale (in both Units and Dollars). (Do not use dollar signs (S) when entering you must enter your answers with commas.) Date Cost/Unit Sept. 1 Sept. 8 0 Sept. 23 Sept. 250 Beginning Inventory Purchases Purchase Purchase Ave Compute the total units sold and total units in the ending inventory Total Units Sold Compute the total units sold and total units in the ending inventory. Total Units Sold Units in the Ending Inventory 525 Before moving onto the next section, please do the following (for screen help, click on the hyperlinks below): 1. Scroll to the end of the page and click on the "Save for later" button to save your work 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the "Printer Version" button at the top of the page. Doing this will open your saved answers in a new window to help you complete the next section. Complete these steps each time you have finished a section. Do not click on the "Submit Answers" button until you have completed all of the sections. LINK TO TEXT LINK TO TECT Your answer is partially correct. Try again. Compute the value of the ending inventory at the end of September under the FIFO periodic cost flow assumption. (Do not use dollar sig formatted numbers reflected in your final answers, you must enter your answers with commas.) Number of Units Cost/Unit Date 24000 Sept. o 160 150 130 15000 35750 Sept. 230 Sept.259 Ending Inventory 74750 10250 Show All X 15854502470.png Mique Robles...docx Mguel RAG OOK $ 15854502054...pro Q Search or type URL PRINTER VERSION BACK NEXT Compute the value of the cost of goods sold at the end of September under the FIFO periodic cost flow assumption (Do not use dollar signs (S) when entering amounts. To see comma formatted numbers reflected in your final answers, you must enter your answers with commas.) Cost of Goods Sold Goods Available for Sale or 300 61500 2 80 Before moving onto the next section, please do the following (for screen help, click on the hyperlinks below) 1. Scroll to the end of the page and click on the "Save for later" button to save your work 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the printer Version" button at the top of the page. Doing this will open your saved answers in a new window to help you complete the next section. Complete these steps each time you have finished a section. Do not dick on the "Submit Answers" button until you have completed all of the sections. LINK TO TEXT Your answer is partially correct. Try again. Compute the value of the ending inventory at the end of September under the UFO periodic cost flow assumption. (Do not use dollar wat formatted numbers reflected in your final answers, you must enter your answers with commas.) Total Number of Units Cost/Unit Date Sept. 124 Sept. 8 A Miguel R1A100 CAE4502470.png A Miguel Robles...dock BACK Your answer is partially correct. Try again. NET Compute the value of the ending Inventory at the end of September under the LIFO periodic cost flow assumption. (Do not use dollar signs ($) when entering amounts. To see com formatted numbers reflected in your final answers, you must enter your answers with commas.) Date Number of Units Cost/Unit Sept. 12 T Sept. 8 Compute the value of the cost of goods sold at the end of September under the LIFO periodic cost flow assumption. (Do not use dollar signs ($) when entering amounts formatted numbers reflected in your final answers, you must enter your ans Cost of Goods Sold - Before moving onto the next section, please do the following (for screen help, click on the hyperlinks below: 1. Scroll to the end of the page and click on the "Save for later" button to save your work. 2. When you are ready to begin the next section, you can reference the work that you have completed by clicking on the Printer Version" button at the top of the page. Doing this will open your saved answers in a new window to help you complete the next section Complete these steps each time you have finished a section. Do not click on the Submit Answer button until you have completed all of the sections het dock Miguel Ang PRINTER VERSION MACK NEXT URCES est Spring Your answer is incorrect. Try again. Compute the value of the cost of goods sold at the end of September under the FIFO perpetual cost flow assumption. (Do not use dollar signs formatted numbers reflected in your final answers, you must enter your answers with commas.) Number of Units Study Cost/Unit Cost of Goods Sold Compute the value of the ending inventory at the end of September under the FIFO perpetual cost flow assumption. (Do not use dollar signs (S) when entering amous formatted numbers reflected in your final answers, you must enter your answers with commas.) Ending Inventory Show All X A 15854502470.png Miguelfobles...docx 15...docx Miguel Ang 15854502054...ang Q Search or type URL TER VERSION BACK NEXT Your answer is incorrect. Try again Compute the value of the cost of goods sold at the end of September under the LIFO perpetual cost now assumption. (Do not use dollar signs (5) when entering amounts. To formatted numbers reflected in your final answers, you must enter your answers with commas.) Number of Units Cost/Unit Cost of Goods Sold Compute the value of the ending inventory at the end of September under LIFO perpetual cost tow assumption (Do not use dollar signs (5 formatted numbers reflected in your final answers, you must enter your answers with commes.) Number of Units Ending Inventory