Answered step by step

Verified Expert Solution

Question

1 Approved Answer

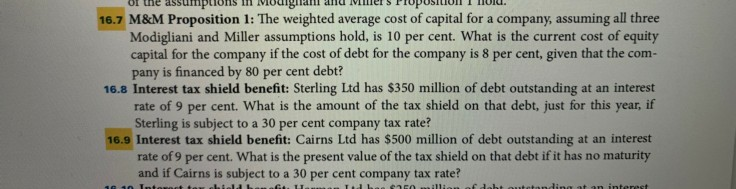

please do the yellow mark 16.7 16.9 Thank you! of the assumptionsn idigani and erroPosition noid 16.7 M&M Proposition 1: The weighted average cost of

please do the yellow mark 16.7 16.9 Thank you!

of the assumptionsn idigani and erroPosition noid 16.7 M&M Proposition 1: The weighted average cost of capital for a company, assuming all three Modigliani and Miller assumptions hold, is 10 per cent. What is the current cost of equity capital for the company if the cost of debt for the company is 8 per cent, given that the com- pany is financed by 80 per cent debt? 16.8 Interest tax shield benefit: Sterling Ltd has $350 million of debt outstanding at an interest rate of 9 per cent. What is the amount of the tax shield on that debt, just for this year, if Sterling is subject to a 30 per cent company tax rate? 16.9 Interest tax shield benefit: Cairns Ltd has $500 million of debt outstanding at an interest rate of 9 per cent. What is the present value of the tax shield on that debt if it has no maturity and if Cairns is subject to a 30 per cent company tax rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started