Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE, do them 1 On a bank reconciliation, the amount of an unrecorded bank service charge should be: Multiple Choice 0/5 points awarded Scored Deducted

PLEASE, do them

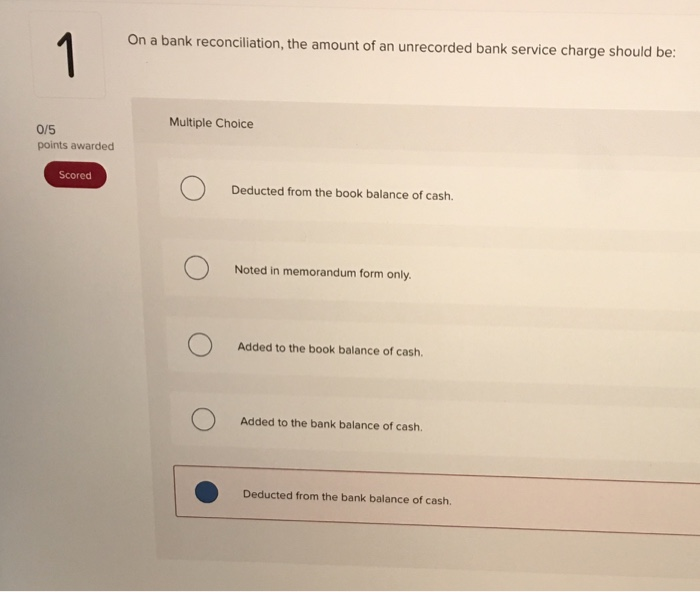

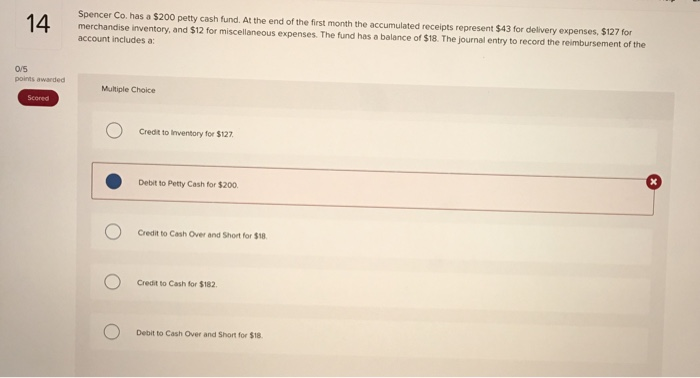

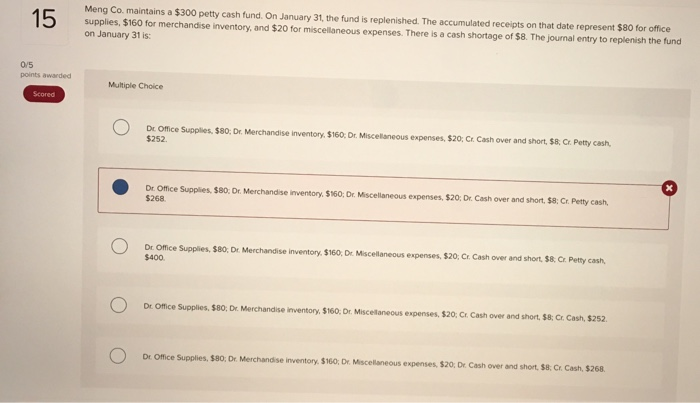

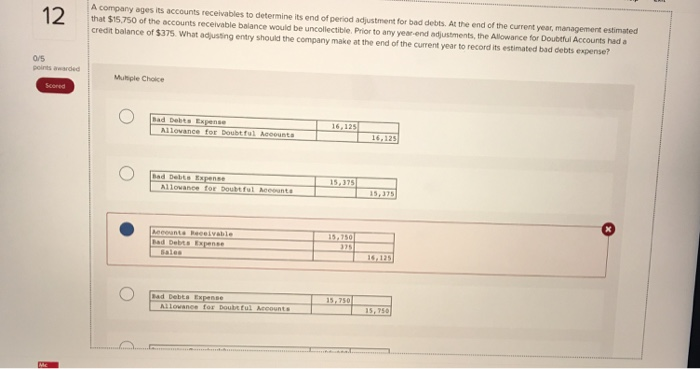

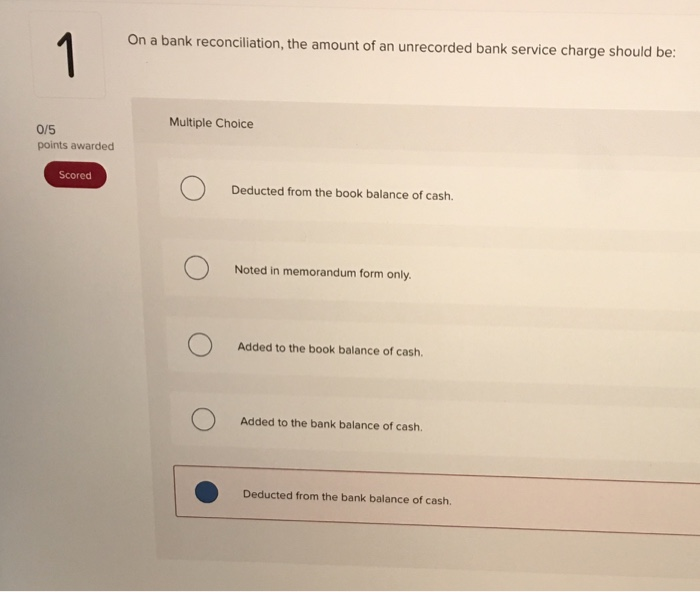

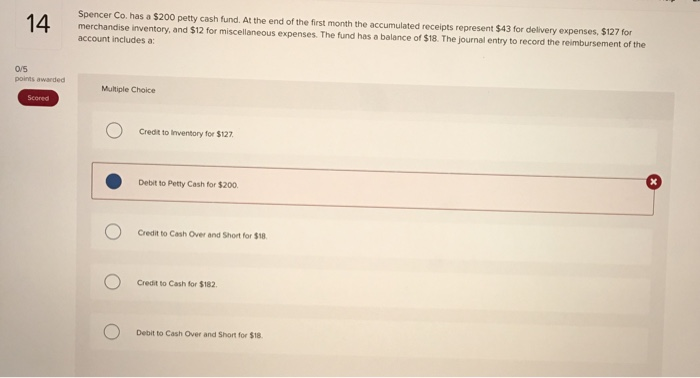

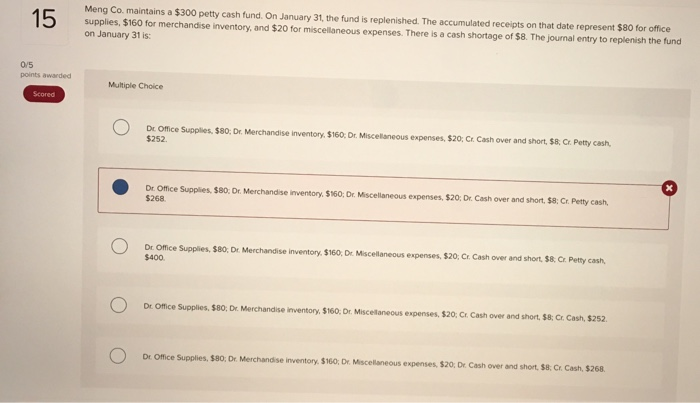

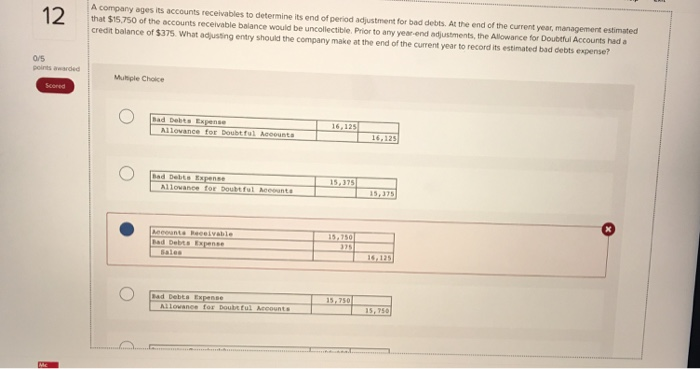

1 On a bank reconciliation, the amount of an unrecorded bank service charge should be: Multiple Choice 0/5 points awarded Scored Deducted from the book balance of cash. Noted in memorandum form only. Added to the book balance of cash. Added to the bank balance of cash. Deducted from the bank balance of cash. Spencer Co. has a $200 petty cash fund. At the end of the first month the accumulated receipts represent $43 for delivery expenses, $127 for merchandise inventory, and $12 for miscellaneous expenses. The fund has a balance of $18. The journal entry to record the reimbursement of the 14 account includes a: 0/5 points awarded Multiple Choice Scored Credit to Inventory for $127 Debit to Petty Cash for $200. Credit to Cash Over and Short for $18 Credit to Cash for $182. Debit to Cash Over and Short for $18. Meng Co. maintains a $300 petty cash fund. On January 31, the fund is replenished. The accumulated receipts on that date represent $80 for office 15 supplies, $160 for merchandise inventory, and $20 for miscellaneous expenses. There is a cash shortage of $8. The journal entry to replenish the fund on January 31 is 0/5 points awarded Multiple Choice Scored Dr. Office Supplies, $80: Dr. Merchandise inventory, $160, Dr. Miscellaneous expenses, $20, Cr Cash over and short, $8 Cr. Petty cash, $252 Dr. Office Supplies, $80: Dr. Merchandise inventory, $160: Dr. Miscellaneous expenses, $20: Dr. Cash over and short, $8: Cr. Petty cash $268. Dr. Office Supplies, $80, Dr. Merchandise inventory, $160, Dr Miscellaneous expenses, $20, Cr. Cash over and short, $8 Cr. Petty cash, $400 Dr. Office Supplies, $80, Dr. Merchandise inventory, $160, Dr. Miscelaneous expenses, $20; Cr. Cash over and short, $8: Cr. Cash, $252 Dr. Office Supplies, $80; Dr. Merchandise inventory. $160; Dr. Miscellaneous expenses, $20, Dr. Cash over and short, $8: Cr. Cash, $268. A company ages its accounts receivables to determine its end of period adiustment for bad debts. At the end of the current year, management estimated that $15,750 of the accounts receivable balance would be uncollectible Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a credit balance of $375 What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense? 12 0/5 points awarded Mutiple Choice Scored Bad Debts Expense 16,125 Allovance for Doubt ful Acoounta 16,125 Bad Debts Expense 15,375 Allovance for Doubt ful Aceounta 15,375 heeoanta Beceivable Bad Debts Expense 15,750 375 14,125 Sales 15, 750 Bad Debta Expense Allowance for Doubttul Accounts 15,750 thumu

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started