Answered step by step

Verified Expert Solution

Question

1 Approved Answer

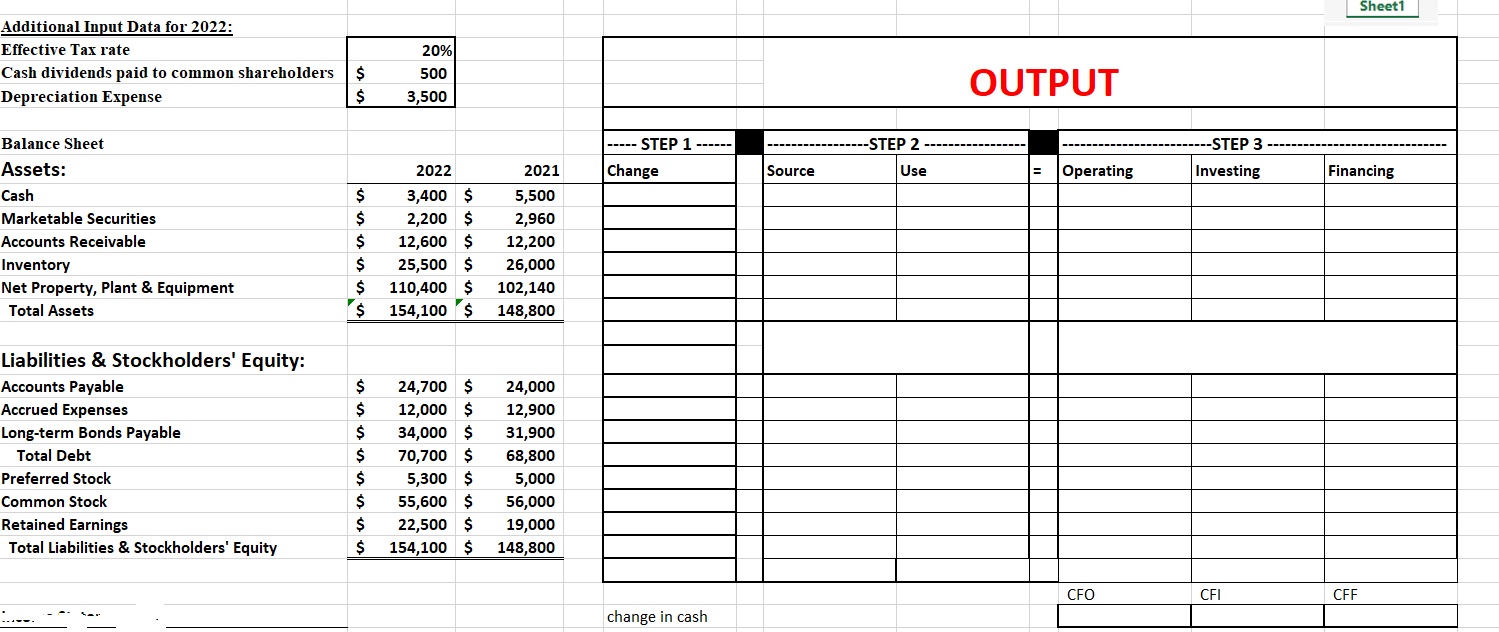

Please do this in excel worksheet with cell references Additional Input Data for 2022: Effective Tax rate Cash dividends paid to common shareholders Depreciation Expense

Please do this in excel worksheet with cell references

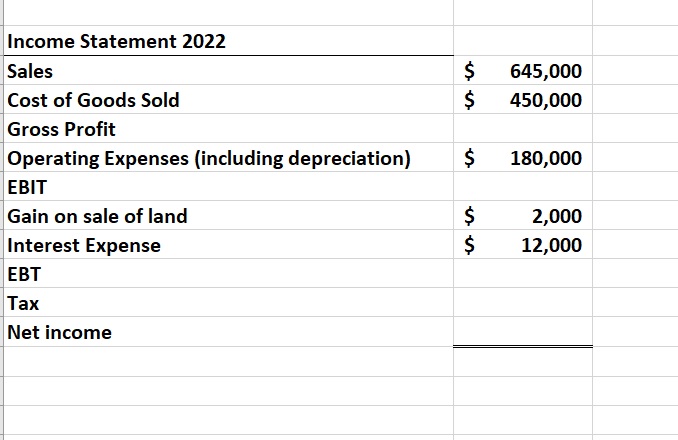

Additional Input Data for 2022: Effective Tax rate Cash dividends paid to common shareholders Depreciation Expense Balance Sheet Assets: Cash Marketable Securities Accounts Receivable Inventory Net Property, Plant \& Equipment Total Assets Liabilities \& Stockholders' Equity: Accounts Payable Accrued Expenses Long-term Bonds Payable Total Debt Preferred Stock Common Stock Retained Earnings Total Liabilities \& Stockholders' Equity \begin{tabular}{|rr|} \hline & 20% \\ $ & 500 \\ $ & 3,500 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline $ & 24,700 & $ & 24,000 \\ \hline $ & 12,000 & $ & 12,900 \\ \hline $ & 34,000 & $ & 31,900 \\ \hline $ & 70,700 & $ & 68,800 \\ \hline $ & 5,300 & $ & 5,000 \\ \hline $ & 55,600 & $ & 56,000 \\ \hline $ & 22,500 & $ & 19,000 \\ \hline $ & 154,100 & $ & 148,800 \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|} \hline & OUTPUT \\ \hline & OUITIT \end{tabular} change in cash \begin{tabular}{l|lr} Income Statement 2022 & & \\ \hline Sales & $ & 645,000 \\ Cost of Goods Sold & $ & 450,000 \\ \hline Gross Profit & & \\ \hline Operating Expenses (including depreciation) & $ & 180,000 \\ \hline EBIT & & \\ \hline Gain on sale of land & $ & 2,000 \\ Interest Expense & $ & 12,000 \\ \hline EBT & & \\ \hline Tax & & \\ \hline Net income & & \\ \hline \end{tabular} Additional Input Data for 2022: Effective Tax rate Cash dividends paid to common shareholders Depreciation Expense Balance Sheet Assets: Cash Marketable Securities Accounts Receivable Inventory Net Property, Plant \& Equipment Total Assets Liabilities \& Stockholders' Equity: Accounts Payable Accrued Expenses Long-term Bonds Payable Total Debt Preferred Stock Common Stock Retained Earnings Total Liabilities \& Stockholders' Equity \begin{tabular}{|rr|} \hline & 20% \\ $ & 500 \\ $ & 3,500 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline $ & 24,700 & $ & 24,000 \\ \hline $ & 12,000 & $ & 12,900 \\ \hline $ & 34,000 & $ & 31,900 \\ \hline $ & 70,700 & $ & 68,800 \\ \hline $ & 5,300 & $ & 5,000 \\ \hline $ & 55,600 & $ & 56,000 \\ \hline $ & 22,500 & $ & 19,000 \\ \hline $ & 154,100 & $ & 148,800 \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|} \hline & OUTPUT \\ \hline & OUITIT \end{tabular} change in cash \begin{tabular}{l|lr} Income Statement 2022 & & \\ \hline Sales & $ & 645,000 \\ Cost of Goods Sold & $ & 450,000 \\ \hline Gross Profit & & \\ \hline Operating Expenses (including depreciation) & $ & 180,000 \\ \hline EBIT & & \\ \hline Gain on sale of land & $ & 2,000 \\ Interest Expense & $ & 12,000 \\ \hline EBT & & \\ \hline Tax & & \\ \hline Net income & & \\ \hline \end{tabular}

Additional Input Data for 2022: Effective Tax rate Cash dividends paid to common shareholders Depreciation Expense Balance Sheet Assets: Cash Marketable Securities Accounts Receivable Inventory Net Property, Plant \& Equipment Total Assets Liabilities \& Stockholders' Equity: Accounts Payable Accrued Expenses Long-term Bonds Payable Total Debt Preferred Stock Common Stock Retained Earnings Total Liabilities \& Stockholders' Equity \begin{tabular}{|rr|} \hline & 20% \\ $ & 500 \\ $ & 3,500 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline $ & 24,700 & $ & 24,000 \\ \hline $ & 12,000 & $ & 12,900 \\ \hline $ & 34,000 & $ & 31,900 \\ \hline $ & 70,700 & $ & 68,800 \\ \hline $ & 5,300 & $ & 5,000 \\ \hline $ & 55,600 & $ & 56,000 \\ \hline $ & 22,500 & $ & 19,000 \\ \hline $ & 154,100 & $ & 148,800 \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|} \hline & OUTPUT \\ \hline & OUITIT \end{tabular} change in cash \begin{tabular}{l|lr} Income Statement 2022 & & \\ \hline Sales & $ & 645,000 \\ Cost of Goods Sold & $ & 450,000 \\ \hline Gross Profit & & \\ \hline Operating Expenses (including depreciation) & $ & 180,000 \\ \hline EBIT & & \\ \hline Gain on sale of land & $ & 2,000 \\ Interest Expense & $ & 12,000 \\ \hline EBT & & \\ \hline Tax & & \\ \hline Net income & & \\ \hline \end{tabular} Additional Input Data for 2022: Effective Tax rate Cash dividends paid to common shareholders Depreciation Expense Balance Sheet Assets: Cash Marketable Securities Accounts Receivable Inventory Net Property, Plant \& Equipment Total Assets Liabilities \& Stockholders' Equity: Accounts Payable Accrued Expenses Long-term Bonds Payable Total Debt Preferred Stock Common Stock Retained Earnings Total Liabilities \& Stockholders' Equity \begin{tabular}{|rr|} \hline & 20% \\ $ & 500 \\ $ & 3,500 \\ \hline \end{tabular} \begin{tabular}{|r|r|r|r|} \hline $ & 24,700 & $ & 24,000 \\ \hline $ & 12,000 & $ & 12,900 \\ \hline $ & 34,000 & $ & 31,900 \\ \hline $ & 70,700 & $ & 68,800 \\ \hline $ & 5,300 & $ & 5,000 \\ \hline $ & 55,600 & $ & 56,000 \\ \hline $ & 22,500 & $ & 19,000 \\ \hline $ & 154,100 & $ & 148,800 \\ \hline \hline \end{tabular} \begin{tabular}{|l|l|} \hline & OUTPUT \\ \hline & OUITIT \end{tabular} change in cash \begin{tabular}{l|lr} Income Statement 2022 & & \\ \hline Sales & $ & 645,000 \\ Cost of Goods Sold & $ & 450,000 \\ \hline Gross Profit & & \\ \hline Operating Expenses (including depreciation) & $ & 180,000 \\ \hline EBIT & & \\ \hline Gain on sale of land & $ & 2,000 \\ Interest Expense & $ & 12,000 \\ \hline EBT & & \\ \hline Tax & & \\ \hline Net income & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started