Answered step by step

Verified Expert Solution

Question

1 Approved Answer

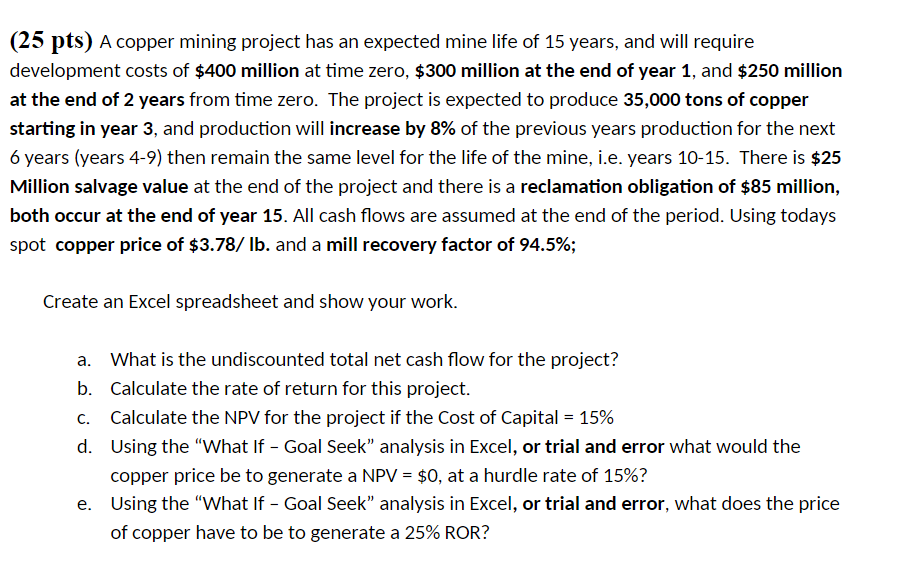

Please do this on an excel spreadsheet using excel formulas. A copper mining project has an expected mine life of 1 5 years, and will

Please do this on an excel spreadsheet using excel formulas.

A copper mining project has an expected mine life of years, and will require

development costs of $ million at time zero, $ million at the end of year and $ million

at the end of years from time zero. The project is expected to produce tons of copper

starting in year and production will increase by of the previous years production for the next

years years then remain the same level for the life of the mine, ie years There is $

Million salvage value at the end of the project and there is a reclamation obligation of $ million,

both occur at the end of year All cash flows are assumed at the end of the period. Using todays

spot copper price of $ and a mill recovery factor of ;

Create an Excel spreadsheet and show your work.

a What is the undiscounted total net cash flow for the project?

b Calculate the rate of return for this project.

c Calculate the NPV for the project if the Cost of Capital

d Using the "What If Goal Seek" analysis in Excel, or trial and error what would the

copper price be to generate a NPV $ at a hurdle rate of

e Using the "What If Goal Seek" analysis in Excel, or trial and error, what does the price

of copper have to be to generate a ROR?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started