Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do this question fast Star Inc. installed new factory machinery. The electrical work required to prepare for the installation was $19,000. The invoice price

please do this question fast

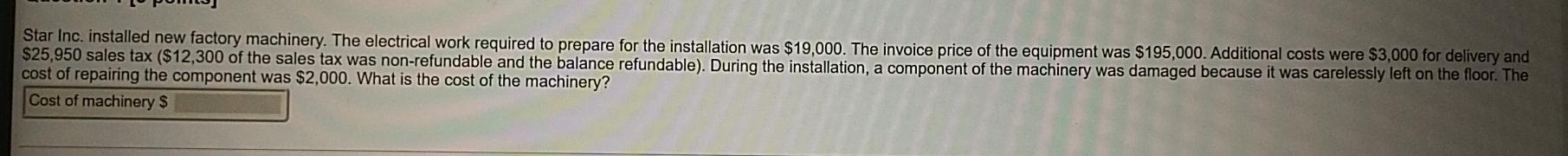

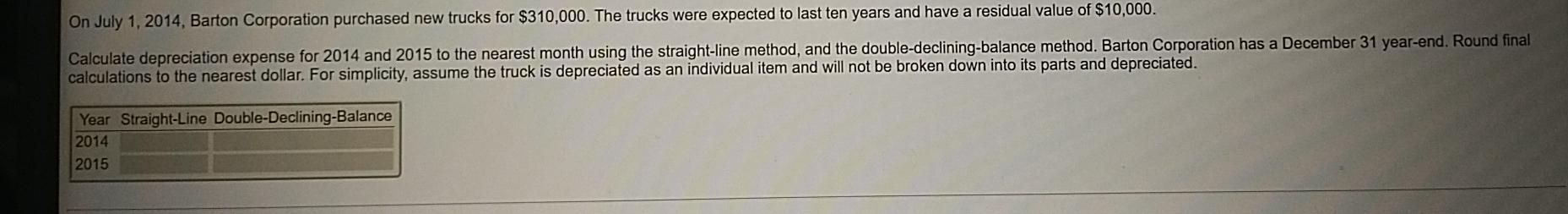

Star Inc. installed new factory machinery. The electrical work required to prepare for the installation was $19,000. The invoice price of the equipment was $195,000. Additional costs were $3,000 for delivery and $25,950 sales tax ($12,300 of the sales tax was non-refundable and the balance refundable). During the installation, a component of the machinery was damaged because it was carelessly left on the floor. The cost of repairing the component was $2,000. What is the cost of the machinery? Cost of machinery $ On July 1, 2014, Barton Corporation purchased new trucks for $310,000. The trucks were expected to last ten years and have a residual value of $10,000. Calculate depreciation expense for 2014 and 2015 to the nearest month using the straight-line method, and the double-declining-balance method. Barton Corporation has a December 31 year-end. Round final calculations to the nearest dollar. For simplicity, assume the truck is depreciated as an individual item and will not be broken down into its parts and depreciated. Year Straight-Line Double-Declining-Balance 2014 2015Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started