Question: please dont answer it on excel and provide the formulas if needed Values Values Accounts Payable & Accruals $300 Short-term notes $150 $150 Long-term debt

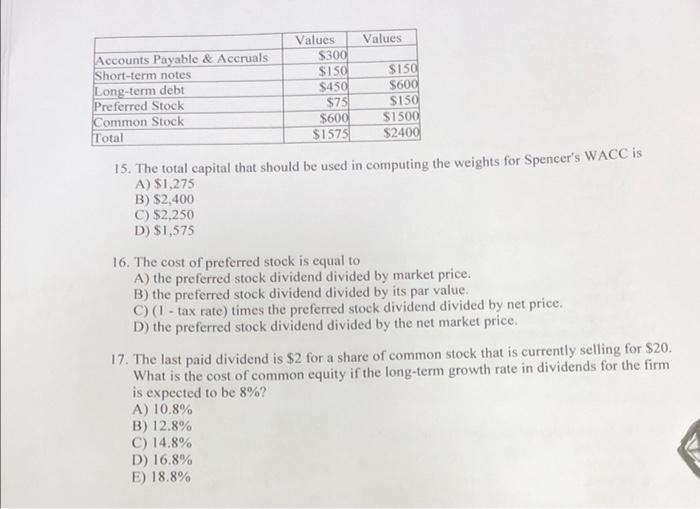

Values Values Accounts Payable & Accruals $300 Short-term notes $150 $150 Long-term debt $450 S600 Preferred Stock $75 SIS Common Stock $600 $1500 Total $1575 $2400 15. The total capital that should be used in computing the weights for Spencer's WACC is A) $1,275 B) $2,400 C) $2,250 D) $1,575 16. The cost of preferred stock is equal to A) the preferred stock dividend divided by market price. B) the preferred stock dividend divided by its par value. C) (1 - tax rate) times the preferred stock dividend divided by net price. D) the preferred stock dividend divided by the net market price. 17. The last paid dividend is $2 for a share of common stock that is currently selling for $20. What is the cost of common equity if the long-term growth rate in dividends for the firm is expected to be 8%? A) 10.8% B) 12.8% C) 14.8% D) 16.8% E) 18.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts