Question

*Please dont copy previous answers post. I would like to know where the numbers/formula come from. Thank you. JLB Corporation is attempting to determine whether

*Please dont copy previous answers post. I would like to know where the numbers/formula come from. Thank you.

JLB Corporation is attempting to determine whether to lease or purchase research equipment. the firm is in the 40% tax bracket, and its after tax cost of debtis currently 8%. the terms of the lease and of the purchase are as follows:

LEASE: Annual end-of-year lease payment of $25,200 are required over the 3-year life of the lease. All maintenance costs will be paid by the lessor;insurance and other cost will be borne by the lesse. the lesse will excercise its option to purchase the asset for $5,000 at termination of lease.

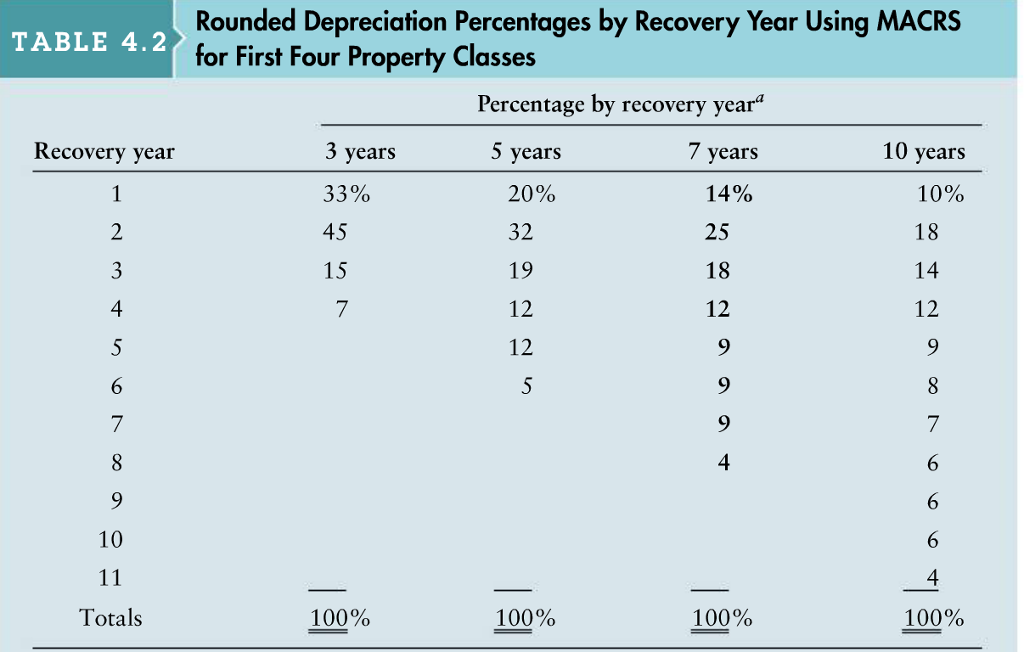

PURCHASE: The research equipment, costing $60,000 can be financed entirely with a 14% loan requiring annual end-of-year payments of $25,844 for 3 years. the firm in this case will depreciate the equipment under MARCS using a 3 year recovery period. The firm will pay 1,800 per year for a service contract the covers all maintenance costs;insurance and other costs will be borne by the firm. The firm plans to keep the equipment and use it beyond its 3-year recovery period. A. Calculate the after-tax cash outflow associated with each B. Calculate the present value of each outflow stream,using the after-tax cost of debt. C. Which Alternative-Lease of Purchase-would you recommend? Why?

Rounded Depreciation Percentages by Recovery Year Using MACRS TABLE 4.2 for First Four Property Classes Percentage by recovery year 5 years 7 years Recovery year 3 years 10 years 20% 10% 33% 14% 18 45 25 32 15 18 14 19 12 12 12 12 10 11 100% 100% 100% 100% Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started