Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please double check my work, thank you. Mason Co. is evaluating two alternative investment proposals. Below are data for each proposal Proposal A Proposal B

Please double check my work, thank you.

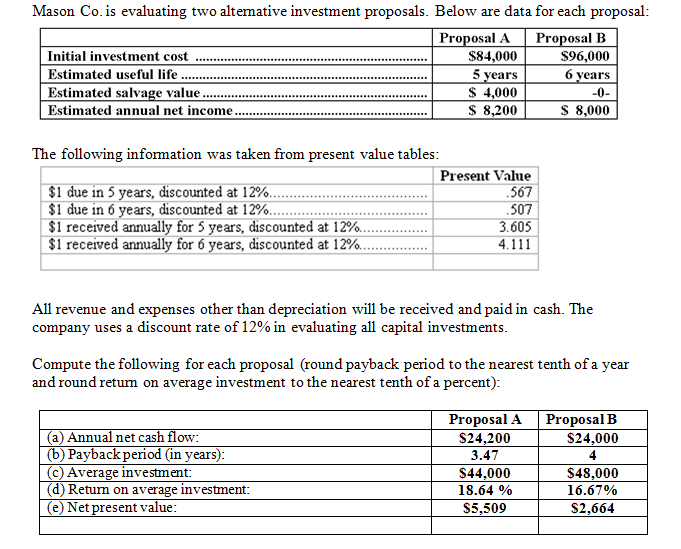

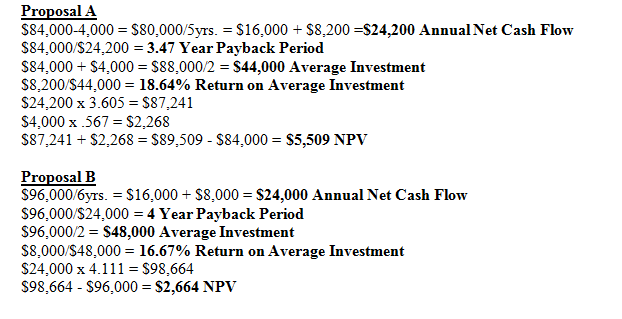

Mason Co. is evaluating two alternative investment proposals. Below are data for each proposal Proposal A Proposal B Initial investment cost S84,000 S96,000 Estimated useful life............................................................. 5 years 6 years -0- S 4,000 Estimated salvage value............................................................. S 8.200 Estimated annual net income......................... S 8,000 The following information w as taken from present value tables Present Value $1 due in 5 years, discounted at 12% $1 due in 6 years, discounted at 12% 567 507 3.605 $1 received annually for 5 years, discounted at 12%. $1 received annually for 6 years, discounted at 12%. 4.111 All revenue and expenses other than depreciation will be received and paid in cash. The company uses a discount rate of 12% in evaluating all capital investments. Compute the following for each proposal (round payback period to the nearest tenth of a year and round return on average investment tothe nearest tenth of a percent Proposal A Proposal B (a) Annual net cash flow S24,200 $24,000 3.47 4 (b) Payback period in years (c) Average investment: $44.000 $48.000 (d) Return on average investment 18.64 16.67% (e) Net present value S5,509 S2,664Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started