Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please double check the answers you give me. The answers that were entered were from a Chegg expert answer and they were incorrect. Thank you!!!

Please double check the answers you give me. The answers that were entered were from a Chegg expert answer and they were incorrect. Thank you!!!

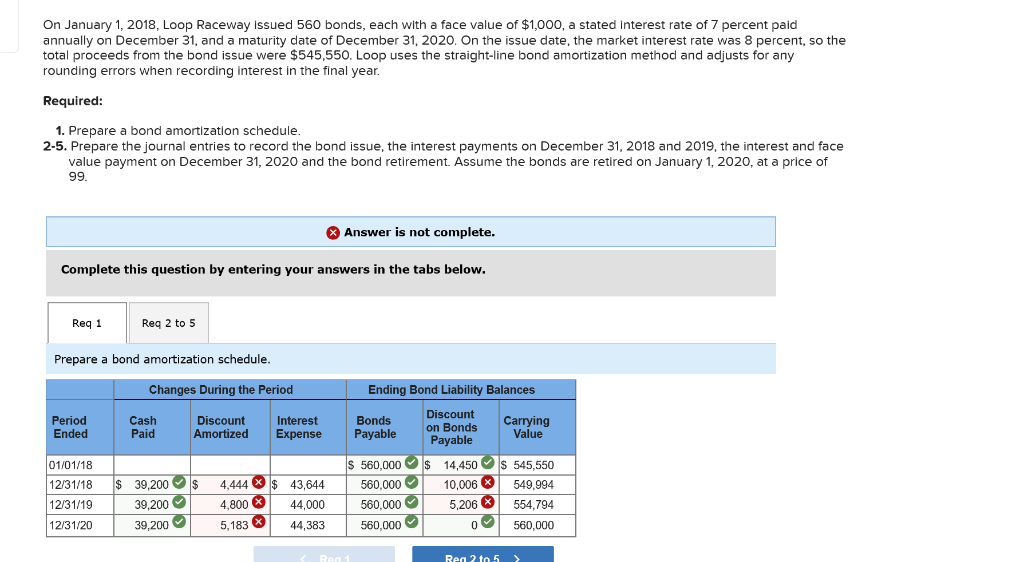

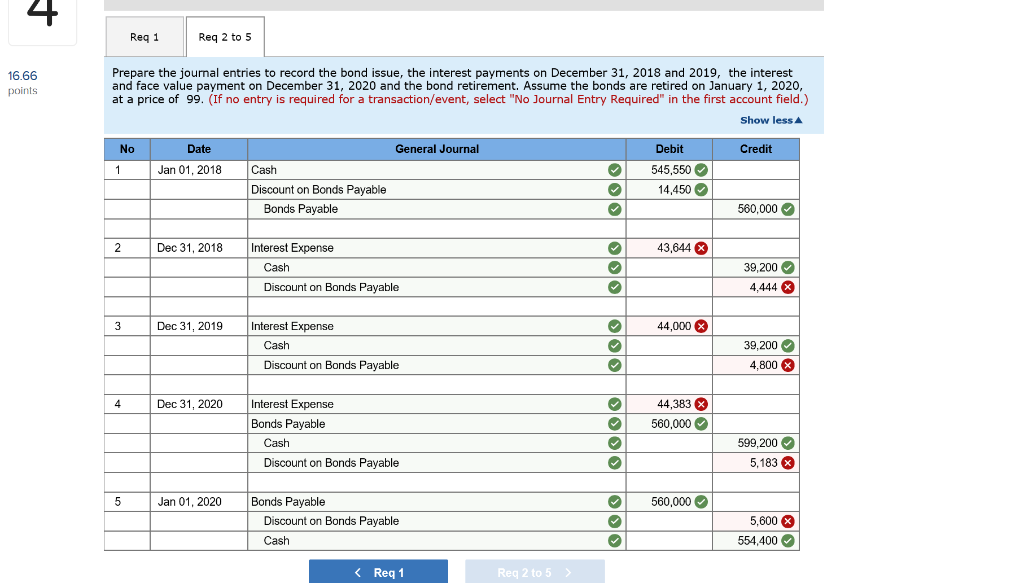

On January 1, 2018, Loop Raceway issued 560 bonds, each with a face value of $1,000, a stated interest rate of 7 percent paid annually on December 31, and a maturity date of December 31, 2020. On the issue date, the market interest rate was 8 percent, so the total proceeds from the bond issue were $545,550. Loop uses the straight-line bond amortization method and adjusts for any rounding errors when recording interest in the final year Required 1. Prepare a bond amortization schedule 2-5. Prepare the journal entries to record the bond issue, the interest payments on December 31, 2018 and 2019, the interest and face value payment on December 31, 2020 and the bond retirement. Assume the bonds are retired on January 1, 2020, at a price of Answer is not complete. Complete this question by entering your answers in the tabs below Req 2 to 5 Req 1 Prepare a bond amortization schedule Changes During the Period Ending Bond Liability Balances Discount Payable Cash Paid Bonds Period Ended Discount Amortized Interest Expense Payable on Bonds Carrying Value 01/01/18 12/31/18 39,200 4,444 $ 43,644 1231/19 12/31/20 S 560,00014,450 545,550 549,994 554,794 560,000 560,000 560,000 560,000 10,006 39,200 39,200 4,800 44,000 5,206 44,383 5,183 Reg 1 Rea 2 to5 > Req 1 Req 2 to 5 Prepare the journal entries to record the bond issue, the interest payments on December 31, 2018 and 2019, the interest and face value payment on December 31, 2020 and the bond retirement. Assume the bonds are retired on January 1, 2020 at a price of 99. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) 16.66 Show less Credit General Journal Debit 545,550 14,450 Jan 01, 2018 Discount on Bonds Payable 560.000 Bonds Payable 43,644 Dec 31, 2018 Interest Expense 39,200 Cash 4.444 Discount on Bonds Payable 44,000 Dec 31, 2019 Interest Expense 39,200 Cash Discount on Bonds Payable 4,800 Dec 31, 2020 Interest Expense 44,383 560,000 4 Bonds Payable 599,200 5,183 Cash Discount on Bonds Payable Jan 01, 2020 Bonds Payable 560.0000 5,600 554,400 Discount on Bonds Payable CashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started