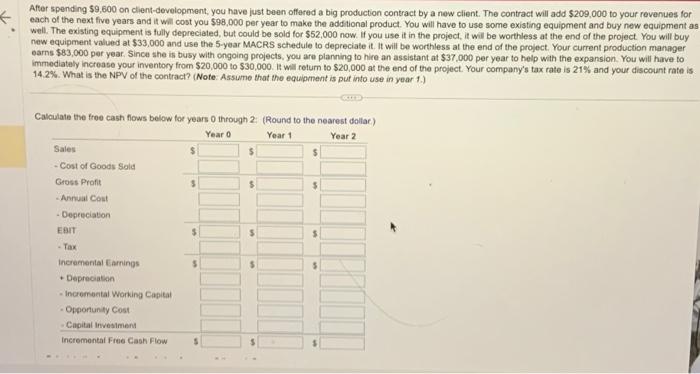

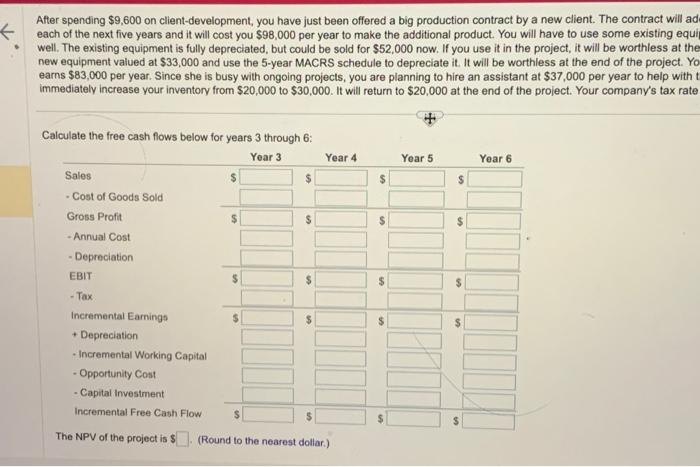

After spending $9,600 on client-development, you have just been offered a big production contract by a new client. The contract will add $209,000 to your revenues for each of the next five years and it will cost you $98,000 per year to make the additional product. You wilt have to use some existing equipment and buy new equipment a well. The existing equipment is fully depreciated, but could be sold for $52,000 now. If you use if in the project, it wil be worthless at the end of the project. You will buy new equipment valued at $33,000 and use the 5-year MACRS schedule to depreciate it. It will be worthless at the end of the project. Your current production manager earns $83,000 per year. Since she is busy with ongoing projects, you are planning to hire an assistant at $37,000 per year to help with the expansion. You will have to immediately increase your inventory from $20,000 to $30,000. 18 will retum to $20,000 at the end of the project. Your company's tax rate is 21% and your discount rate is 14.2%. What is the NPV of the contract? (Note: Assume that the equipment is put into use in year 7 .) Calculate the free cash flows below for years 0 through 2: (Round to the nearest dollac) After spending $9,600 on client-development, you have just been offered a big production contract by a new client. The contract will ad each of the next five years and it will cost you $98,000 per year to make the additional product. You will have to use some existing equi well. The existing equipment is fully depreciated, but could be sold for $52,000 now. If you use it in the project, it will be worthless at the new equipment valued at $33,000 and use the 5-year MACRS schedule to depreciate it. It will be worthless at the end of the project. Yo earns $83,000 per year. Since she is busy with ongoing projects, you are planning to hire an assistant at $37,000 per year to help with immediately increase your inventory from $20,000 to $30,000. It will return to $20,000 at the end of the project. Your company's tax rate Calculate the free cash flows below for years 3 throuch 6 : The NPV of the project is : (Round to the nearest dollar.) After spending $9,600 on client-development, you have just been offered a big production contract by a new client. The contract will add $209,000 to your revenues for each of the next five years and it will cost you $98,000 per year to make the additional product. You wilt have to use some existing equipment and buy new equipment a well. The existing equipment is fully depreciated, but could be sold for $52,000 now. If you use if in the project, it wil be worthless at the end of the project. You will buy new equipment valued at $33,000 and use the 5-year MACRS schedule to depreciate it. It will be worthless at the end of the project. Your current production manager earns $83,000 per year. Since she is busy with ongoing projects, you are planning to hire an assistant at $37,000 per year to help with the expansion. You will have to immediately increase your inventory from $20,000 to $30,000. 18 will retum to $20,000 at the end of the project. Your company's tax rate is 21% and your discount rate is 14.2%. What is the NPV of the contract? (Note: Assume that the equipment is put into use in year 7 .) Calculate the free cash flows below for years 0 through 2: (Round to the nearest dollac) After spending $9,600 on client-development, you have just been offered a big production contract by a new client. The contract will ad each of the next five years and it will cost you $98,000 per year to make the additional product. You will have to use some existing equi well. The existing equipment is fully depreciated, but could be sold for $52,000 now. If you use it in the project, it will be worthless at the new equipment valued at $33,000 and use the 5-year MACRS schedule to depreciate it. It will be worthless at the end of the project. Yo earns $83,000 per year. Since she is busy with ongoing projects, you are planning to hire an assistant at $37,000 per year to help with immediately increase your inventory from $20,000 to $30,000. It will return to $20,000 at the end of the project. Your company's tax rate Calculate the free cash flows below for years 3 throuch 6 : The NPV of the project is : (Round to the nearest dollar.)