Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please download the report from the google. pdf can't attach here. Part II: Public company financials Use EDGAR or another source to obtain the most

Please download the report from the google. pdf can't attach here.

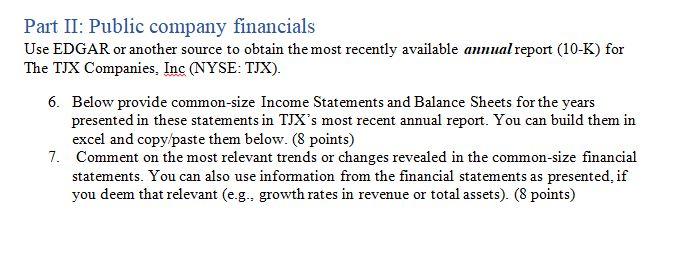

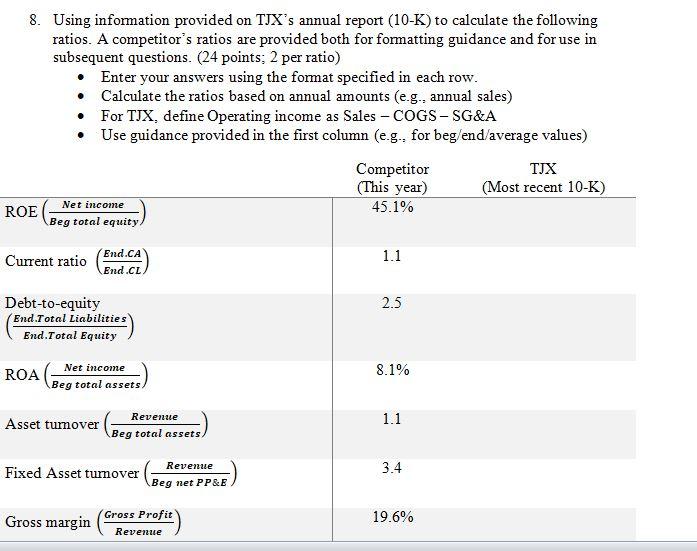

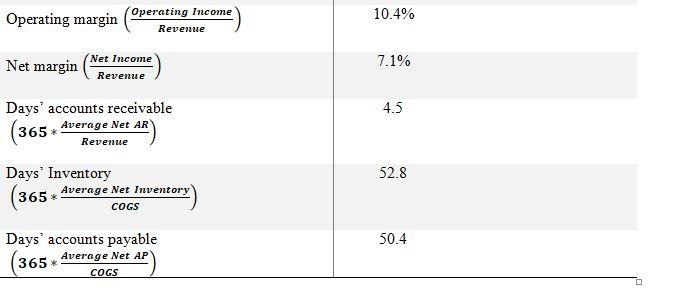

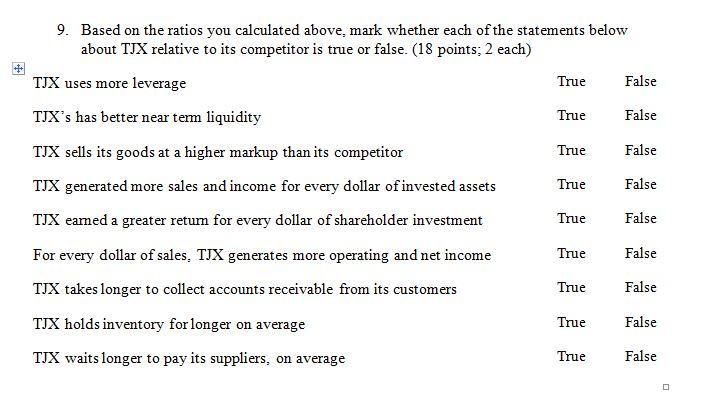

Part II: Public company financials Use EDGAR or another source to obtain the most recently available annual report (10-K) for The TJX Companies, Inc (NYSE: TJX). 6. Below provide common-size Income Statements and Balance Sheets for the years presented in these statements in TJX's most recent annual report. You can build them in excel and copy/paste them below. (8 points) 7. Comment on the most relevant trends or changes revealed in the common-size financial statements. You can also use information from the financial statements as presented, if you deem that relevant (e.g., growth rates in revenue or total assets). ( 8 points) 8. Using information provided on TJX's annual report (10-K) to calculate the following ratios. A competitor's ratios are provided both for formatting guidance and for use in subsequent questions. ( 24 points; 2 per ratio) - Enter your answers using the format specified in each row. - Calculate the ratios based on annual amounts (e.g., annual sales) - For TJX, define Operating income as Sales - COGS-SG\&A - Use guidance provided in the first column (e.g., for beg/end/average values) 9. Based on the ratios you calculated above, mark whether each of the statements below ahout TTX relative to its comnetitnr is the or false (18 nninte. 7 each ) Part II: Public company financials Use EDGAR or another source to obtain the most recently available annual report (10-K) for The TJX Companies, Inc (NYSE: TJX). 6. Below provide common-size Income Statements and Balance Sheets for the years presented in these statements in TJX's most recent annual report. You can build them in excel and copy/paste them below. (8 points) 7. Comment on the most relevant trends or changes revealed in the common-size financial statements. You can also use information from the financial statements as presented, if you deem that relevant (e.g., growth rates in revenue or total assets). ( 8 points) 8. Using information provided on TJX's annual report (10-K) to calculate the following ratios. A competitor's ratios are provided both for formatting guidance and for use in subsequent questions. ( 24 points; 2 per ratio) - Enter your answers using the format specified in each row. - Calculate the ratios based on annual amounts (e.g., annual sales) - For TJX, define Operating income as Sales - COGS-SG\&A - Use guidance provided in the first column (e.g., for beg/end/average values) 9. Based on the ratios you calculated above, mark whether each of the statements below ahout TTX relative to its comnetitnr is the or false (18 nninte. 7 each )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started