Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please draw flow cash The company plans to buy one new machine, where it will take on a 20% loan and 80% of common shares.

please draw flow cash

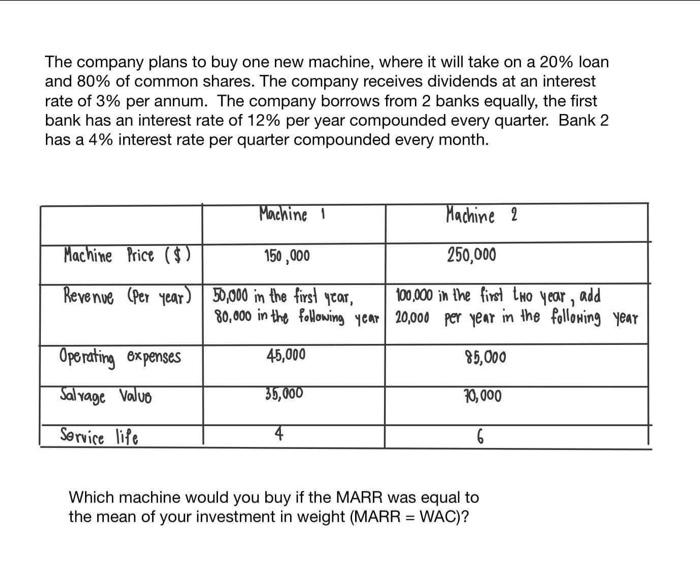

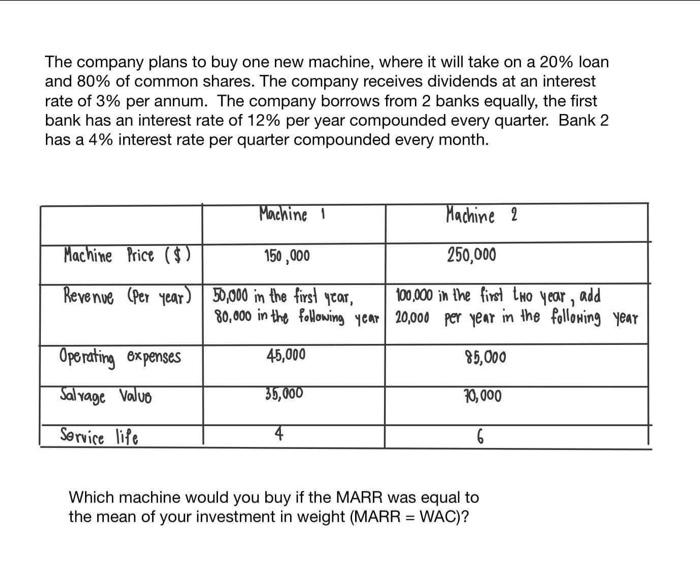

The company plans to buy one new machine, where it will take on a 20% loan and 80% of common shares. The company receives dividends at an interest rate of 3% per annum. The company borrows from 2 banks equally, the first bank has an interest rate of 12% per year compounded every quarter. Bank 2 has a 4% interest rate per quarter compounded every month. Machine 1 Machine 2 Machine Price ($) 150,000 250,000 Revenue (Per year) 50,000 in the first year, 100,000 in the first two year, add 80,000 in the following year 20,000 per year in the following year 45,000 85,000 Operating expenses Salvage Value 35,000 70,000 Service life 4 6 Which machine would you buy if the MARR was equal to the mean of your investment in weight (MARR = WAC)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started