Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please elaborate what more info you need. All info is given and the requirements are at the bottom. Kindly assist. Thank you Question 1 (22

Please elaborate what more info you need. All info is given and the requirements are at the bottom. Kindly assist. Thank you

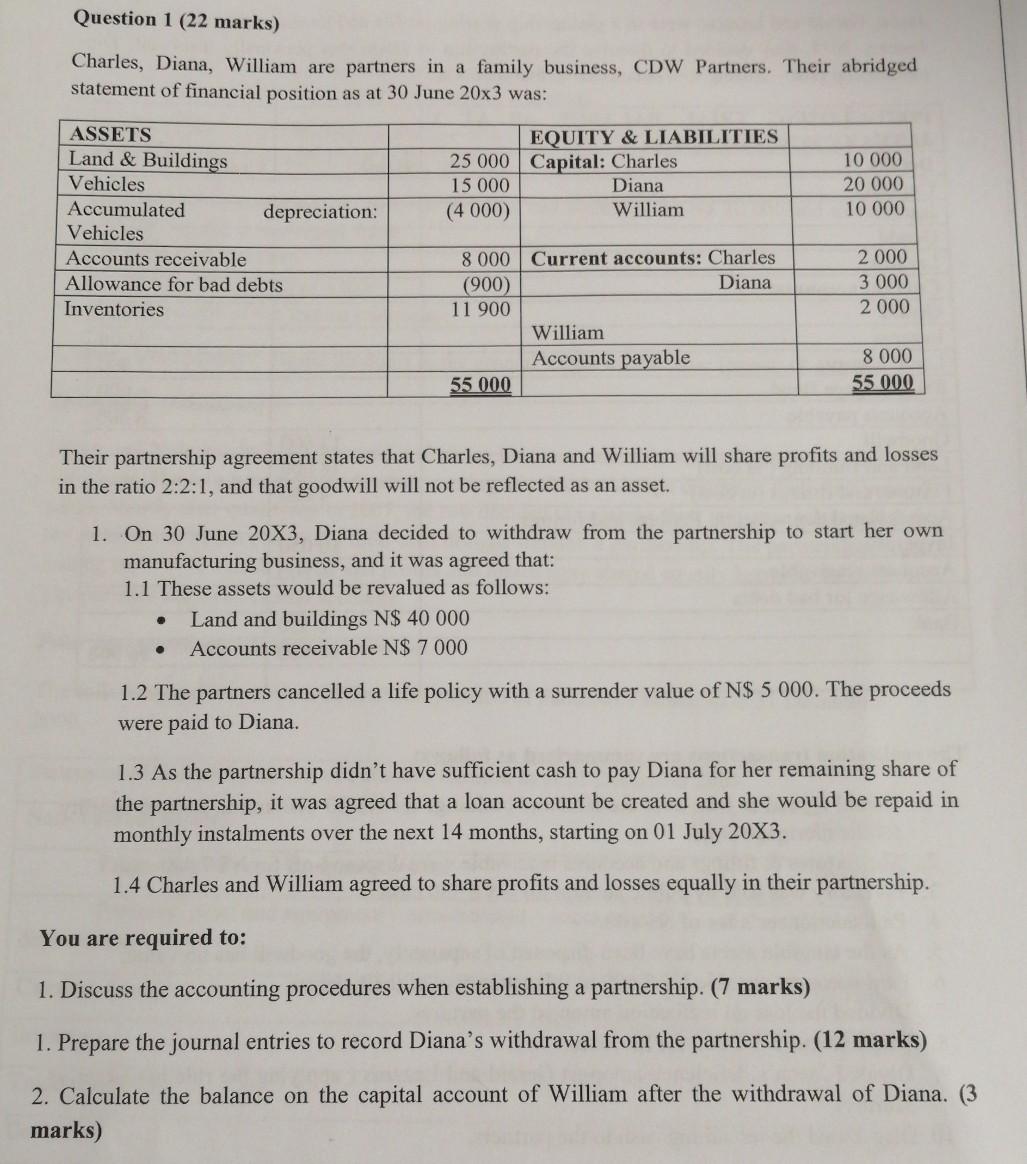

Question 1 (22 marks) Charles, Diana, William are partners in a family business, CDW Partners. Their abridged statement of financial position as at 30 June 20x3 was: EQUITY & LIABILITIES 25 000 Capital: Charles 15 000 Diana (4 000) William 10 000 20 000 10 000 ASSETS Land & Buildings Vehicles Accumulated depreciation: Vehicles Accounts receivable Allowance for bad debts Inventories 2 000 3 000 2000 8 000 Current accounts: Charles (900) Diana 11 900 William Accounts payable 55 000 8 000 55 000 Their partnership agreement states that Charles, Diana and William will share profits and losses in the ratio 2:2:1, and that goodwill will not be reflected as an asset. 1. On 30 June 20X3, Diana decided to withdraw from the partnership to start her own manufacturing business, and it was agreed that: 1.1 These assets would be revalued as follows: Land and buildings N$ 40 000 Accounts receivable N$ 7 000 1.2 The partners cancelled a life policy with a surrender value of N$ 5 000. The proceeds were paid to Diana. 1.3 As the partnership didn't have sufficient cash to pay Diana for her remaining share of the partnership, it was agreed that a loan account be created and she would be repaid in monthly instalments over the next 14 months, starting on 01 July 20X3. 1.4 Charles and William agreed to share profits and losses equally in their partnership. You are required to: 1. Discuss the accounting procedures when establishing a partnership. (7 marks) 1. Prepare the journal entries to record Diana's withdrawal from the partnership. (12 marks) 2. Calculate the balance on the capital account of William after the withdrawal of Diana. (3 marks) Question 1 (22 marks) Charles, Diana, William are partners in a family business, CDW Partners. Their abridged statement of financial position as at 30 June 20x3 was: EQUITY & LIABILITIES 25 000 Capital: Charles 15 000 Diana (4 000) William 10 000 20 000 10 000 ASSETS Land & Buildings Vehicles Accumulated depreciation: Vehicles Accounts receivable Allowance for bad debts Inventories 2 000 3 000 2000 8 000 Current accounts: Charles (900) Diana 11 900 William Accounts payable 55 000 8 000 55 000 Their partnership agreement states that Charles, Diana and William will share profits and losses in the ratio 2:2:1, and that goodwill will not be reflected as an asset. 1. On 30 June 20X3, Diana decided to withdraw from the partnership to start her own manufacturing business, and it was agreed that: 1.1 These assets would be revalued as follows: Land and buildings N$ 40 000 Accounts receivable N$ 7 000 1.2 The partners cancelled a life policy with a surrender value of N$ 5 000. The proceeds were paid to Diana. 1.3 As the partnership didn't have sufficient cash to pay Diana for her remaining share of the partnership, it was agreed that a loan account be created and she would be repaid in monthly instalments over the next 14 months, starting on 01 July 20X3. 1.4 Charles and William agreed to share profits and losses equally in their partnership. You are required to: 1. Discuss the accounting procedures when establishing a partnership. (7 marks) 1. Prepare the journal entries to record Diana's withdrawal from the partnership. (12 marks) 2. Calculate the balance on the capital account of William after the withdrawal of DianaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started