Answered step by step

Verified Expert Solution

Question

1 Approved Answer

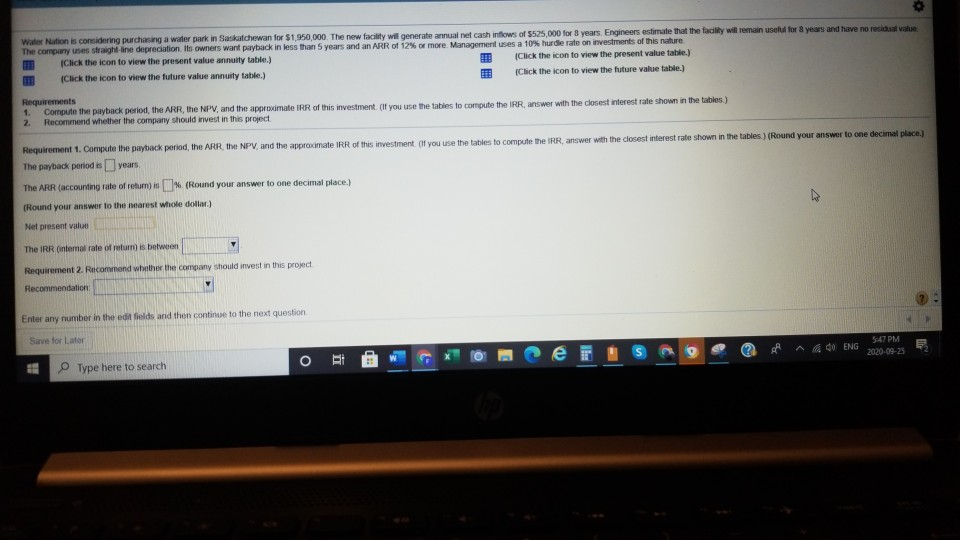

please enlarge to view. Water Nation is considering purchasing a waterpark in Saskatchewan for $1,950,000. The new facility wil generate annual net cash inflows of

please enlarge to view.

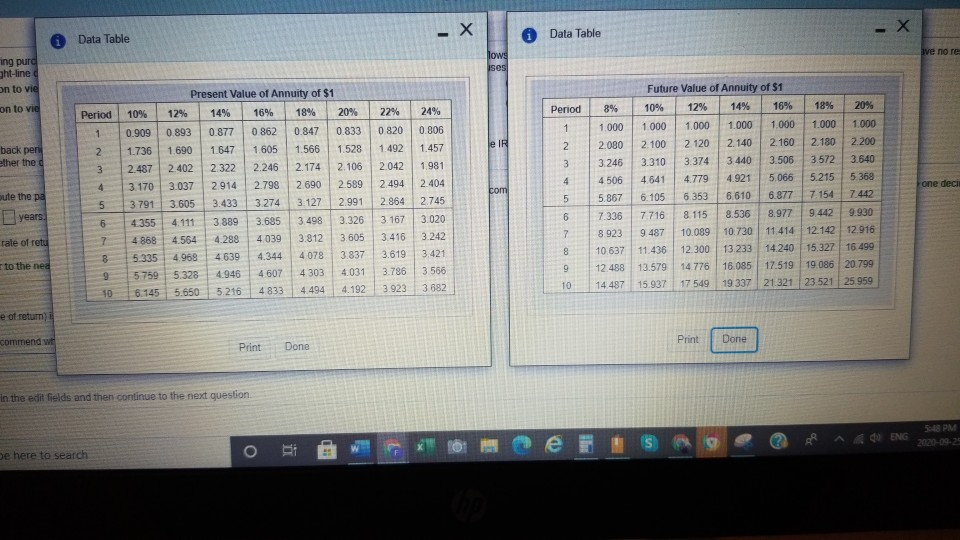

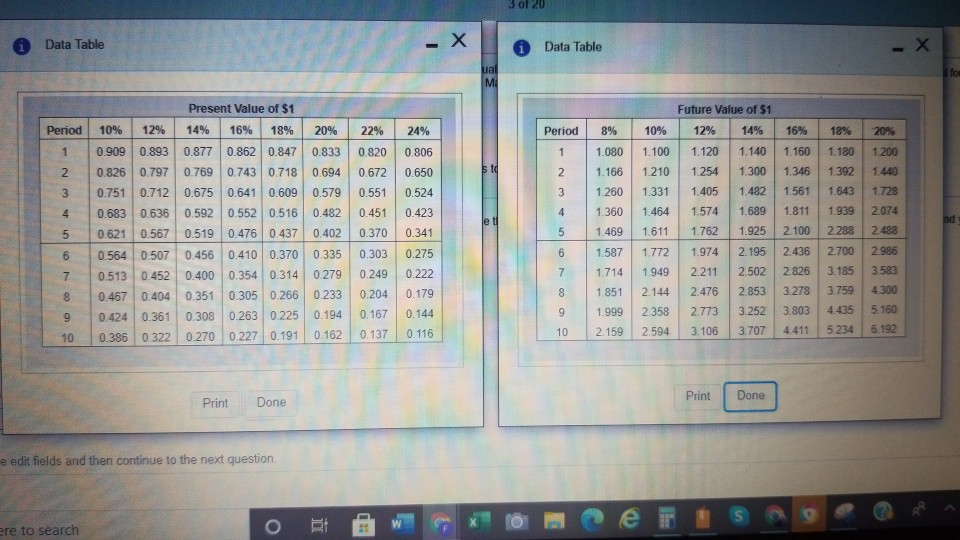

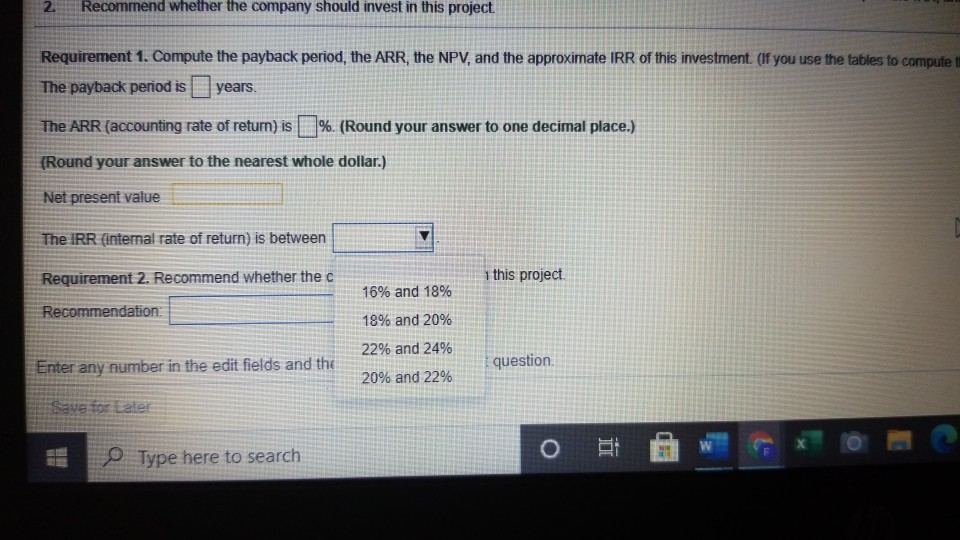

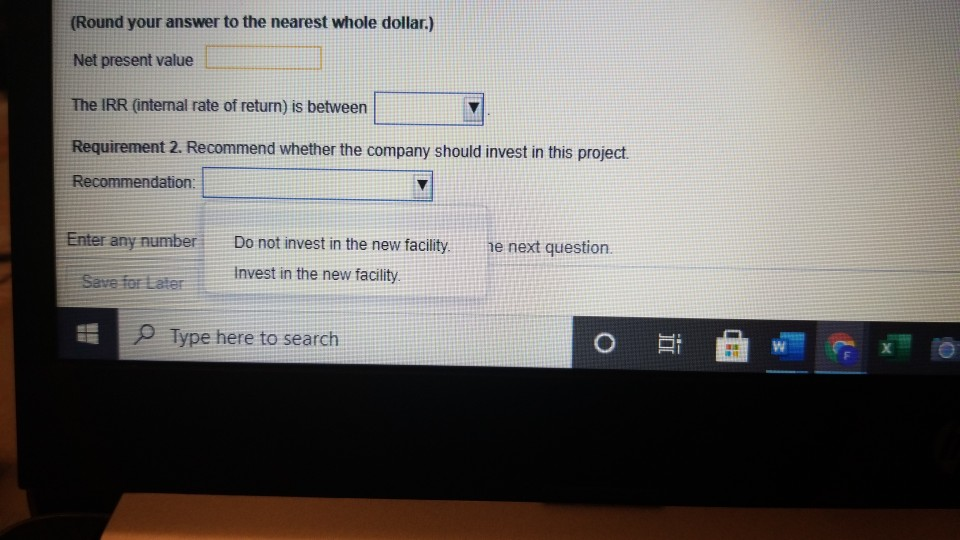

Water Nation is considering purchasing a waterpark in Saskatchewan for $1,950,000. The new facility wil generate annual net cash inflows of 5525,000 for 3 years. Engineers estimate that the facility will remain useful for years and have no residual value. The company uses straight-line depreciation. Ils owners want payback in less than 5 years and an ARR of 12% or more Management uses a 10% hurdle rate on investments of this nature (Click the icon to view the present value annuity table.) Click the icon to view the present value table.) Click the icon to view the future value annuity table.) (Click the icon to view the future value table.) Requirements 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of this investment (if you use the tables to compute the IRR answer with the closest interest rate shown in the tables.) 2 Recommend whether the company should invest in this project Requirement 1. Compute the payback period, the ARR, the NPV and the approximate IRR of this investment. If you use the tables to compute the IRR answer with the closest interest rate shown in the tables) (Round your answer to one decimal place.) The payback period is years The ARR (accounting rate of retum) %(Round your answer to one decimal place.) (Round your answer to the rest wiele dollar) Net present value The IRR (intemal rate of return) is between Requirement 2. Recommend whether the company should invest in this project Recommendation Enter any number in the edit fields and then continue to the next question Save for Later e A 400 ENG 5:47 PM 2020-09-23 o i Type here to search - X - X Data Table Data Table sve no re lows ises ing puro ght-line on to vie on to vie Period 10% 8% 22% 24% Period 1 1.000 1 0.909 0 820 1.492 le IR 2 2 back per ether the 3 1.736 2.487 3.170 3791 3 2.080 3.246 4.506 2.042 2.494 4 4 one deci com Present Value of Annuity of $1 12% 14% 16% 18% 20% 0.893 0.877 0 862 0.847 0.833 1.690 1.647 1.605 1.566 1.528 2.402 2.322 2.246 2.174 2.106 3.037 2.914 2.798 2.690 2.589 3.605 3.433 3.274 3.127 2.991 4.111 3.889 3.685 3.498 3.326 4.564 4.288 4039 3.812 3.605 4.968 4.639 4.344 4.078 3.837 5.328 4.946 4607 4303 4.031 5.650 5.216 4833 4.494 4.192 Future Value of Annuity of $1 10% 12% 14% 16% 18% 20% 1.000 1.000 1.000 1.000 1.000 1.000 2.100 2120 2.140 2.160 2.180 2.200 3.310 3.374 3.440 3.506 3.572 3.640 4.641 4.779 4.921 5.066 5.215 5.368 6.105 6.353 6.610 6.877 7.154 7.442 7.716 8 115 8.536 8.977 9.442 9.930 9.487 10.089 10.730 11.414 12.142 12.916 11.436 12.300 13 233 14.240 15.327 16.499 13.579 14776 16.085 17.519 19.086 20.799 15.937 17 549 19.337 21.321 23.521 25 959 ule the pa 5 5.867 ch 0.806 1.457 1.981 2.404 2.745 3.020 3.242 3.421 3566 3.682 years 6 6 2.864 3.167 3.416 3.619 3.786 7 rate of retu 7 4.355 4 868 5.335 5759 6.145 7.336 8.923 10.637 12.488 14.487 8 9 000 to the nea 10 10 3.923 e of return) commend with Print Done Print Done In the edit fields and then continue to the next question CD BP ENG 5:48 PM 2020-09-2 be here to search 3 of 20 Data Table -X Data Table - X ua M . for Present Value of $1 Future Value of $1 Period 20% 22% 24% Period 8% 10% 12% 14% 16% 18% 20% 1 0.833 1 1.080 0.820 0.672 0.551 1.100 1.210 1.140 1.300 1.160 1.346 2 2 0.806 0.650 0.524 0.423 1.120 1.254 1.405 1.574 3 1.180 1.392 1.643 1.939 3 1.166 1.260 1.360 3 0.694 0.579 0.482 0.402 1.331 1.482 1.561 4 4 1.689 1.811 0.451 0.370 let nd 10% 12% 14% 16% 18% 0.909 0.893 0.877 0.862 0.847 0.826 0.797 0.769 0.743 0.718 0.751 0.712 0.675 0.641 0.609 0.683 0.636 0.592 0.552 0.516 0.621 0.567 0.519 0.476 0.437 0.564 0.507 0.456 0.410 0.370 0.513 0.452 0.400 0.354 0.314 0.467 0.404 0.351 0.305 0.266 0.424 0.361 0.308 0.263 0.225 0.386 0.322 0.270 0.227 0.191 1.200 1440 1728 2074 2.488 2.986 3.583 1.464 1.611 5 5 0.341 5 1.469 1.762 1.925 2.100 6 0.335 6 1.772 2.195 2.436 0.303 0.249 0.275 0.222 0.179 7 7 1.587 1.714 1.851 1.949 2.826 1.974 2.211 2.476 2.773 2.288 2.700 3.185 3.759 4.435 0.204 8 0.279 0.233 0.194 0.162 2.144 000) 2.502 2.853 3.252 3.707 3.278 3.803 0.144 9 1.999 2.358 0.167 0.137 4.300 5.160 6.192 10 0.116 2.159 2.594 3.106 4.411 10 5234 Print Done Print Done e edit fields and then continue to the next question o Bi 01: ere to search e 2. Recommend whether the company should invest in this project. Requirement 1. Compute the payback period, the ARR, the NPV, and the approximate IRR of this investment. (If you use the tables to compute The payback period is years. The ARR (accounting rate of return) is %. (Round your answer to one decimal place.) (Round your answer to the nearest whole dollar.) Net present value The IRR (internal rate of return) is between Requirement 2. Recommend whether the c 1 this project Recommendation: 16% and 18% 18% and 20% 22% and 24% Enter any number in the edit fields and the question 20% and 22% Save for taler JITE O F Type here to search (Round your answer to the nearest whole dollar.) Net present value The IRR (internal rate of return) is between Requirement 2. Recommend whether the company should invest in this project. Recommendation: Enter any number Do not invest in the new facility. Invest in the new facility ne next question Save for Later Type here to search HE w

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started