Please enter all the multiple choice answers

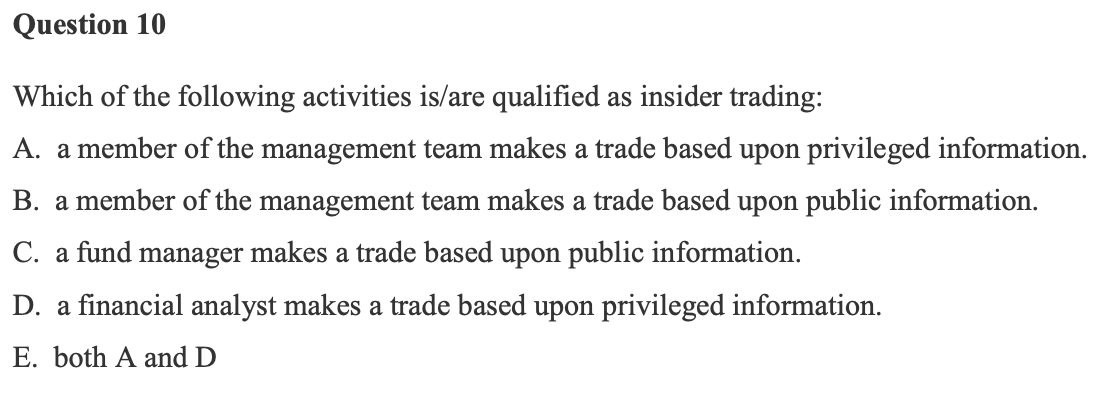

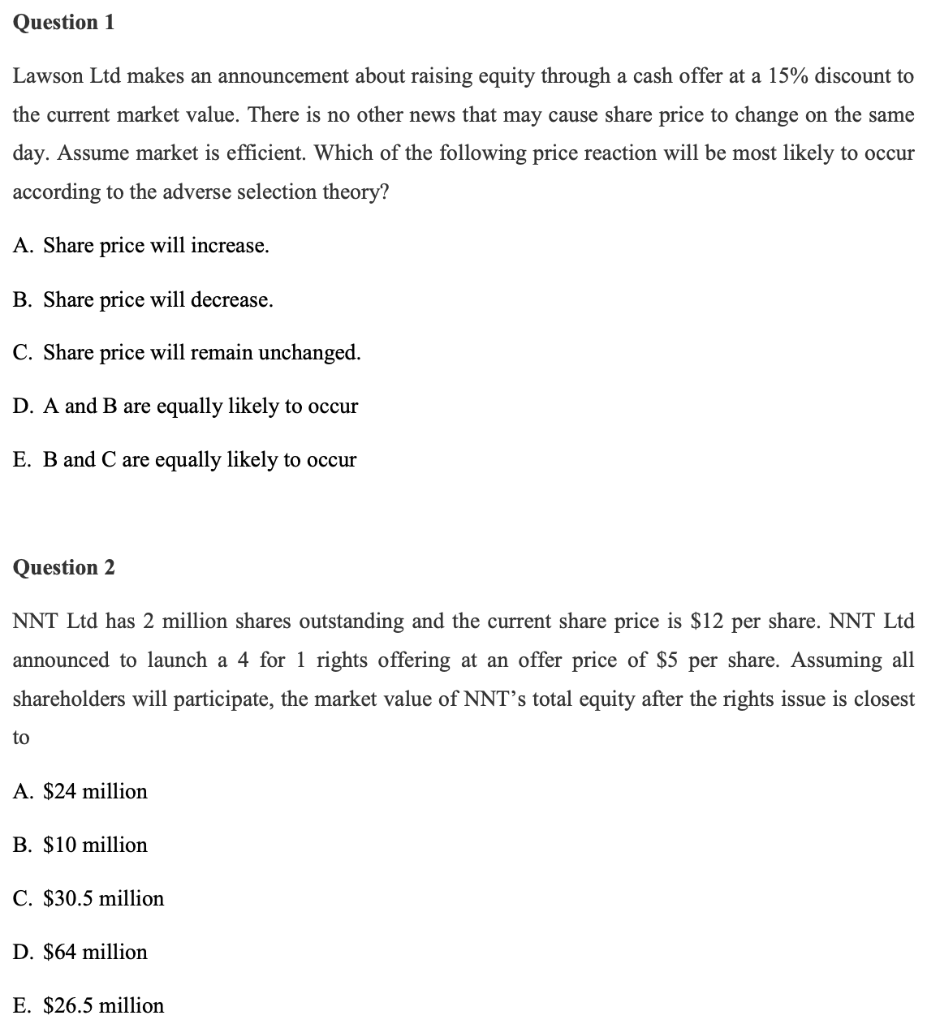

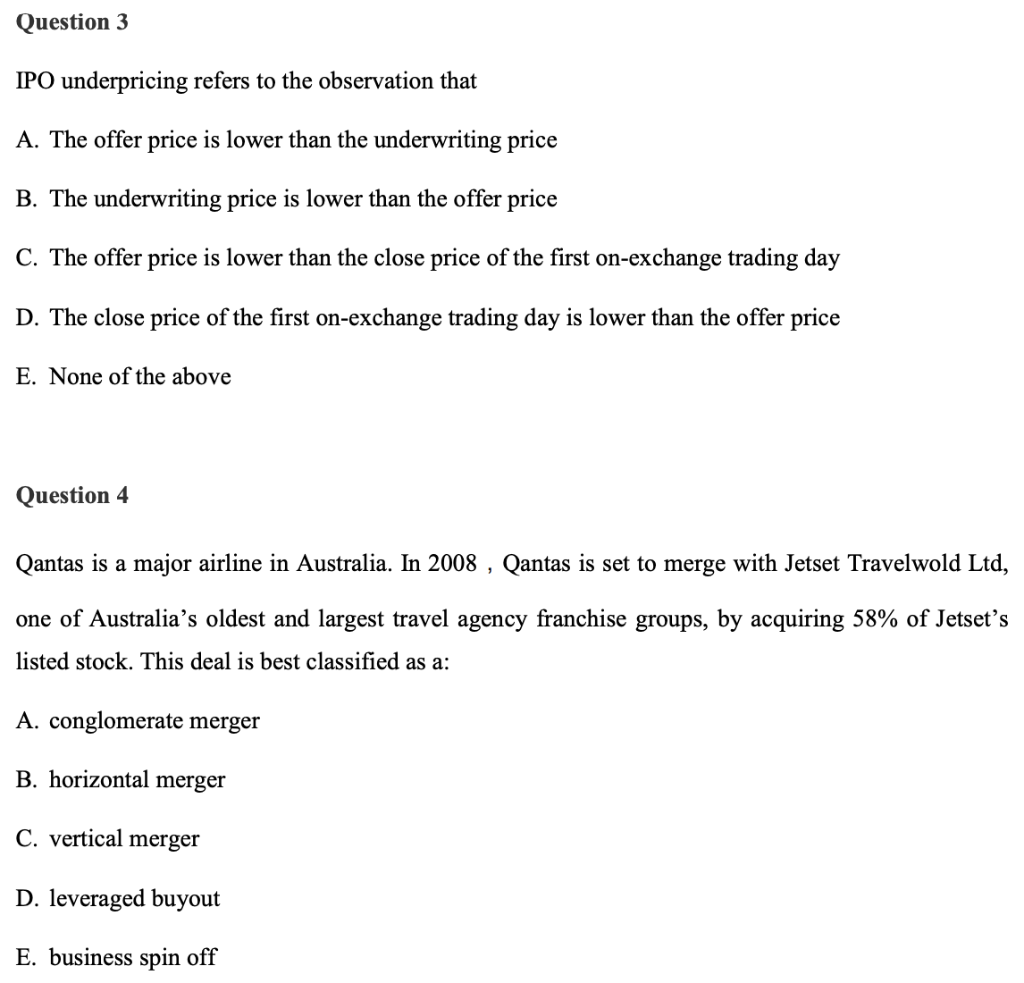

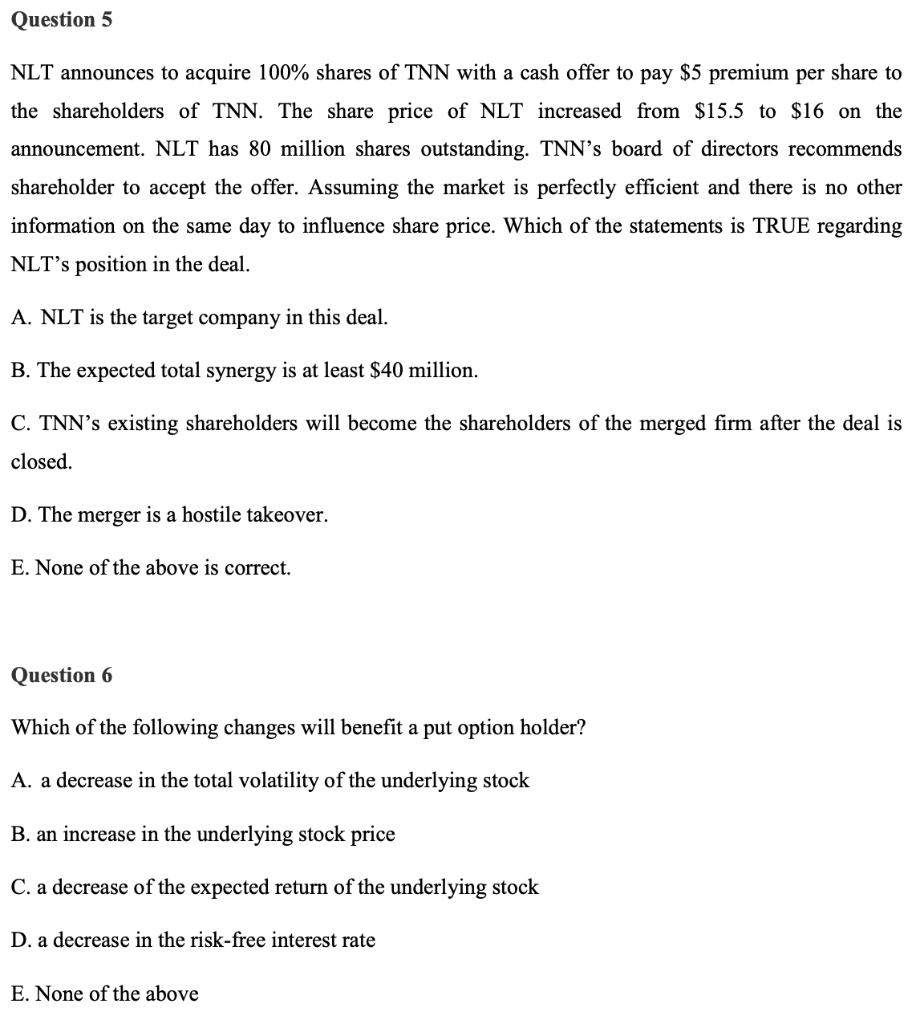

Question 1 Lawson Ltd makes an announcement about raising equity through a cash offer at a 15% discount to the current market value. There is no other news that may cause share price to change on the same day. Assume market is efficient. Which of the following price reaction will be most likely to occur according to the adverse selection theory? A. Share price will increase. B. Share price will decrease. C. Share price will remain unchanged. D. A and B are equally likely to occur E. B and C are equally likely to occur Question 2 NNT Ltd has 2 million shares outstanding and the current share price is $12 per share. NNT Ltd announced to launch a 4 for 1 rights offering at an offer price of $5 per share. Assuming all shareholders will participate, the market value of NNT's total equity after the rights issue is closest to A. $24 million B. $10 million C. $30.5 million D. $64 million E. $26.5 million Question 3 IPO underpricing refers to the observation that A. The offer price is lower than the underwriting price B. The underwriting price is lower than the offer price C. The offer price is lower than the close price of the first on-exchange trading day D. The close price of the first on-exchange trading day is lower than the offer price E. None of the above Question 4 Qantas is a major airline in Australia. In 2008 , Qantas is set to merge with Jetset Travelwold Ltd, one of Australia's oldest and largest travel agency franchise groups, by acquiring 58% of Jetset's listed stock. This deal is best classified as a: A. conglomerate merger B. horizontal merger C. vertical merger D. leveraged buyout E. business spin off Question 5 NLT announces to acquire 100% shares of TNN with a cash offer to pay $5 premium per share to the shareholders of TNN. The share price of NLT increased from $15.5 to $16 on the announcement. NLT has 80 million shares outstanding. TNN's board of directors recommends shareholder to accept the offer. Assuming the market is perfectly efficient and there is no other information on the same day to influence share price. Which of the statements is TRUE regarding NLT's position in the deal. A. NLT is the target company in this deal. B. The expected total synergy is at least $40 million. C. TNN's existing shareholders will become the shareholders of the merged firm after the deal is closed. D. The merger is a hostile takeover. E. None of the above is correct. Question 6 Which of the following changes will benefit a put option holder? A. a decrease in the total volatility of the underlying stock B. an increase in the underlying stock price C. a decrease of the expected return of the underlying stock D. a decrease in the risk-free interest rate E. None of the above Question 7 A board of directors is said to be captured when: A. a majority of the directors are independent directors. B. a majority of the directors are outside directors. C. its monitoring duties have been compromised by connections or perceived loyalties to management. D. when the CEO also serves as chairman of the board of directors. E. None of the above is correct. Question 8 Directors who are not employees, former employees, or family members of employees and who do not have existing or potential business relationships with the firm are called: A. monitoring directors. B. independent directors. C. grey directors. D. inside directors. E. executive directors Question 9 Which of the following is NOT a direct action that can be taken by shareholders? A. Voting to the management team B. Submitting shareholder resolutions directing the board to take specific actions C. Accepting the tender offer place by a bidder D. Withholding votes for the board of directors candidates E. Initiating a proxy contest Question 10 Which of the following activities is/are qualified as insider trading: A. a member of the management team makes a trade based upon privileged information. B. a member of the management team makes a trade based upon public information. C. a fund manager makes a trade based upon public information. D. a financial analyst makes a trade based upon privileged information. E. both A and D