Answered step by step

Verified Expert Solution

Question

1 Approved Answer

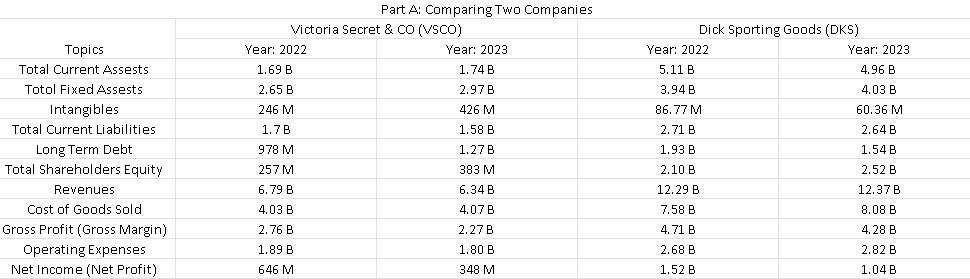

Please enter on your spreadsheet, the following information for your company, and the competitor selected, for the most recent 2 years. A . Using the

Please enter on your spreadsheet, the following information for your company, and the competitor selected, for the most recent years.

A Using the Financials option on the menu, and then the Income Statement and Balance Sheet options which then appear below the top menu:

a Total Current Assets

b Total Fixed Assets

c Intangibles

d Total Current Liabilities

e Long Term Debt

f Total Shareholders Equity

g Revenues

h Cost of Goods Sold

i Gross Profit also referred to as Gross Margin

j Operating Expenses

k Net Income also referred to as Net Profit

B As mentioned above or by calculating from the financial statements for your companies enter the following financial ratios, for your company and its competitor for the past years.

a Current Ratio

b Leverage Ratio financial leverage

c Gross Profit Gross Margin on the site

d Return on Equity

e Return on Assets

f Return on Sales Operating Margin

g Asset Turnover

h Inventory Turnover

C Analyze the profitability of your two companies:

a Which company showed the greatest improvement or least decrease in profitability as measured by ROA?

b Which company showed the greatest improvement or least decrease in profitability as measured by ROE?

c Are your answers for a and b different?

d If yes, why?

D Analyze the productivity of your two companies:

a Which company showed the greatest improvement or least decrease in productivity as measured by Asset Turnover?

b Based on the available information what would you say was the biggest cause of this increase or lesser amount of decrease in productivity?

E Estimate Cost Structure of the companies. Use the ratio of current assets to total assets as an estimate of the cost structure.

i Which company has a higher fixed cost structure?

j In this exercise, do you think that the current ratio is a reasonable representation of the relative cost structure of your two companies? Hint: This would depend on the nature of the noncurrent assets of your companies.

k Is the yeartoyear change over the past years, in the same direction for the companies?

l Given the relative cost structures of the two companies, and the change in sales for the companies, what would you have expected for the change in Gross Profit? An increase? Decrease? Why?Part A: Comparing Two Companies

tableTopicsVictoria Secret & CO VSCODick Sporting Goods DKSYear: Year: Year: Year: Total Current Assests,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started