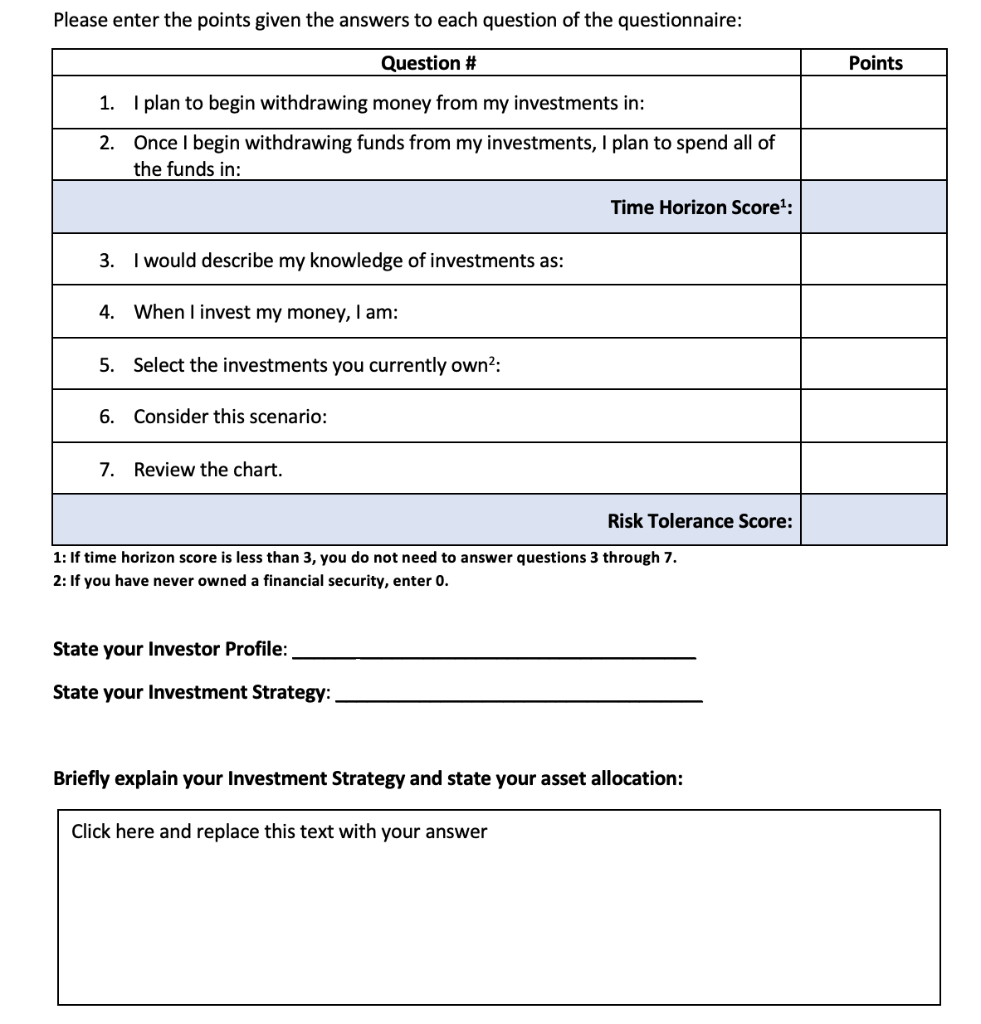

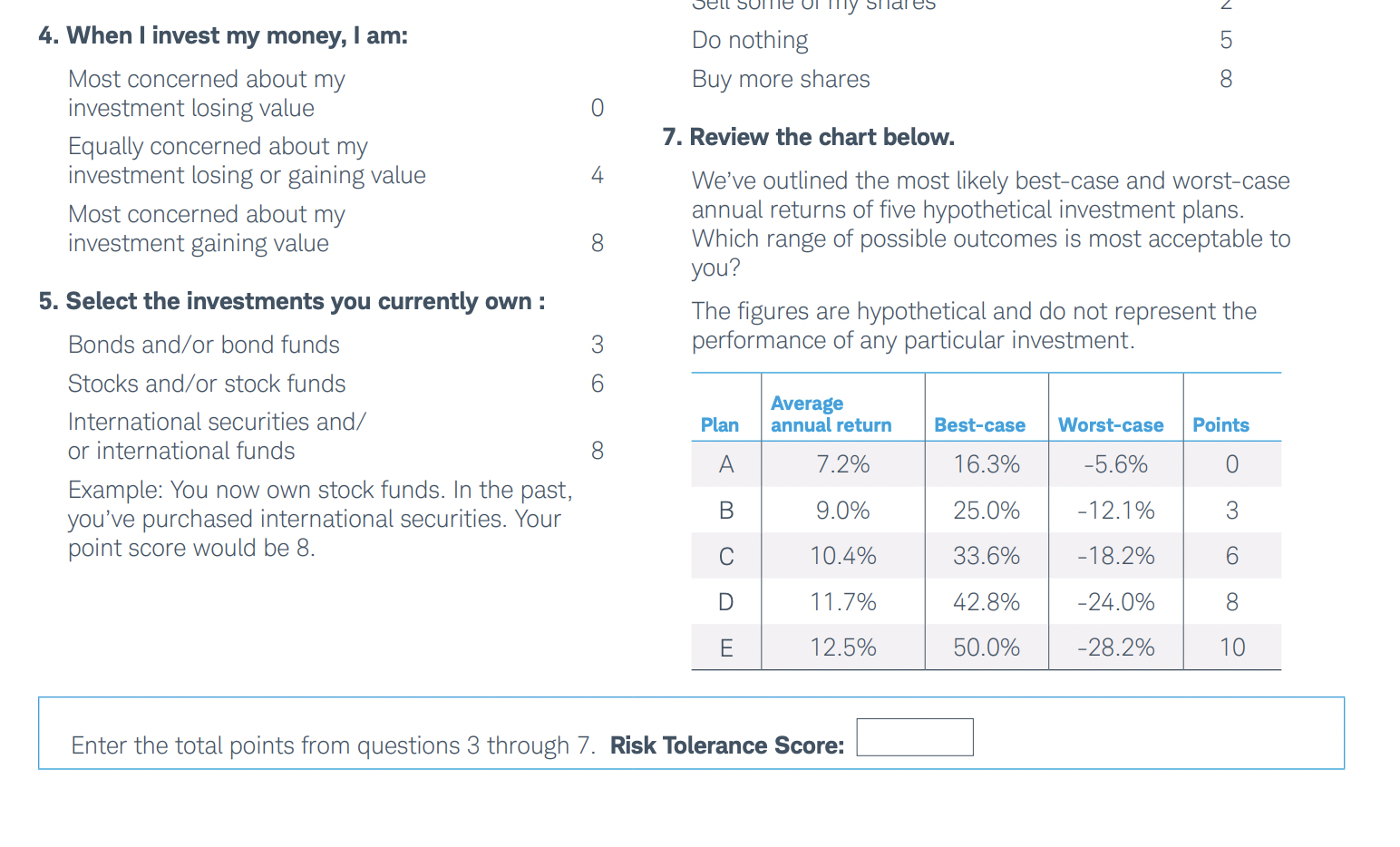

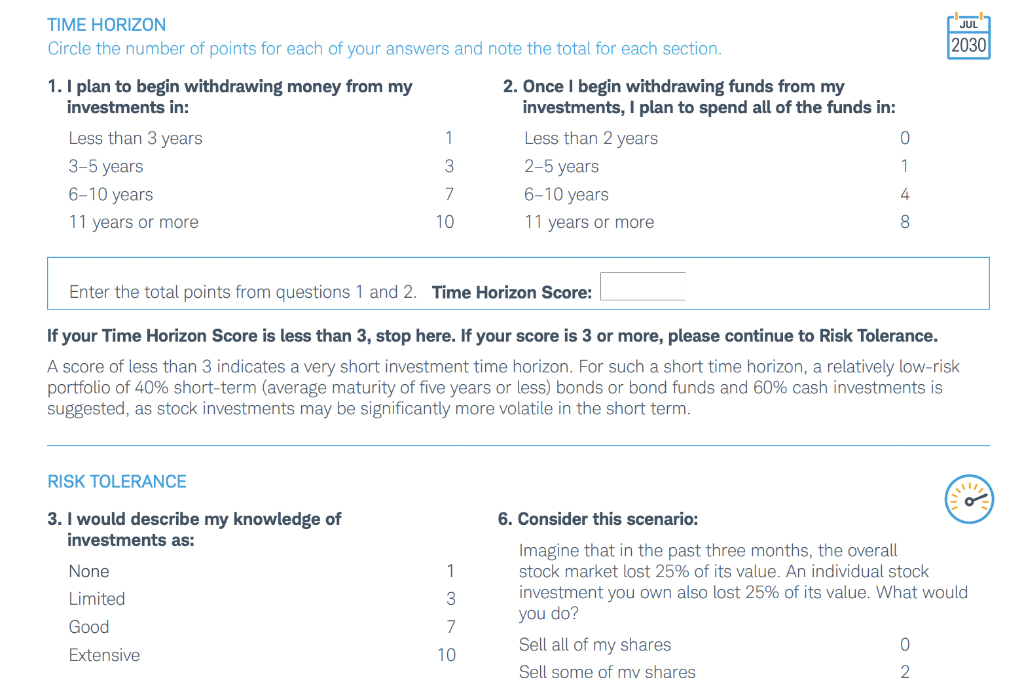

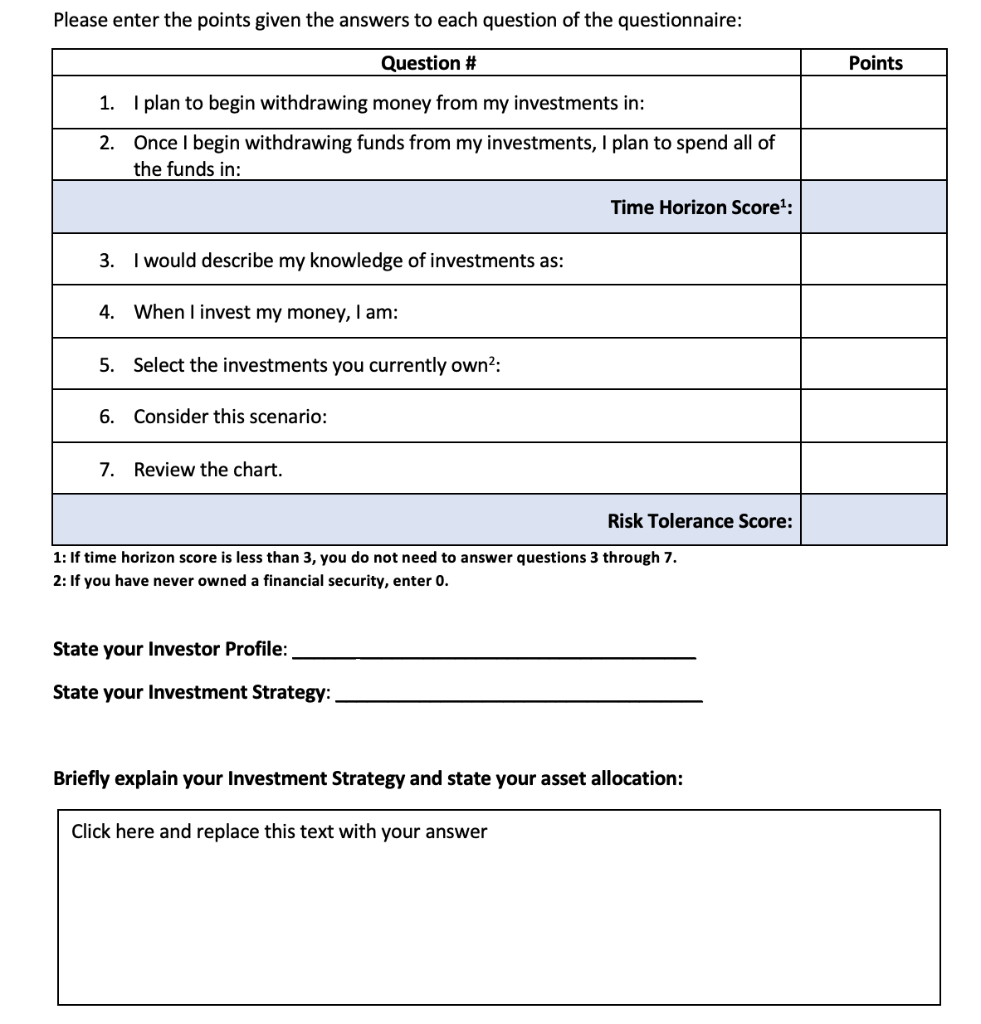

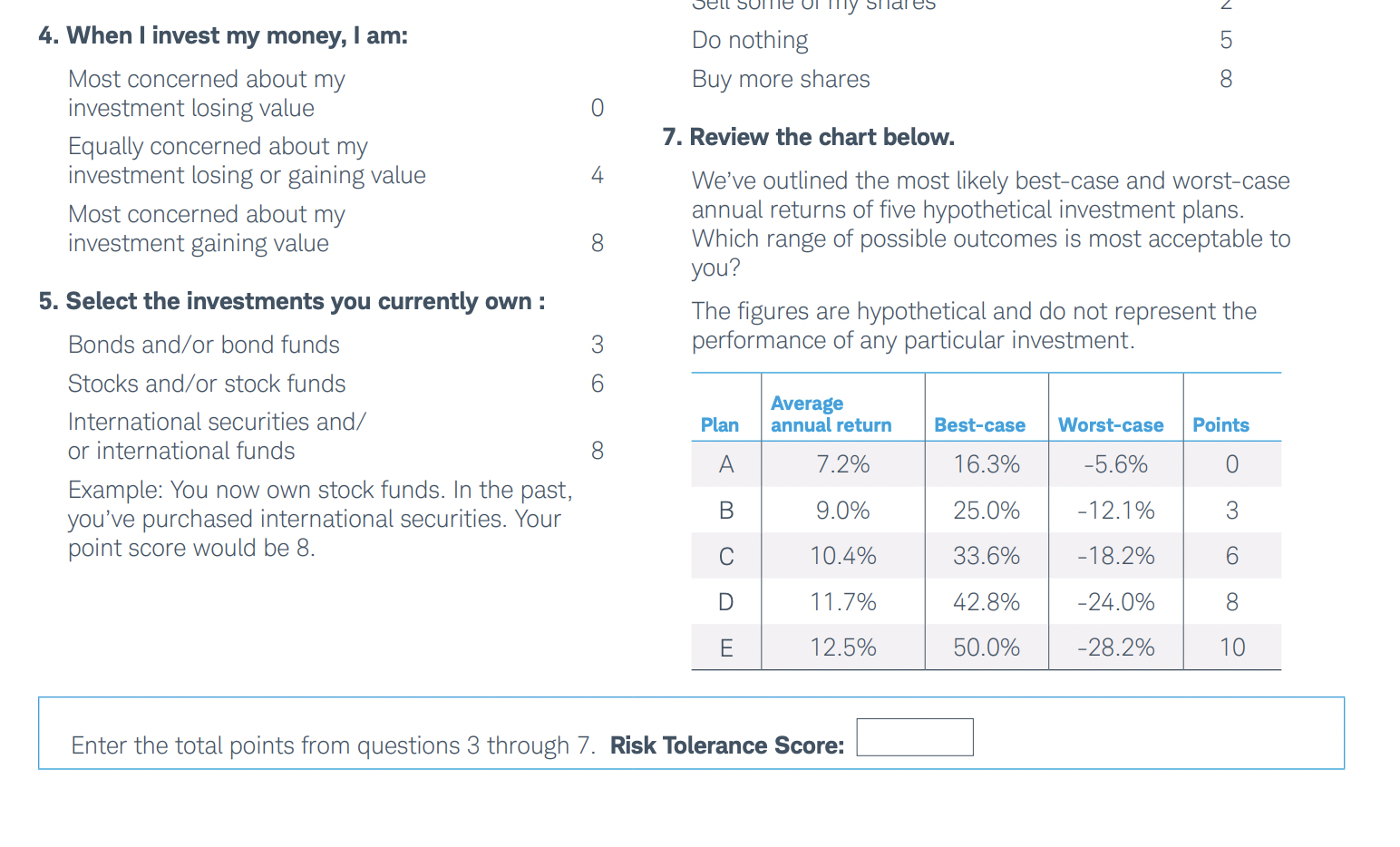

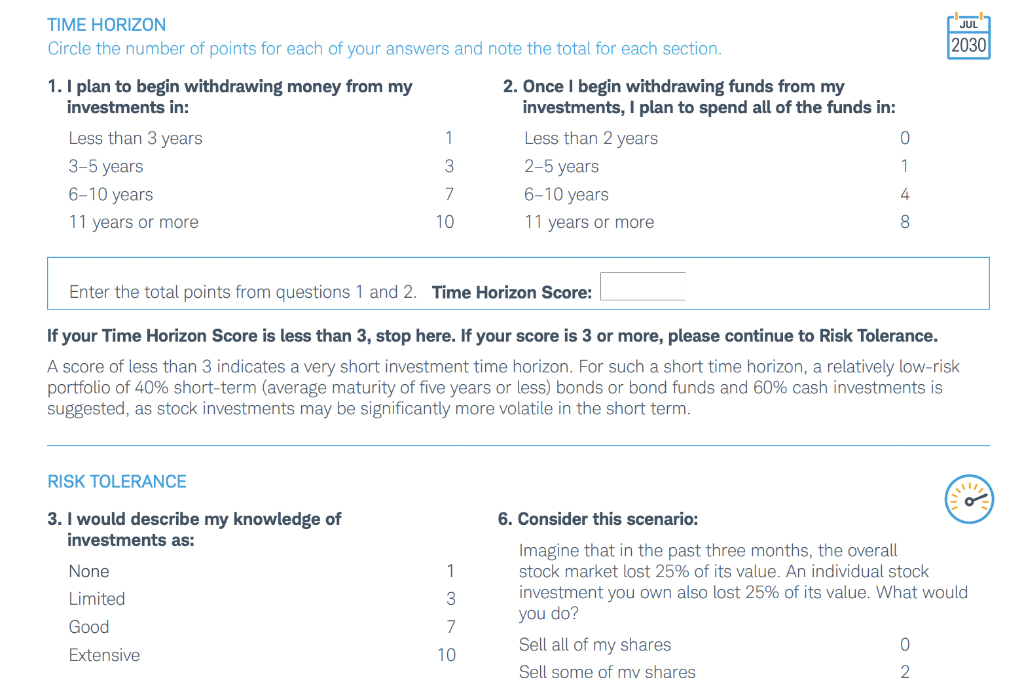

Please enter the points given the answers to each question of the questionnaire: Question # Points 1. I plan to begin withdrawing money from my investments in: 2. Once I begin withdrawing funds from my investments, I plan to spend all of the funds in: Time Horizon Score: 3. I would describe my knowledge of investments as: 4. When I invest my money, I am: 5. Select the investments you currently own2: 6. Consider this scenario: 7. Review the chart. Risk Tolerance Score: 1: If time horizon score is less than 3, you do not need to answer questions 3 through 7. 2: If you have never owned a financial security, enter 0. State your Investor Profile: State your Investment Strategy: Briefly explain your Investment Strategy and state your asset allocation: Click here and replace this text with your answer Idles Do nothing Buy more shares 00 07 N 5 8 O 4. When I invest my money, I am: Most concerned about my investment losing value Equally concerned about my investment losing or gaining value Most concerned about my investment gaining value 7. Review the chart below. 4 8 We've outlined the most likely best-case and worst-case annual returns of five hypothetical investment plans. Which range of possible outcomes is most acceptable to you? The figures are hypothetical and do not represent the performance of any particular investment. 3 6 5. Select the investments you currently own : Bonds and/or bond funds Stocks and/or stock funds International securities and/ or international funds Example: You now own stock funds. In the past, you've purchased international securities. Your point score would be 8. Average annual return Plan Best-case Worst-case Points 8 A 7.2% 16.3% -5.6% 0 B 9.0% 25.0% -12.1% 3 10.4% 33.6% -18.2% 6 D 11.7% 42.8% -24.0% 8 00 E 12.5% 50.0% -28.2% 10 Enter the total points from questions 3 through 7. Risk Tolerance Score: JUL TIME HORIZON Circle the number of points for each of your answers and note the total for each section. 2030 1 1. I plan to begin withdrawing money from my investments in: Less than 3 years 3-5 years 6-10 years 11 years or more 2. Once I begin withdrawing funds from my investments, I plan to spend all of the funds in: Less than 2 years 0 2-5 years 1 6-10 years 4 8 11 years or more 3 7 10 Enter the total points from questions 1 and 2. Time Horizon Score: If your Time Horizon Score is less than 3, stop here. If your score is 3 or more, please continue to Risk Tolerance. A score of less than 3 indicates a very short investment time horizon. For such a short time horizon, a relatively low-risk portfolio of 40% short-term (average maturity of five years or less) bonds or bond funds and 60% cash investments is suggested, as stock investments may be significantly more volatile in the short term. RISK TOLERANCE 6. Consider this scenario: 3. I would describe my knowledge of investments as: None 1 Imagine that in the past three months, the overall stock market lost 25% of its value. An individual stock investment you own also lost 25% of its value. What would 3 Limited Good you do? 7 10 0 Extensive Sell all of my shares Sell some of my shares 2 Find a suitable investment strategy Your investing strategy should reflect the kind of investor you are-your personal investor profile. This quiz will help you determine your profile and then match it to an investment strategy that's designed for investors like you. The quiz measures two key factors: YOUR TIME HORIZON When will you begin withdrawing money from your account and at what rate? If it's many years away, there may be more time to weather the market's inevitable ups and downs and you may be comfortable with a portfolio that has a greater potential for appreciation and a higher level of risk. YOUR RISK TOLERANCE How do you feel about risk? Some investments fluctuate more dramatically in value than others but may have the potential for higher returns. It's important to select investments that fit within your level of tolerance for this risk Please enter the points given the answers to each question of the questionnaire: Question # Points 1. I plan to begin withdrawing money from my investments in: 2. Once I begin withdrawing funds from my investments, I plan to spend all of the funds in: Time Horizon Score: 3. I would describe my knowledge of investments as: 4. When I invest my money, I am: 5. Select the investments you currently own2: 6. Consider this scenario: 7. Review the chart. Risk Tolerance Score: 1: If time horizon score is less than 3, you do not need to answer questions 3 through 7. 2: If you have never owned a financial security, enter 0. State your Investor Profile: State your Investment Strategy: Briefly explain your Investment Strategy and state your asset allocation: Click here and replace this text with your answer Idles Do nothing Buy more shares 00 07 N 5 8 O 4. When I invest my money, I am: Most concerned about my investment losing value Equally concerned about my investment losing or gaining value Most concerned about my investment gaining value 7. Review the chart below. 4 8 We've outlined the most likely best-case and worst-case annual returns of five hypothetical investment plans. Which range of possible outcomes is most acceptable to you? The figures are hypothetical and do not represent the performance of any particular investment. 3 6 5. Select the investments you currently own : Bonds and/or bond funds Stocks and/or stock funds International securities and/ or international funds Example: You now own stock funds. In the past, you've purchased international securities. Your point score would be 8. Average annual return Plan Best-case Worst-case Points 8 A 7.2% 16.3% -5.6% 0 B 9.0% 25.0% -12.1% 3 10.4% 33.6% -18.2% 6 D 11.7% 42.8% -24.0% 8 00 E 12.5% 50.0% -28.2% 10 Enter the total points from questions 3 through 7. Risk Tolerance Score: JUL TIME HORIZON Circle the number of points for each of your answers and note the total for each section. 2030 1 1. I plan to begin withdrawing money from my investments in: Less than 3 years 3-5 years 6-10 years 11 years or more 2. Once I begin withdrawing funds from my investments, I plan to spend all of the funds in: Less than 2 years 0 2-5 years 1 6-10 years 4 8 11 years or more 3 7 10 Enter the total points from questions 1 and 2. Time Horizon Score: If your Time Horizon Score is less than 3, stop here. If your score is 3 or more, please continue to Risk Tolerance. A score of less than 3 indicates a very short investment time horizon. For such a short time horizon, a relatively low-risk portfolio of 40% short-term (average maturity of five years or less) bonds or bond funds and 60% cash investments is suggested, as stock investments may be significantly more volatile in the short term. RISK TOLERANCE 6. Consider this scenario: 3. I would describe my knowledge of investments as: None 1 Imagine that in the past three months, the overall stock market lost 25% of its value. An individual stock investment you own also lost 25% of its value. What would 3 Limited Good you do? 7 10 0 Extensive Sell all of my shares Sell some of my shares 2 Find a suitable investment strategy Your investing strategy should reflect the kind of investor you are-your personal investor profile. This quiz will help you determine your profile and then match it to an investment strategy that's designed for investors like you. The quiz measures two key factors: YOUR TIME HORIZON When will you begin withdrawing money from your account and at what rate? If it's many years away, there may be more time to weather the market's inevitable ups and downs and you may be comfortable with a portfolio that has a greater potential for appreciation and a higher level of risk. YOUR RISK TOLERANCE How do you feel about risk? Some investments fluctuate more dramatically in value than others but may have the potential for higher returns. It's important to select investments that fit within your level of tolerance for this risk