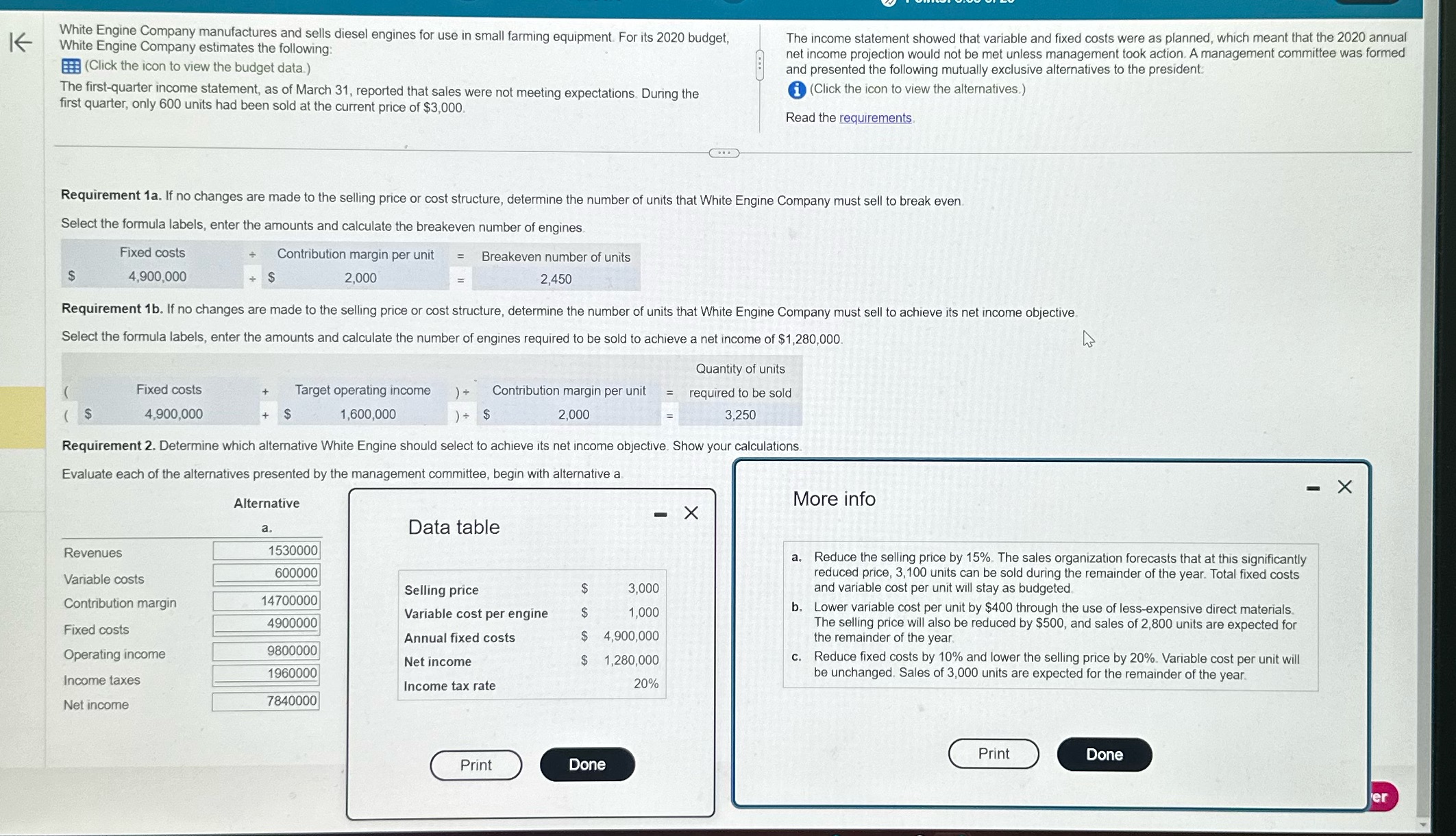

Please evaluate alternatives a, b and c, and determine which alternative White Engine should select to achieve its net income objective.

White Engine Company manufactures and sells diesel engines for use in small farming equipment. For its 2020 budget, The income statement showed that variable and fixed costs were as planned, which meant that the 2020 annual White Engine Company estimates the following net income projeclion would not be met unless management took action. A management committee was formed BB (Click the icon to view the budget data ) | and presented the following mutually exclusive alternatives to the president The first-quarter income statement, as of March 31, reported that sales were not meeting expectations. During the (Click the icon to view the alternatives ) first quarter, only 600 units had been sold at the current price of $3,000. Read the requirements (SR Sl e Requirement 1a. If no changes are made to the selling price or cost structure, determine the number of units that White Engine Company must sell to break even Select the formula labels, enter the amounts and calculate the breakeven number of engines Fixed costs + Contribution margin perunit = Breakeven number of units S 4,900,000 + 2,000 = 2,450 Requirement 1b. If no changes are made to the selling price or cost structure, determine the number of units that White Engine Company must sell to achieve its net income objective. Select the formula labels, enter the amounts and calculate the number of engines required ta be sold to achieve a net income of $1,280,000 [} Quantity of units ( Fixed costs + Target operating income )= Confribution margin perunit = required to be sold ('8 4,900,000 + 8 1,600,000 )= $ 2,000 = 3,250 Requirement 2. Determine which alternative White Engine should select to achieve its net income objective. Show your calculations. Evaluate each of the alternatives presented by the management committee, begin with alternative a Alternative More info a Data table Revenues E _1530000] Reduce the selling price by 15%. The sales organization forecasts that at this significantly ~ 600000! 3 reduced price, 3,100 units can be sold during the de Total Variable costs 600000 p 5 g the remainder of the year. Total fixed costs Selling price 3,000 and variable cost per unit will stay as budgeted A = ol Contribution margin { 14700000| Lower variable cost per unit by $400 through the use of less-expensive direct materials L Variable cost per engine 1,000 4900000 The selling price will also be reduced by $500, and sales of 2,800 units are expected for Fixed costs _ Annual fixed costs 4,900,000 the remainder of the year e inoms ~ 9800000 N 1.280.000 . Reduce fixed costs by 10% and lower the selling price by 20%. Variable cost per unit will 1960000 y i be unchanged. Sales of 3,000 units are expected for the remainder of the year. Income taxes Income tax rate 20% Net income G D