Question

Please evaluate the list of stocks and bonds presented and use the information given plus your knowledge of the needed computations to answer the ten

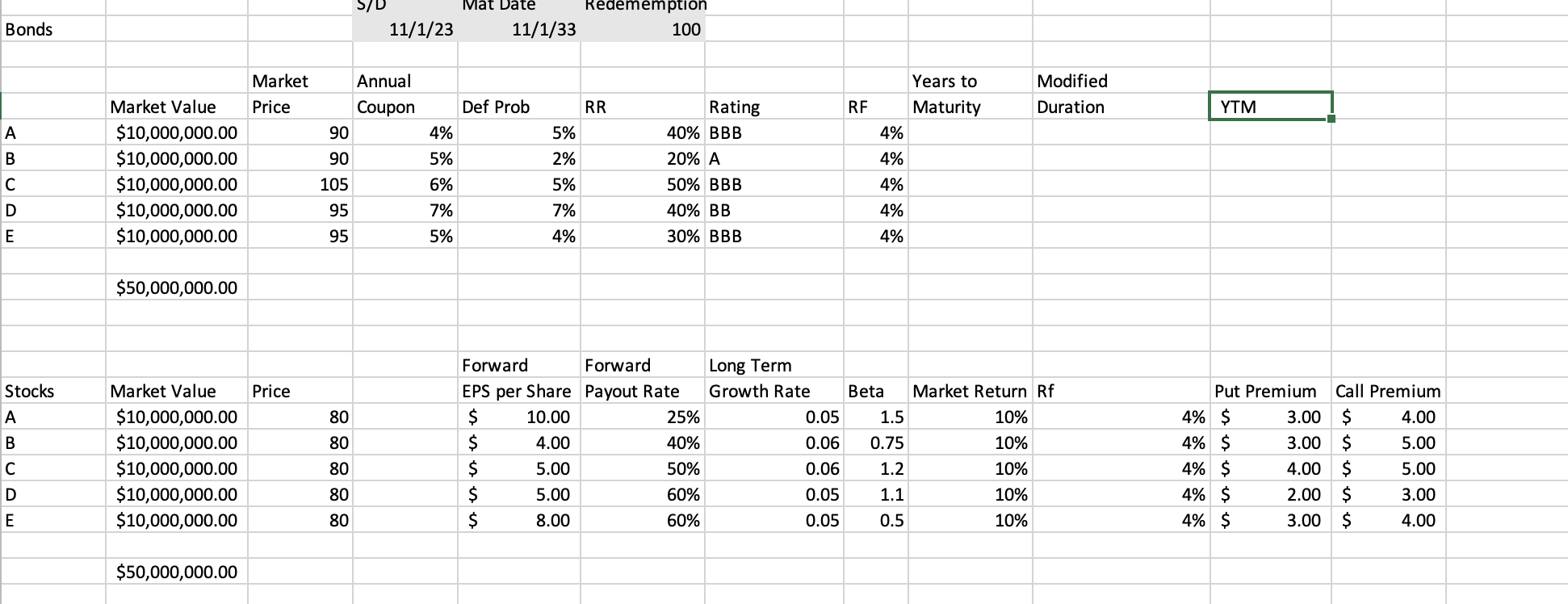

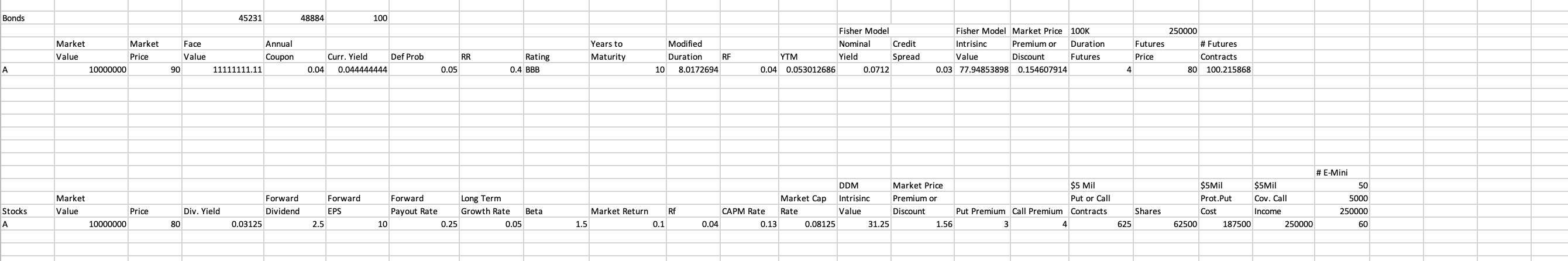

Please evaluate the list of stocks and bonds presented and use the information given plus your knowledge of the needed computations to answer the ten questions listed below. 1. Which bond has the cheapest market price relative to its intrinsic value or price using a Fisher model nominal yield as the discount rate? 2. Which stock is priced the cheapest compared to its intrinsic value or price using a CAPM expected return and a constant growth DDM model. 3. If you bought $10 million of each bond at the market price - how many 5-year note futures contracts with a face value of $250K and a market value of 80 and a duration of 4 would you need to buy or sell to hedge the entire portfolio? What is the portfolio duration? 4 If you bought $10 million of each stock at the market price - how many SP500 E-Mimi futures contracts worth 5,000 index points with a $50 multiplier would you need to buy or sell to hedge the entire portfolio? What is the portfolio beta? 5. What is the expected return of the portfolio based on the YTM of the bonds and CAPM required rate of return of

Bonds Mat Date 11/1/23 11/1/33 Redememption 100 Market Annual Market Value Price Coupon Def Prob RR Rating Years to RF Maturity Modified Duration YTM A $10,000,000.00 90 4% 5% 40% BBB 4% B $10,000,000.00 90 5% 2% 20% A 4% C $10,000,000.00 105 6% 5% 50% BBB 4% D $10,000,000.00 95 7% 7% 40% BB 4% E $10,000,000.00 95 5% 4% 30% BBB 4% $50,000,000.00 Forward Forward Long Term Stocks Market Value Price EPS per Share Payout Rate Growth Rate Beta Market Return Rf Put Premium Call Premium A $10,000,000.00 80 $ 10.00 25% 0.05 1.5 10% 4% $ 3.00 $ 4.00 B $10,000,000.00 80 $ 4.00 40% 0.06 0.75 10% 4% $ 3.00 $ 5.00 C $10,000,000.00 80 $ 5.00 50% 0.06 1.2 10% 4% $ 4.00 $ 5.00 D $10,000,000.00 80 $ 5.00 60% 0.05 1.1 10% 4% $ 2.00 $ 3.00 E $10,000,000.00 80 $ 8.00 60% 0.05 0.5 10% 4% $ 3.00 $ 4.00 $50,000,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started