Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please exercise e5-8 solutions Chopter S The Income Statemert and the Statement of Cash Flows Division F fa atinued Operations During December 2016, Smythe Company

please exercise e5-8 solutions

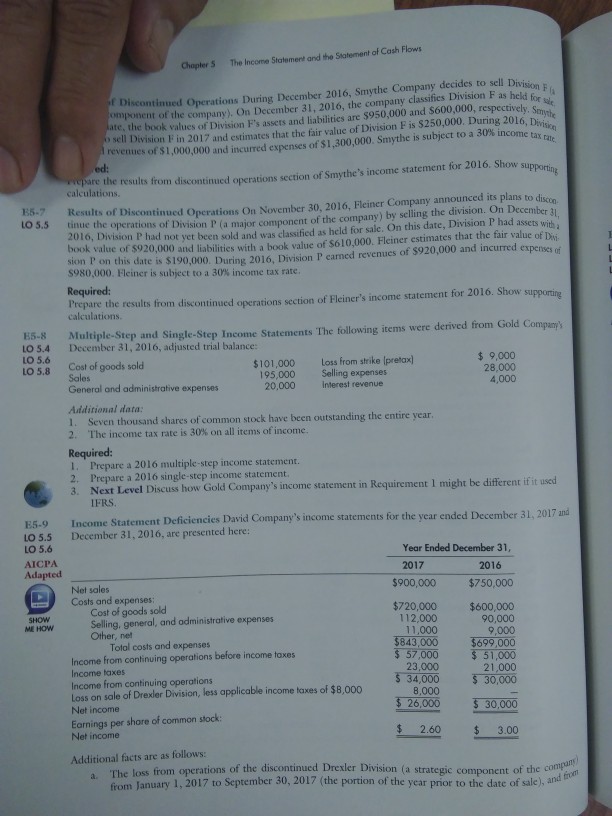

Chopter S The Income Statemert and the Statement of Cash Flows Division F fa atinued Operations During December 2016, Smythe Company decides to sell D 31, 2016, the company classifies Division F as held for e, the book values of Division F's assets and liabilities are $950,000 and $600,000, respectively.S sell Division F in 2017 and estimates that the fair value of Division F is $250,000. During 2016, Divi revenues of$1,000,000 and incurred expenses of $1,300,00. S mythe is sub ect to a 30% income tang mponent of the company). On December are the results from discontinued operations section of Smythe's income statement for 2016. Show supponti Results of Discontinued Operations On November 30, 2016, Fleiner Company announced its plans to dicon ed: calculations. 85-7 LO 5.5 tinue BS.7 201, Division P had not yet been sold and was classified as held for sale. On this date, Division P had assets with bo e the operations of Division P (a major component of the company) by selling the division. On December 2u ok value of $920,000 and liabilitics with a book value of S610,000. Fleiner estimates that the fair value of Di soon this date is $190,000. During 2016, Division P earned revenues of $920,000 and incurred expenses S980,000. Fleiner is subject to a 30% income tax rate. Required: Prepare the results from discontinued operations section of Fleiner's income statement for 2016. Show supporting calculations. Multiple-Step and Single-Step Income Statements The following items were derived from Gold Company E5-8 LO 5.4 LO 5.6 LO 5.8 December 31, 2016, adjusted trial balance 9,000 28,000 4,000 Cost of goods sold $101,000 Loss from strike (pretax) Sales General and administrative expenses 195,000 Selling expenses 20,000 Interest revenue Additional data: 1. S 2. The income tax rate is 30% on all items of income. even thousand shares of common stock have been outstanding the entire I. Prepare a 2016 multiple-step income statement. 2. Prepare a 2016 single-step income statement. 3. Next Level Discuss how Gold Co mpany's income statement in Requirement I might be different if it uscd IFRS. ncome statements for the year ended December 31, 2017 and Income Statement Deficiencies David Company's i December 31, 2016, are presented here: E5.9 LO 5.5 LO 5.6 AICPA Adapted Year Ended December 31 2017 2016 Net sales Costs and expenses $900,000 $750,000 $720,000 $600,000 90,000 9,000 $843,000 699,000 57,000 ,51,000 21,000 $ 30,000 Cost of goods sold Selling, general, and administrative expenses 112,000 11,000 ME HOW Otherl costs Total costs and expenses Income from continuing operations before income toxes Income taxes Income from continuing operations Loss on sale of Drexler Division, less applicable income taxes of $8,000 Net income 4,000 8,000 Earnings per shore of common stock Net income 26,000-30,000 60- 00 Additional facts are as follows: The loss from operations of the discontinued Drexler Division (a strategic component of the com from January 1, 2017 to September 30, 2017 (the portion of the year prior to the date of sale), andStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started