Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please explain 1. At the beginning of the year four years ago, Mountain View Company purchased construction equipment for $901,000, with a useful life of

Please explain

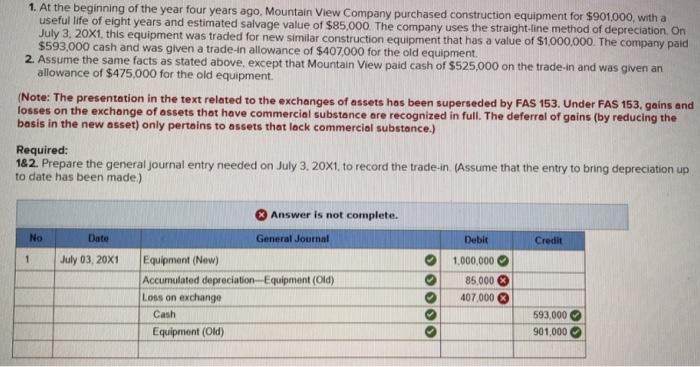

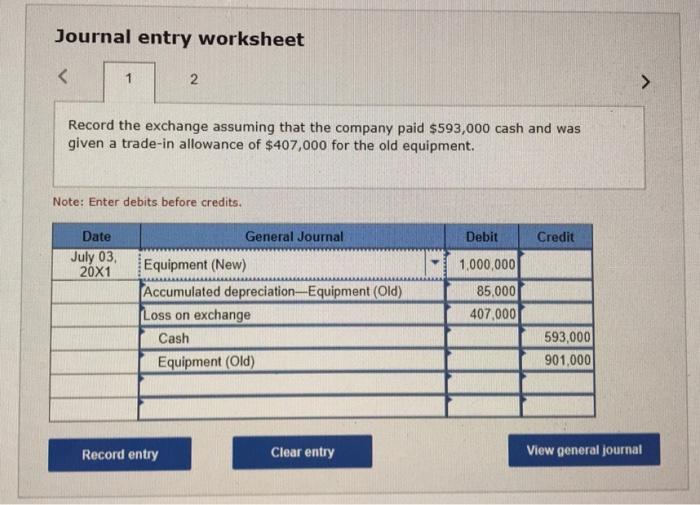

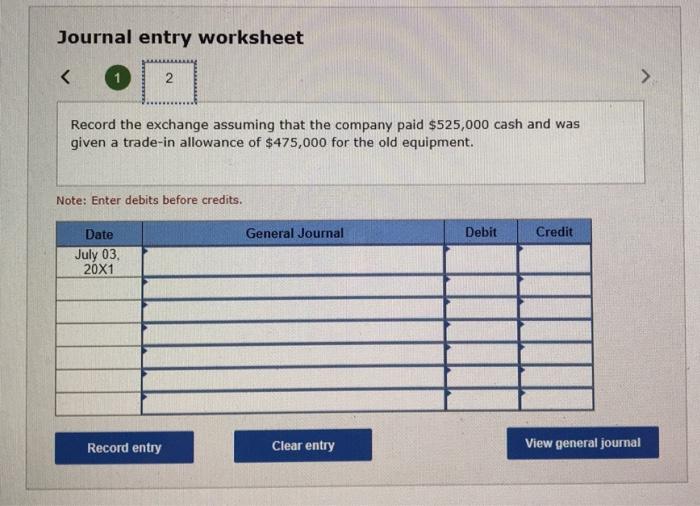

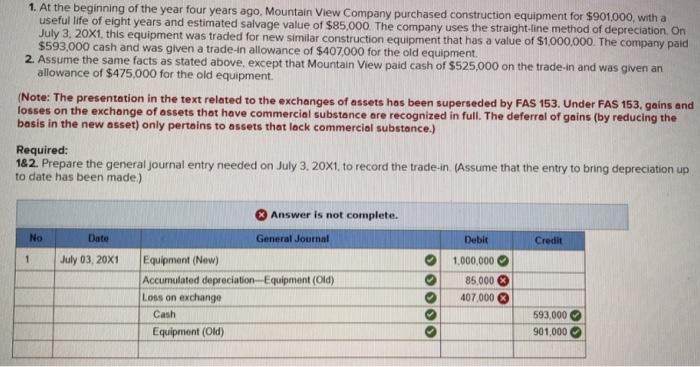

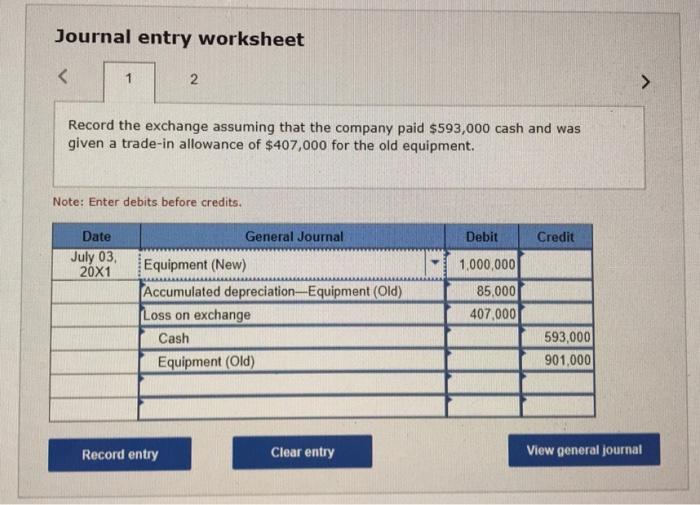

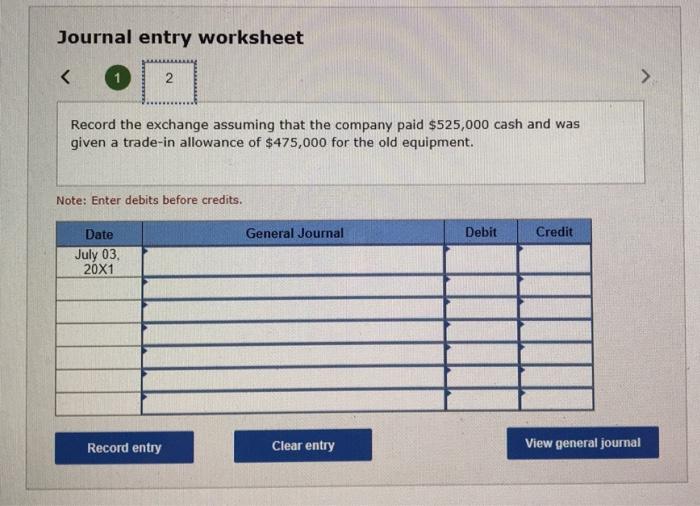

1. At the beginning of the year four years ago, Mountain View Company purchased construction equipment for $901,000, with a useful life of eight years and estimated salvage value of $85,000. The company uses the straight-line method of depreciation. On July 3. 20X1, this equipment was traded for new similar construction equipment that has a value of $1,000,000. The company paid $593,000 cash and was given a trade-in allowance of $407,000 for the old equipment. 2. Assume the same facts as stated above, except that Mountain View paid cash of $525,000 on the trade-in and was given an allowance of $475,000 for the old equipment. (Note: The presentation in the text related to the exchanges of assets hos been superseded by FAS 153. Under FAS 153, gains and losses on the exchange of assets that have commercial substance are recognized in full. The deferral of gains (by reducing the basis in the new asset) only pertains to assets that lack commercial substance.) Required: 182. Prepare the general journal entry needed on July 3. 20x1, to record the trade-in. (Assume that the entry to bring depreciation up to date has been made.) Journal entry worksheet Record the exchange assuming that the company paid $593,000 cash and was given a trade-in allowance of $407,000 for the old equipment. Note: Enter debits before credits. Journal entry worksheet Record the exchange assuming that the company paid $525,000 cash and was given a trade-in allowance of $475,000 for the old equipment. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started