Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please explain 3. Consider the following asset and liability structure: Country Bank Asset: $10 million in one-year, Fixed-rate commercial loan Liability: $ 10 million in

please explain

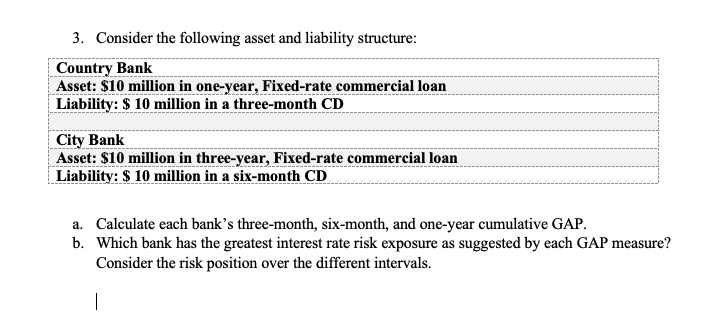

3. Consider the following asset and liability structure: Country Bank Asset: $10 million in one-year, Fixed-rate commercial loan Liability: $ 10 million in a three-month CD City Bank Asset: $10 million in three-year, Fixed-rate commercial loan Liability: $ 10 million in a six-month CD a. Calculate each bank's three-month, six-month, and one-year cumulative GAP. b. Which bank has the greatest interest rate risk exposure as suggested by each GAP measure? Consider the risk position over the different intervalsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started