Answered step by step

Verified Expert Solution

Question

1 Approved Answer

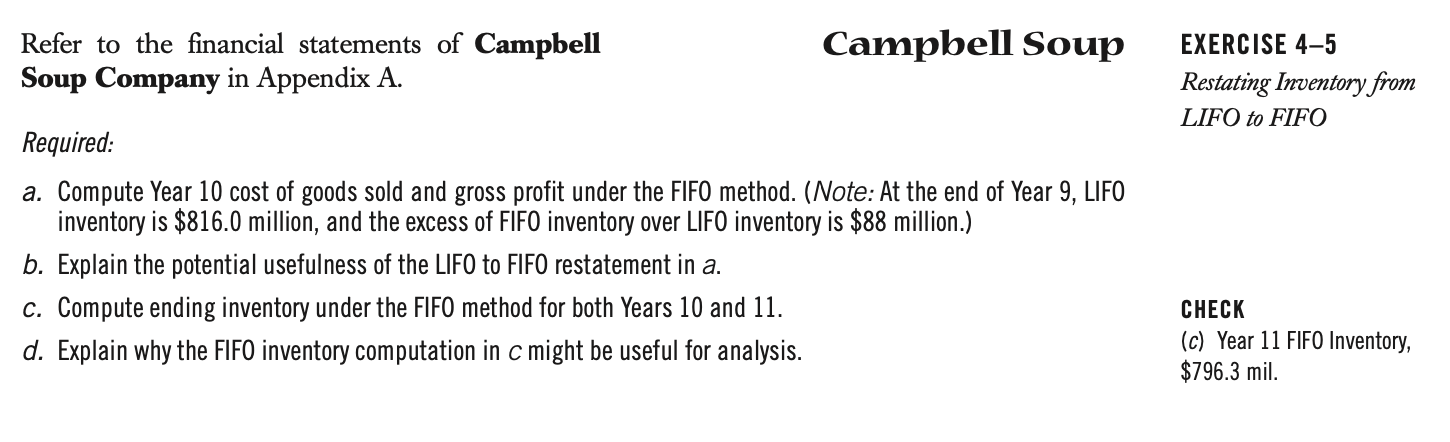

Please explain all steps and show all calculations. Thank you Refer to the financial statements of Campbell Soup Company in Appendix A. Required: a. Compute

Please explain all steps and show all calculations. Thank you

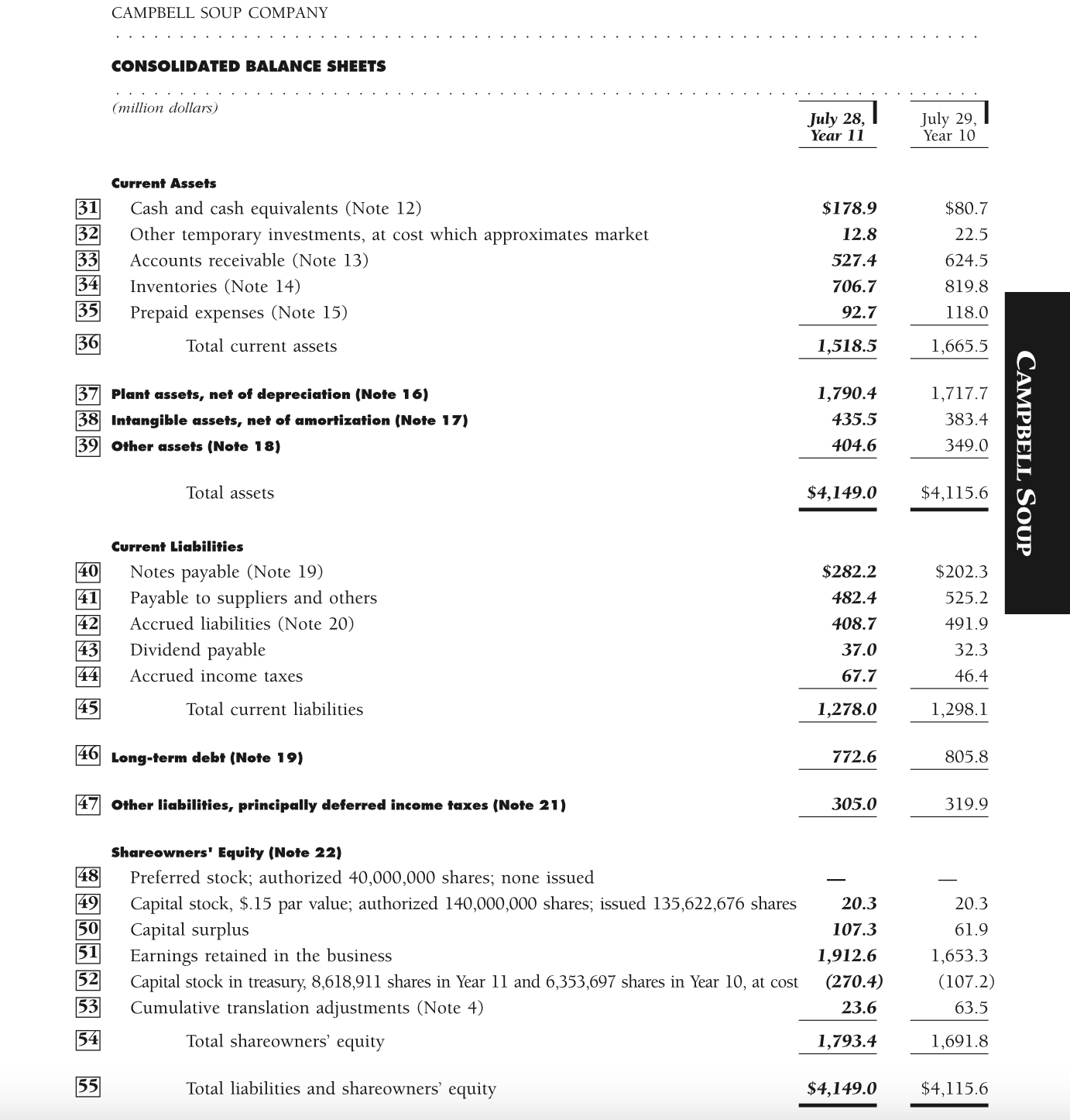

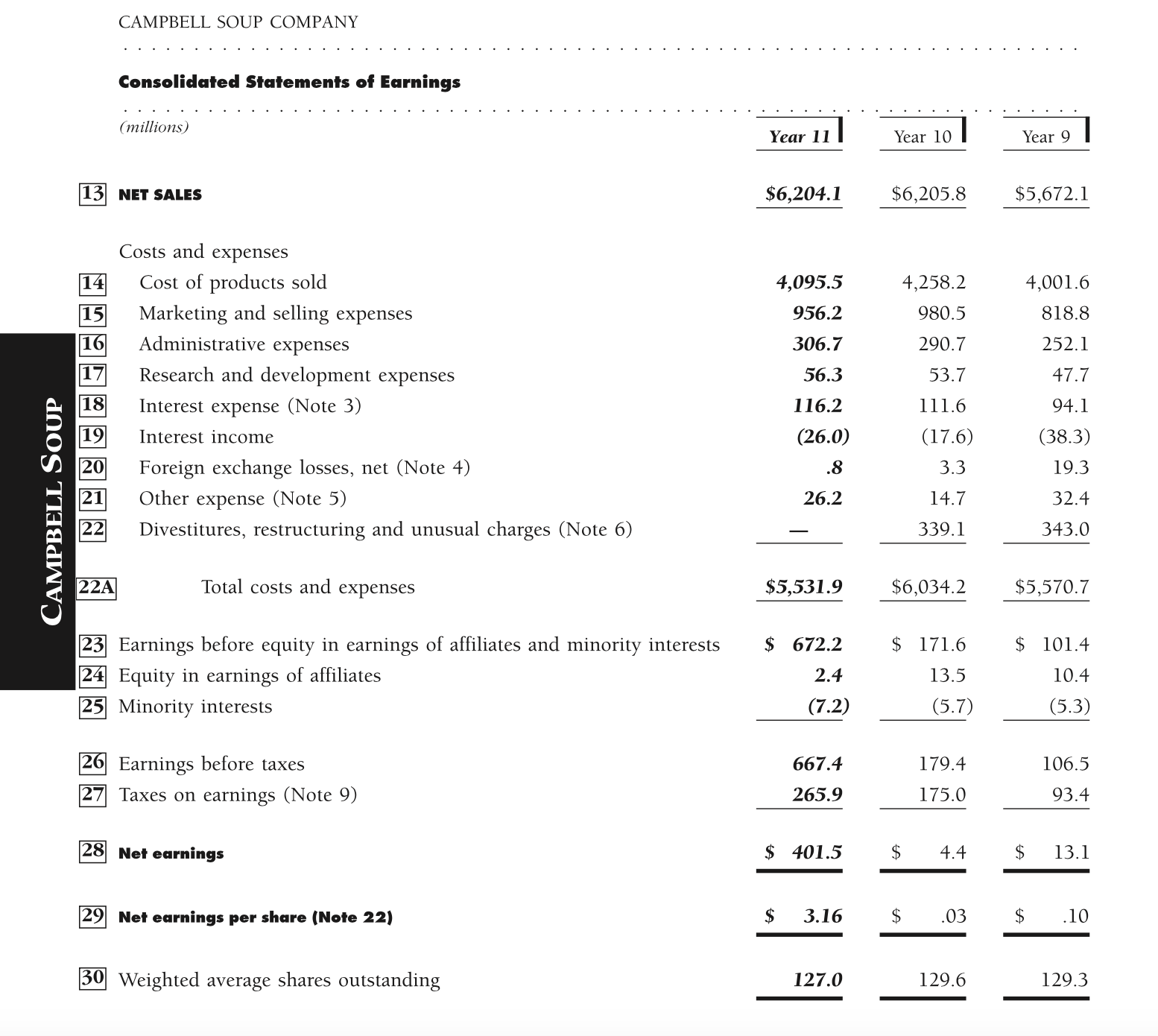

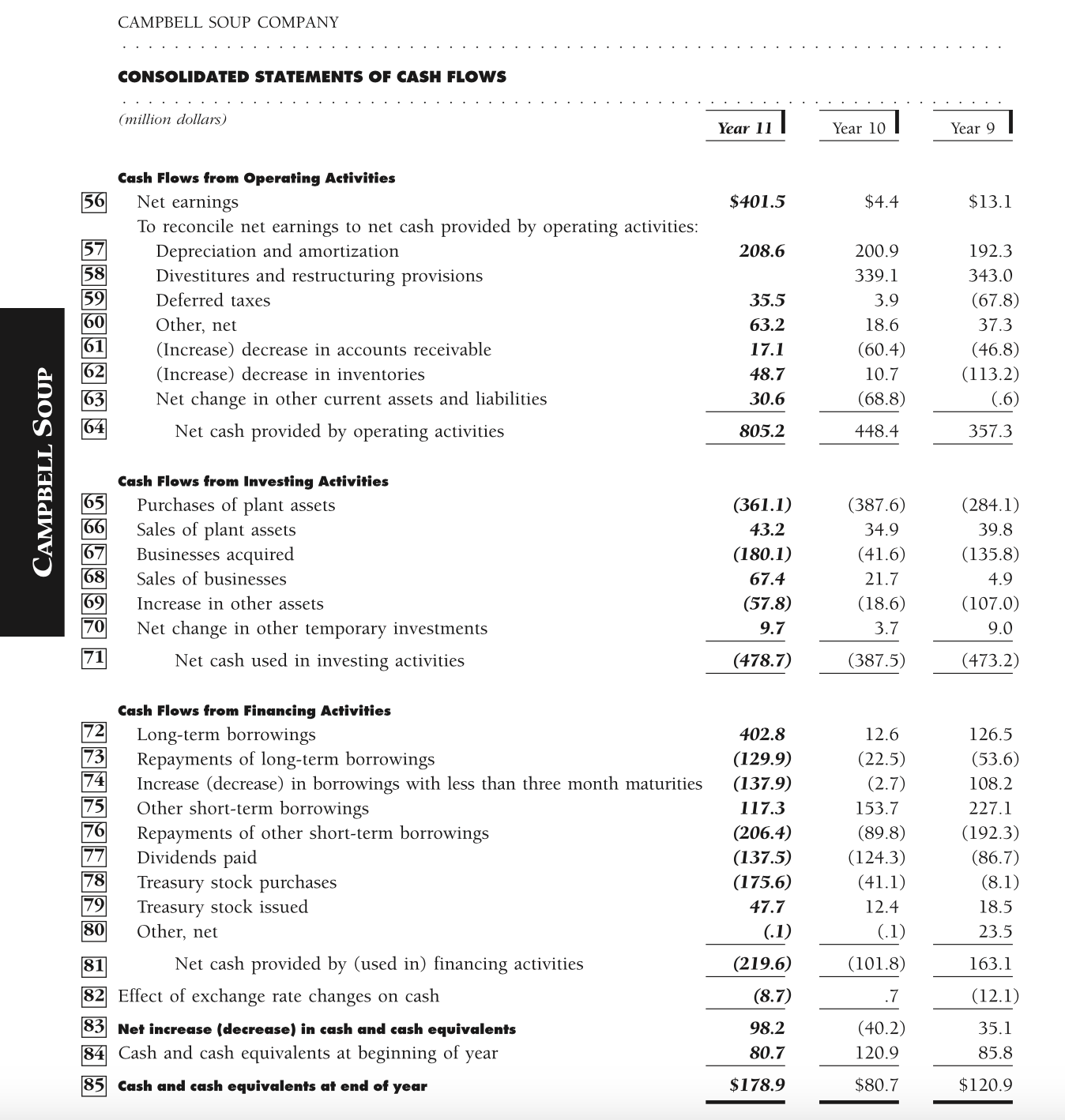

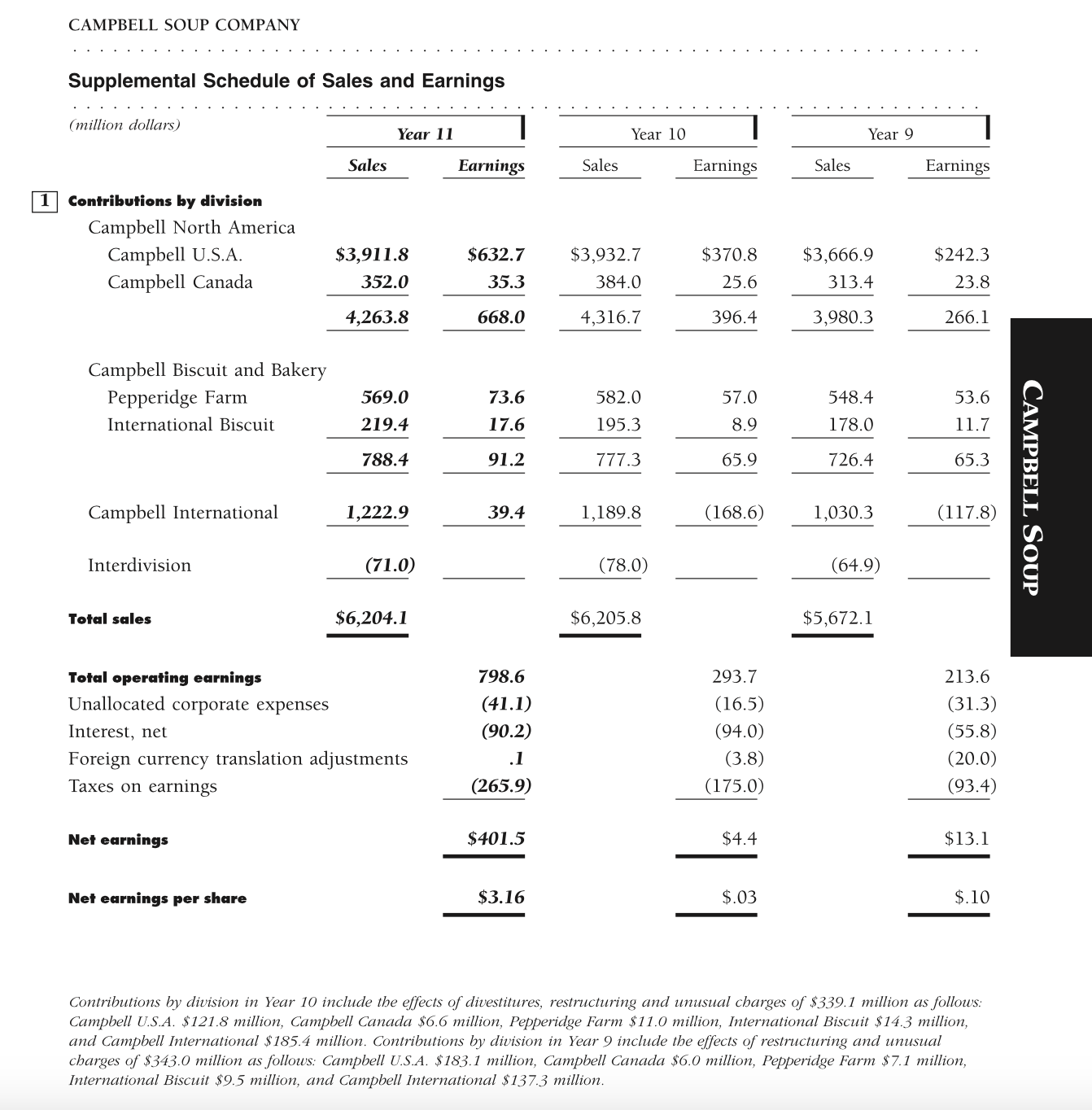

Refer to the financial statements of Campbell Soup Company in Appendix A. Required: a. Compute Year 10 cost of goods sold and gross profit under the FIF0 method. (Note: At the end of Year 9, LIF0 inventory is $816.0 million, and the excess of FIF0 inventory over LIF0 inventory is $88 million.) b. Explain the potential usefulness of the LIF0 to FIF0 restatement in a. c. Compute ending inventory under the FIF0 method for both Years 10 and 11. d. Explain why the FIFO inventory computation in c might be useful for analysis. Campbell Soup EXERCISE 4-5 Restating Inventory from LIFO to FIFO CHECK (c) Year 11 FIFO Inventory, $796.3 mil. CAMPBELL SOUP COMPANY CONSOLIDATED BALANCE SHEETS (million dollars) Current Assets 31 Cash and cash equivalents (Note 12) 32 Other temporary investments, at cost which approximates market 33 Accounts receivable (Note 13) 34 Inventories (Note 14) 35 Prepaid expenses (Note 15) 36 Total current assets 37 Plant assets, net of depreciation (Note 16) 38 Intangible assets, net of amortization (Note 17) 39 Other assets (Note 18 ) Total assets Current Liabilities 40 Notes payable (Note 19) 41 Payable to suppliers and others 42 Accrued liabilities (Note 20) 43 Dividend payable 44 Accrued income taxes 45 Total current liabilities 46 Long-term debt (Note 19 ) 47 Other liabilities, principally deferred income taxes (Note 21 ) Shareowners' Equity (Note 22) 48 Preferred stock; authorized 40,000,000 shares; none issued 49 Capital stock, \$.15 par value; authorized 140,000,000 shares; issued 135,622,676 shares 50 Capital surplus 51 Earnings retained in the business 52 Capital stock in treasury, 8,618,911 shares in Year 11 and 6,353,697 shares in Year 10, at cost 53 Cumulative translation adjustments (Note 4) 54 Total shareowners' equity 55 July28,Year11 July29,Year10 CAMPBELL SOUP COMPANY Consolidated Statements of Earnings (millions) \begin{tabular}{llll} \hline Year 11 & Year 10 & & Year 9 \\ \cline { 4 - 5 } & & \\ $6,204.1 & $6,205.8 & $5,672.1 \\ \hline \end{tabular} 13 NET SALES Costs and expenses 14 Cost of products sold 15 Marketing and selling expenses 16 Administrative expenses 17 Research and development expenses B 18 Interest expense (Note 3) 19 Interest income 20 Foreign exchange losses, net (Note 4) 21 Other expense (Note 5) 22 Divestitures, restructuring and unusual charges (Note 6) 22A Total costs and expenses 23 Earnings before equity in earnings of affiliates and minority interests 24 Equity in earnings of affiliates 25 Minority interests 26 Earnings before taxes 27 Taxes on earnings (Note 9) 28 Net earnings 29 Net earnings per share (Note 22) 30 Weighted average shares outstanding CAMPBELL SOUP COMPANY CONSOLDATED STATEMENTS OF CASH FLOWS (million dollars) Cash Flows from Operating Activities 56 Net earnings $401.5 To reconcile net earnings to net cash provided by operating activities: 57 Depreciation and amortization 58 Divestitures and restructuring provisions 59 Deferred taxes 60 Other, net 6 (Increase) decrease in accounts receivable 62 (Increase) decrease in inventories 63 Net change in other current assets and liabilities 64 Net cash provided by operating activities Cash Flows from Investing Activities 65 Purchases of plant assets 66 Sales of plant assets 67 Businesses acquired 68 Sales of businesses 69 Increase in other assets 70 Net change in other temporary investments 71 Net cash used in investing activities Cash Flows from Financing Activities 72 Long-term borrowings 73 Repayments of long-term borrowings 74 Increase (decrease) in borrowings with less than three month maturities 75 Other short-term borrowings 76 Repayments of other short-term borrowings 77 Dividends paid 78 Treasury stock purchases 79 Treasury stock issued 80 Other, net 81 Net cash provided by (used in) financing activities 82 Effect of exchange rate changes on cash 83 Net increase (decrease) in cash and cash equivalents 84 Cash and cash equivalents at beginning of year 85 Cash and cash equivalents at end of year (361.1) 43.2 (180.1) 67.4 (57.8) 9.7 (478.7) $4.4 200.9 339.1 3.9 18.6 (60.4) 10.7 (68.8) 448.4 (387.6) 34.9 (41.6) 21.7 (18.6) 3.7 (387.5) 402.8 (129.9) (137.9) 117.3 (206.4) (137.5) (175.6) 47.7 (.1) (219.6(8.7)98.280.7$178.9 12.6 (22.5) (2.7) 153.7 (89.8) (124.3) (41.1) 12.4 (.1) (101.8) (284.1) 39.8 (135.8) 4.9 (107.0) 9.0(473.2) 126.5 (53.6) 108.2 227.1 (192.3) (86.7) (8.1) 18.5 23.5 23.5 163.1 (12.1)35.185.8$120.9 Contributions by division in Year 10 include the effects of divestitures, restructuring and unusual charges of \$339.1 million as follows: Campbell U.S.A. \$121.8 million, Campbell Canada $6.6 million, Pepperidge Farm \$11.0 million, International Biscuit \$14.3 million, and Campbell International \$185.4 million. Contributions by division in Year 9 include the effects of restructuring and unusual charges of \$343.0 million as follows: Campbell U.S.A. \$183.1 million, Campbell Canada \$6.0 million, Pepperidge Farm \$7.1 million, International Biscuit \$9.5 million, and Campbell International \$137.3 million

Refer to the financial statements of Campbell Soup Company in Appendix A. Required: a. Compute Year 10 cost of goods sold and gross profit under the FIF0 method. (Note: At the end of Year 9, LIF0 inventory is $816.0 million, and the excess of FIF0 inventory over LIF0 inventory is $88 million.) b. Explain the potential usefulness of the LIF0 to FIF0 restatement in a. c. Compute ending inventory under the FIF0 method for both Years 10 and 11. d. Explain why the FIFO inventory computation in c might be useful for analysis. Campbell Soup EXERCISE 4-5 Restating Inventory from LIFO to FIFO CHECK (c) Year 11 FIFO Inventory, $796.3 mil. CAMPBELL SOUP COMPANY CONSOLIDATED BALANCE SHEETS (million dollars) Current Assets 31 Cash and cash equivalents (Note 12) 32 Other temporary investments, at cost which approximates market 33 Accounts receivable (Note 13) 34 Inventories (Note 14) 35 Prepaid expenses (Note 15) 36 Total current assets 37 Plant assets, net of depreciation (Note 16) 38 Intangible assets, net of amortization (Note 17) 39 Other assets (Note 18 ) Total assets Current Liabilities 40 Notes payable (Note 19) 41 Payable to suppliers and others 42 Accrued liabilities (Note 20) 43 Dividend payable 44 Accrued income taxes 45 Total current liabilities 46 Long-term debt (Note 19 ) 47 Other liabilities, principally deferred income taxes (Note 21 ) Shareowners' Equity (Note 22) 48 Preferred stock; authorized 40,000,000 shares; none issued 49 Capital stock, \$.15 par value; authorized 140,000,000 shares; issued 135,622,676 shares 50 Capital surplus 51 Earnings retained in the business 52 Capital stock in treasury, 8,618,911 shares in Year 11 and 6,353,697 shares in Year 10, at cost 53 Cumulative translation adjustments (Note 4) 54 Total shareowners' equity 55 July28,Year11 July29,Year10 CAMPBELL SOUP COMPANY Consolidated Statements of Earnings (millions) \begin{tabular}{llll} \hline Year 11 & Year 10 & & Year 9 \\ \cline { 4 - 5 } & & \\ $6,204.1 & $6,205.8 & $5,672.1 \\ \hline \end{tabular} 13 NET SALES Costs and expenses 14 Cost of products sold 15 Marketing and selling expenses 16 Administrative expenses 17 Research and development expenses B 18 Interest expense (Note 3) 19 Interest income 20 Foreign exchange losses, net (Note 4) 21 Other expense (Note 5) 22 Divestitures, restructuring and unusual charges (Note 6) 22A Total costs and expenses 23 Earnings before equity in earnings of affiliates and minority interests 24 Equity in earnings of affiliates 25 Minority interests 26 Earnings before taxes 27 Taxes on earnings (Note 9) 28 Net earnings 29 Net earnings per share (Note 22) 30 Weighted average shares outstanding CAMPBELL SOUP COMPANY CONSOLDATED STATEMENTS OF CASH FLOWS (million dollars) Cash Flows from Operating Activities 56 Net earnings $401.5 To reconcile net earnings to net cash provided by operating activities: 57 Depreciation and amortization 58 Divestitures and restructuring provisions 59 Deferred taxes 60 Other, net 6 (Increase) decrease in accounts receivable 62 (Increase) decrease in inventories 63 Net change in other current assets and liabilities 64 Net cash provided by operating activities Cash Flows from Investing Activities 65 Purchases of plant assets 66 Sales of plant assets 67 Businesses acquired 68 Sales of businesses 69 Increase in other assets 70 Net change in other temporary investments 71 Net cash used in investing activities Cash Flows from Financing Activities 72 Long-term borrowings 73 Repayments of long-term borrowings 74 Increase (decrease) in borrowings with less than three month maturities 75 Other short-term borrowings 76 Repayments of other short-term borrowings 77 Dividends paid 78 Treasury stock purchases 79 Treasury stock issued 80 Other, net 81 Net cash provided by (used in) financing activities 82 Effect of exchange rate changes on cash 83 Net increase (decrease) in cash and cash equivalents 84 Cash and cash equivalents at beginning of year 85 Cash and cash equivalents at end of year (361.1) 43.2 (180.1) 67.4 (57.8) 9.7 (478.7) $4.4 200.9 339.1 3.9 18.6 (60.4) 10.7 (68.8) 448.4 (387.6) 34.9 (41.6) 21.7 (18.6) 3.7 (387.5) 402.8 (129.9) (137.9) 117.3 (206.4) (137.5) (175.6) 47.7 (.1) (219.6(8.7)98.280.7$178.9 12.6 (22.5) (2.7) 153.7 (89.8) (124.3) (41.1) 12.4 (.1) (101.8) (284.1) 39.8 (135.8) 4.9 (107.0) 9.0(473.2) 126.5 (53.6) 108.2 227.1 (192.3) (86.7) (8.1) 18.5 23.5 23.5 163.1 (12.1)35.185.8$120.9 Contributions by division in Year 10 include the effects of divestitures, restructuring and unusual charges of \$339.1 million as follows: Campbell U.S.A. \$121.8 million, Campbell Canada $6.6 million, Pepperidge Farm \$11.0 million, International Biscuit \$14.3 million, and Campbell International \$185.4 million. Contributions by division in Year 9 include the effects of restructuring and unusual charges of \$343.0 million as follows: Campbell U.S.A. \$183.1 million, Campbell Canada \$6.0 million, Pepperidge Farm \$7.1 million, International Biscuit \$9.5 million, and Campbell International \$137.3 million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started