Answered step by step

Verified Expert Solution

Question

1 Approved Answer

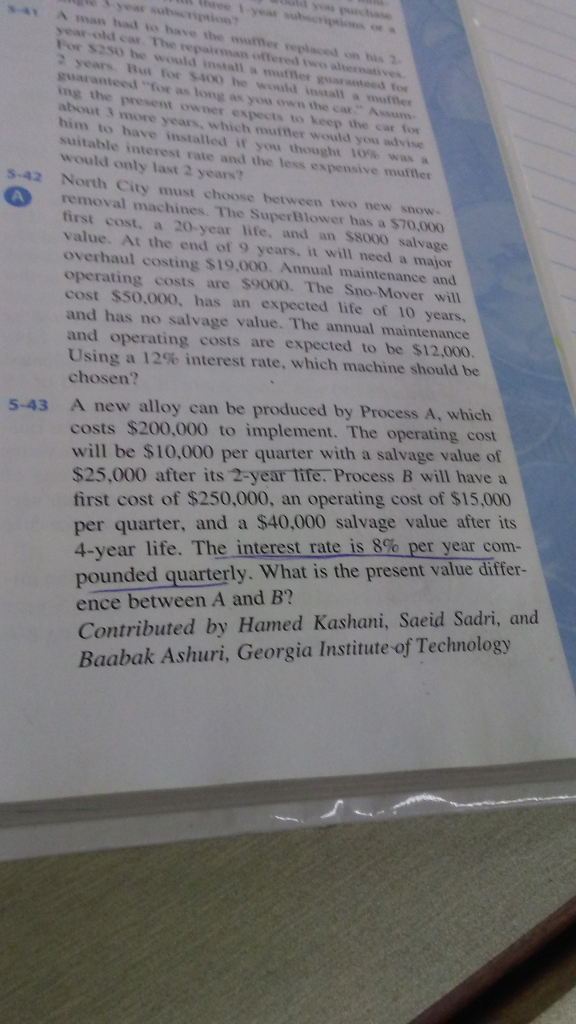

please explain and solve 4-43. My main confused on the interest rate P hree yea year For s2so bho would install a murmes on bis

please explain and solve 4-43. My main confused on the interest rate

P

hree yea year For s2so bho would install a murmes on bis 2 years. But fox 5400 he would stall aneed for for as long as yon own the car" Assum ing the present owner expects to keep the car fow about 3 more years, which mufter would you advise him to have installed if you thought 10% was a suitabble interest rate and the less expensive muffler would only last 2 years? 5-42 North City must choose between two new snow removal machines. The SuperBlower has a $70,000 first cost, a 20-year life, and an $8000 value. At the end of 9 years, it will need a major overhaul costing $19,000. Annual maintenance and salvage operating costs are $9000. The Sno-Mover will cost S50,000, has an expected life of 10 years, and has no salvage value. The annual maintenance and operating costs are expected to be $12,000. Using a 12% interest rate, which machine should be chosen? 5-43 A new alloy can be produced by Process A, which costs $200,000 to implement. The operating cost will be $10,000 per quarter with a salvage value of $25,000 after its 2-year lire. Process B will havea first cost of $250,000, an operating cost of $15,000 per quarter, and a $40,000 salvage value after its 4-year life. The interest rte is 8% peryear com pounded quarterly. What is the present value differ- ence between A and B? Contributed by Hamed Kashani, Saeid Sadri, and Baabak Ashuri, Georgia Institute of TechnologyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started